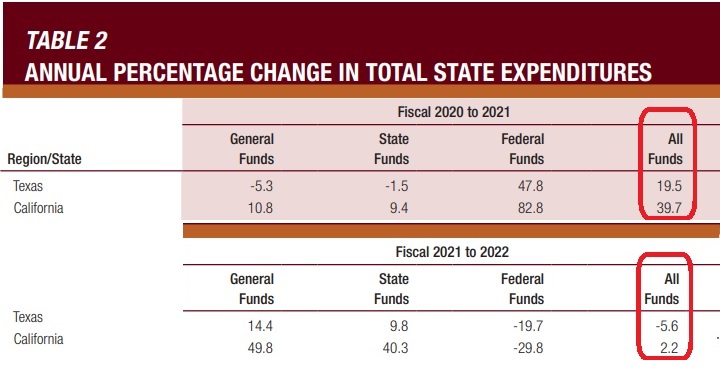

I shared some data last month from the National Association of State Budget Officers to show that Texas lawmakers have been more fiscally responsible than California lawmakers over the past couple of years.

California politicians were more profligate in 2021 when politicians in Washington were sending lots of money to states because of the pandemic.

And California politicians also increased spending faster in 2022 when conditions (sort of) returned to normal.

These results are not a surprise given California’s reputation for profligacy.

What may be a surprise, however, is that (relative) frugality in Texas has only existed for a handful of years. Here are some excerpts from a report written for the Texas Public Policy Foundation by Vance Ginn and Daniel Sánchez-Piñol.

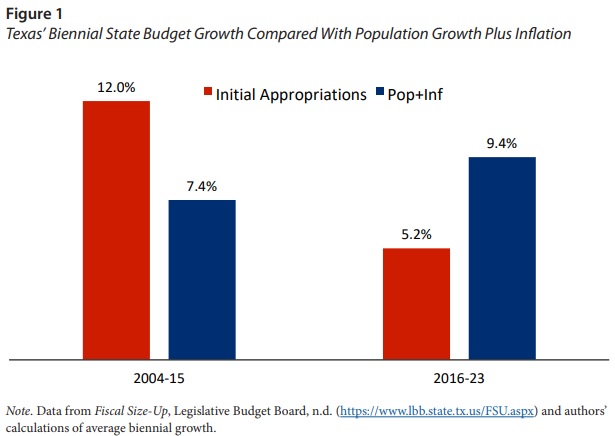

Over the last two decades, Texas’ total state biennial budget growth has had two different phases. The first phase had budget growth above the rate of population growth plus inflation for five of the six budgets from 2004–05 to 2014–15. The second phase…had budget growth below this rate… Figure 1 shows the average biennial growth rates for the six state budgets passed before 2015 and for the four since then. The average biennial budget growth rate in the former period was 12% compared with the rate of population growth plus inflation of 7.4%. In the latter period, the average biennial growth rate of the budget was cut by more than half to 5.2%, which was well below the estimated rate of population growth plus inflation of 9.4%. This improved budget picture must be maintained to correct for the excessive budget growth in the earlier period. …there could be a $27 billion GR surplus at the end of the current 2022–23 biennium. …the priority should be to effectively limit or, even better, freeze the state budget. Texas should use most, if not all, of the resulting surplus to reduce…property tax collections…these taxes could be cut substantially by restraining spending and using the surplus to reduce school district M&O property taxes to ultimately eliminate them over time.

The article has this chart, which is a good illustration of the shift to fiscal restraint in Texas.

For all intents and purposes, Texas in 2016 started abiding by fiscal policy’s Golden Rule.

And this means the burden of government is slowly but surely shrinking compared to the private sector.

That approach is paying big dividends. Spending restraint means there is now a big budget surplus, which is enabling a discussion of how to reduce property taxes (Texas has no income tax).

P.S. I shared data back in 2020 looking at the fiscal performance of Texas and Florida compared to New York and California.

———

Image credit: David Herrera | CC BY 2.0.