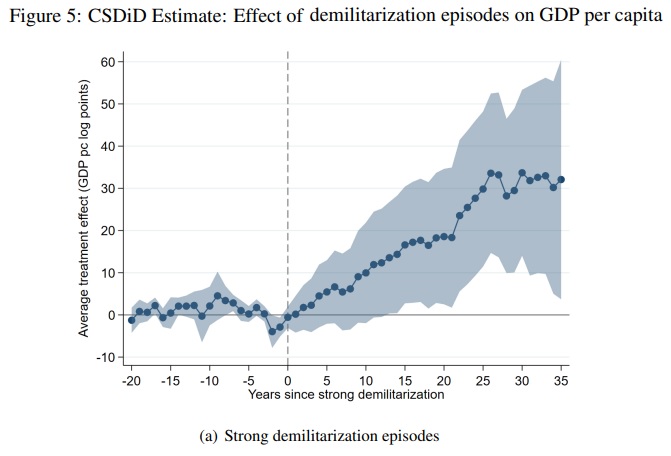

Last year, I shared some academic research showing that less military spending led to better economic performance.

This should not come as a surprise. Every type of government spending necessarily causes harm by diverting resources from the productive sector of the economy.

The relevant question is whether there are also offsetting benefits.

In an ideal world, policymakers should engage in rational cost-benefit analysis when deciding whether to spend money, either for the Pentagon or domestic programs.

I’m writing about this issue today because the U.K.-based Economist has an article about how global events are turning the “peace dividend” turning into a “war tax.”

At the end of the cold war America’s president, George H.W. Bush, popularised the idea that cutting defence spending would boost the economy. …In the decades after the cold war, the thinking was that to spend less on armies meant to spend more on infrastructure and public services and to lower debt or taxes. Since the 1960s the world has “released” about $4trn a year of spending at current prices in this way… Now the peace dividend is turning into a “war tax”. How heavy will it be? …What of the impact on growth? Many historians argue that defence spending is a drain on the rest of the economy. Keeping a country secure has great economic value. But once you buy a missile, say, it tends to sit in storage rather than being put to productive use. During the second world war productivity growth slowed in America, as people were pulled from the fields into munitions factories and military units. Forced limits on military spending in postwar Japan and West Germany, by contrast, coincided with huge productivity improvements in both countries.

I’m glad the Economist acknowledges that government spending is a drain on the private sector.

Maybe this sensible analysis will be recycled the next time there is an article about redistribution spending.

I can’t resist sharing one additional sentence from the article.

Many credit Reagan’s decision to boost defence outlays as crucial to bankrupting the Soviet Union and winning the cold war.

That reinforces my view that the U.S. was very lucky that Reagan won the 1980 election. Not only did he restore the economy, he defeated the Evil Empire.

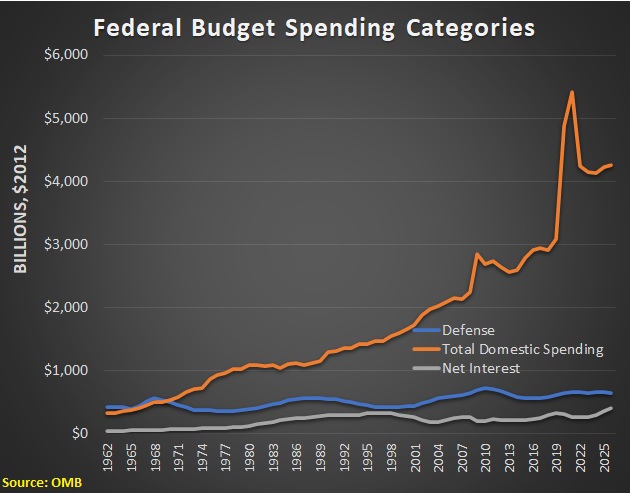

I’ll close by acknowledging that America’s fiscal challenge is an ever-expanding burden of domestic spending. Especially entitlements.

But that does not mean the Pentagon should get a blank check. If global threats require more military spending, that choice should be made with full awareness that economic performance will suffer.

P.S. It would be helpful if supporters of a strong military opposed some of the many ways that politicians insert waste, fraud, inefficiency, and pork in the Pentagon’s budget.

P.P.S. The U.S. experience after World War II is a good example of how lower military spending triggers more growth.

P.P.P.S. My three-part series on the economics of war can be read here, here, and here.

———

Image credit: U.S. Army Photo | Public Domain.