I wrote a two-part series (here and here) about Donald Trump supporting massive middle-class tax increases.

Trump does not admit that is his policy, of course, but that is an unavoidable outcome since he opposes entitlement reform.

In the interest of fairness and bipartisanship, I should explain that Joe Biden also favors huge tax increases on ordinary people.

Like Trump, he does not admit this is his agenda. But, once again, that will be the unavoidable result since he also is against entitlement reform.

But this does not mean Trump and Biden are exactly the same on fiscal policy (like they are on trade policy).

Biden has proposed two additional policies to expand the size and scope (and economic damage) of the federal government.

- Expanding entitlement programs, including per-child handouts.

- Class-warfare tax increases, targeting upper-income taxpayers.

Just in case someone thinks I am unfairly characterizing Biden’s policies, let’s look at some excerpts from a report by Jim Tankersley of the New York Times.

There were no economic pivots in President Biden’s first State of the Union address to a Republican House. He did not pare back his push to raise taxes on high earners or to spend big on new government programs. …The president renewed his calls for trillions of dollars of new federal programs, including for child care and community college… He did not name a single federal spending program he was willing to cut. …It was a no-quarter recommitment to a campaign theme…centered on expanding government…he called for raising taxes on corporations and the wealthy… His proposals included an expanded tax on stock buybacks and what would effectively be a sort of wealth tax on billionaires.

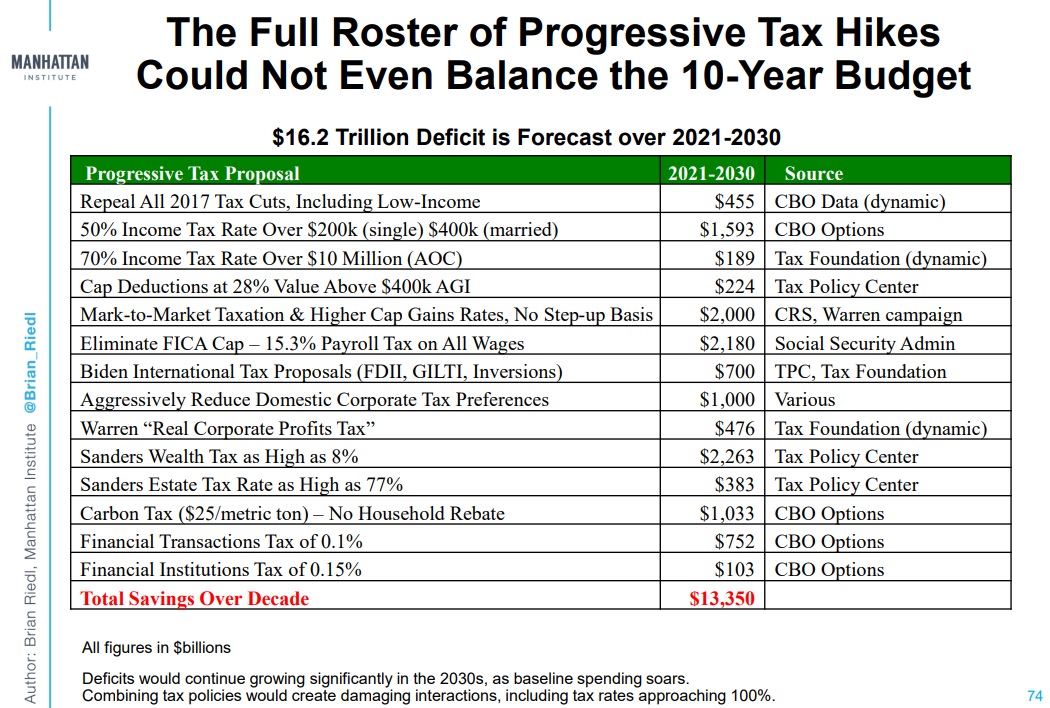

Let’s conclude by considering whether it is possible for Biden to impose sufficiently large taxes on rich people so that there would be no need for big middle-class tax increases.

For that to be the case, Biden’s class warfare tax increases would have to raise enough money to achieve two objectives.

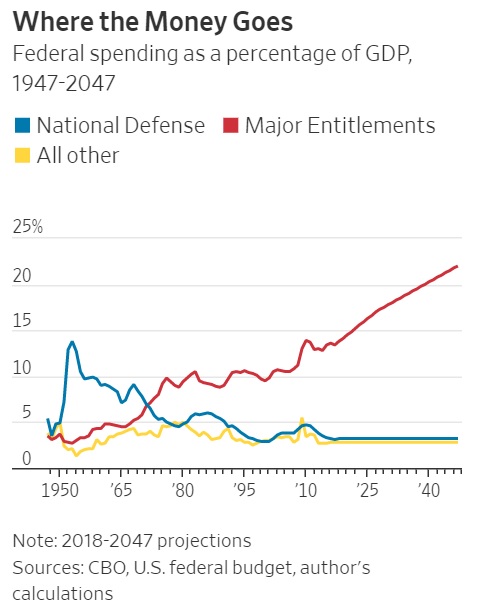

- Collect enough money to finance the built-in expansions of current entitlement programs caused by demographic change.

- Collect enough money to finance his proposals for trillions of dollars of spending on new entitlement programs.

The answer is no. Not even close.

Even if you took all of Biden’s taxes and then added some other class-warfare proposals, that would not be enough to finance built-in spending for the next 10 years.

And that means no revenue to finance Biden’s proposals for additional spending.

Not to mention the built-in spending caused by demographic changes over the next 30 years.

The bottom line is that there are not enough rich people to finance big government.

All of which brings me back to where I started, namely that there will be giant tax increases on lower-income and middle-class households if we don’t figure out a way to restrain and reform entitlements.

P.S. In addition to Trump and Biden, the so-called national conservatives also support huge tax increases on American workers.

P.P.S. Even if there were more rich people, higher class-warfare taxes to finance bigger government would be a big mistake, as acknowledged even by generally left-leaning international bureaucracies such as the World Bank, the International Monetary Fund, the Organization for Economic Cooperation and Development, and the European Central Bank.

P.P.P.S. Biden and other folks on the left sometimes are very open about tax increases on ordinary people, though they have different terms for those tax hikes – such as carbon fees and import barriers.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.