I wrote last week about the ever-expanding burden of government spending in California.

And that was after writing two columns last year (here and here) about the state’s economic decline.

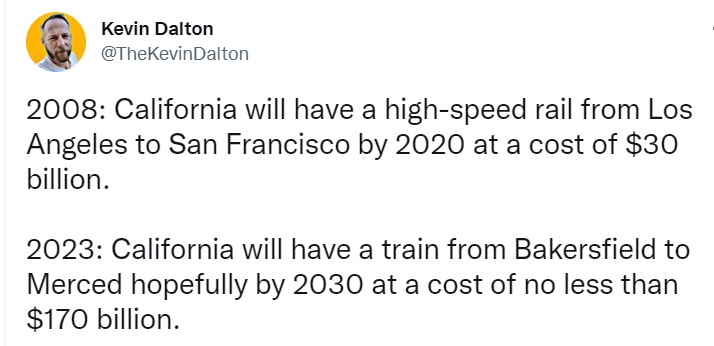

But sometimes a specific story is more compelling than broad economic trends. So here’s a tweet that caught my eye. It tells us a lot about the nature of government contracting, inefficiency, and cost overruns.

But it also tells us a lot about California (sort of like this story from 2021).

By the way, I don’t know if the above numbers are correct. But even if they are only half right, they are a damning indictment of California budgeting.

As you might expect, bad budgeting and extravagant waste also mean high taxes.

And high taxes mean economic decline, and that’s the focus of today’s column.

In a recent column for the Washington Post, Henry Olsen offers a depressing assessment of the California’s future.

California’s…falling population coupled with its $22.5 billion budget deficit suggest it could experience a swift and wrenching decline. …California offers natural beauty…, but people decide how much they want to pay for these things just like other goods. The state’s…high taxes are a significant deterrent to living there, driving many people to flee. …That outward flow of people is turning into a flood. The state’s population dropped by more than 500,000 people between July 2020 and July 2022. Outmigration to other states fueled the decline: Almost 900,000 more people have moved to other states from California in the past three years than have moved in. …This exodus poses massive risks for the state’s finances because of its reliance on revenue from the rich. As of 2018, almost 35 percent of California’s personal income tax revenue came from the sliver of taxpayers earning $1 million or more. Nearly two-thirds come from those earning more than $200,000. That means a small change in these people’s residence can cost the state billions. …It could take a New York-style collapse to force significant change. Given the direction California is heading, that unhappy prospect is no longer unthinkable.

Writing for the City Journal, Steven Malanga has a similarly grim view.

California’s net domestic outmigration ranks highest among the states…In fact, the biggest leavers by far are lower- and middle-income people. And middle-class losses have grown in the last five years to about 200,000 adult residents. Meantime, some 300,000 adult Californians from lower-income categories have also left in that time… Taxes don’t exist in a vacuum; they are one component of a governing philosophy. High taxes represent an approach that favors bigger, more pervasive government, which takes many other forms besides taxes: a tendency to greater regulation and differing spending priorities than those of lower-taxed states, for example. …Fueled by its taxes on high earners and on businesses, California has an enormous budget. Its general fund alone tops $200 billion. You might expect, for that money, top-notch services from government, but the opposite is true. …Advocates for higher taxes often argue that progressive tax systems like California’s are fairer because wealthier residents pay at higher rates. …And yet high-taxing states like California, New York, and New Jersey also have among the highest rates of outmigration. These states are so “fair” that a significant number of their lower- and middle-income residents can’t wait to leave.

The most important insight of Malanga’s column is that California politicians say that they are trying to punish the rich, but lower-income and middle-class people are suffering a lot of collateral damage.

Which should come as no surprise.