Spending caps are the only fiscal rule with a good track record.

I’ve repeatedly written about Switzerland’s spending cap, known as the “debt brake,” which has limited annual spending growth to an average of just 2.2 percent over the past two decades.

That’s very impressive, especially compared to the irresponsible 4.9 percent average annual spending growth in the United States.

I’ve also written several times about Colorado’s spending cap, known as the Taxpayer Bill of Rights (TABOR), including a column earlier this year showing that state taxpayers have received $8.2 billion of tax relief.

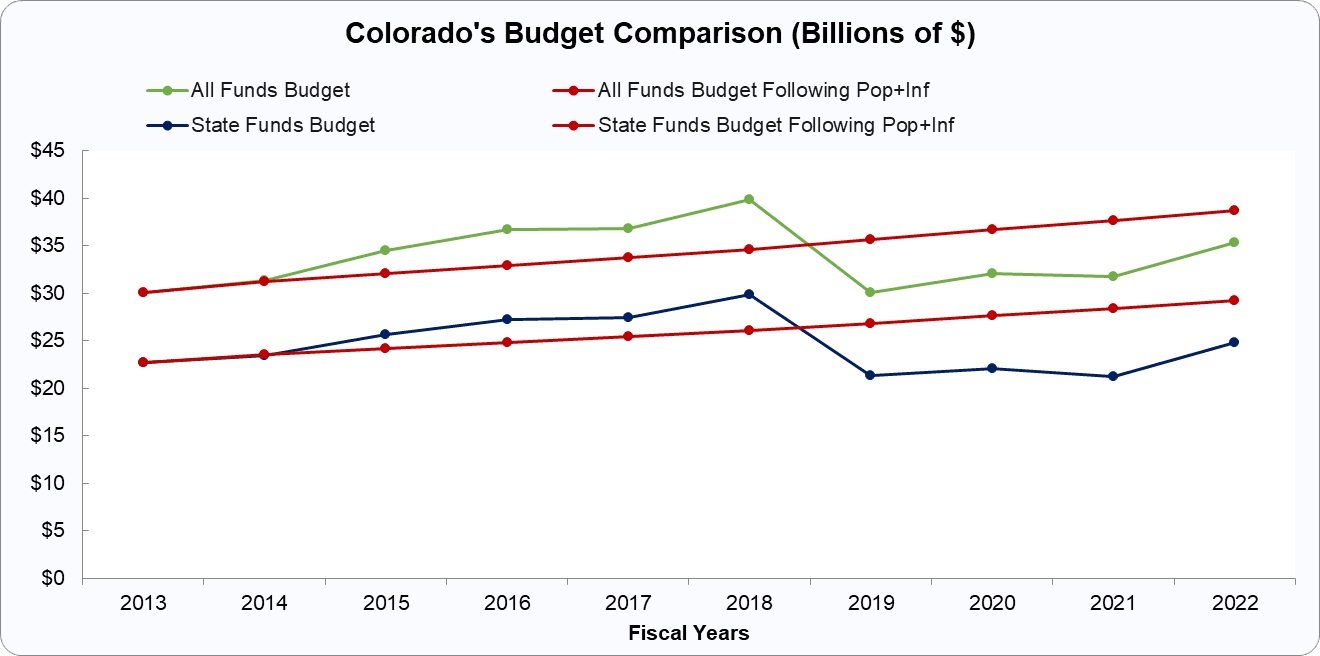

Today, let’s look at more pro-TABOR evidence. Americans for Tax Reform has a “Sustainable Budget Project” to monitor and track state budgets. Here’s their chart showing the results for Colorado.

As you can see, Colorado government spending between 2013 and 2022 was below population plus inflation.

And that’s true when looking at the money that Colorado collected and spent (“state funds budget), and also when looking at total spending (“all funds budget”), which includes spending financed by the federal government.

None of this, however, means that TABOR is perfect.

Vance Ginn just wrote an article on strengthening Colorado’s spending cap for National Review. Here are some highlights.

TABOR recently had its 30th birthday. Voters approved the constitutional amendment in 1992, establishing the strongest tax and expenditure limit in the country. It’s been the gold standard for a sound spending limit ever since. …When adopted, the limit covered about two-thirds of state spending. It requires voter approval for tax increases and mandates refunds to taxpayers if tax revenue exceeds the limit. …Unfortunately, courts and politicians have eroded the strength of TABOR over time, primarily because of politicians’ lack of fiscal restraint. The result has been that TABOR now covers less than half of state spending… The…Sustainable Colorado Budget… will help reinforce the original intent of TABOR, by broadening the spending limit to all state funds. The plan would limit nearly two-thirds of state spending each year, as when voters first adopted TABOR. Doing so will result in larger surpluses to reduce income-tax rates yearly until they’re zero.

Several times in recent years (2013, 2019, 2023), proponents of good fiscal policy have had to fight against referendums to weaken TABOR. As Vance wrote, it’s time to go on offense and push to make the spending cap even more effective.