Which European nation has the costliest welfare state?

Greece would be a good guess, but it’s only in second place.

At the top of the list, according to OECD data, is France, where government spending consumes nearly 60 percent of the nation’s economic output.

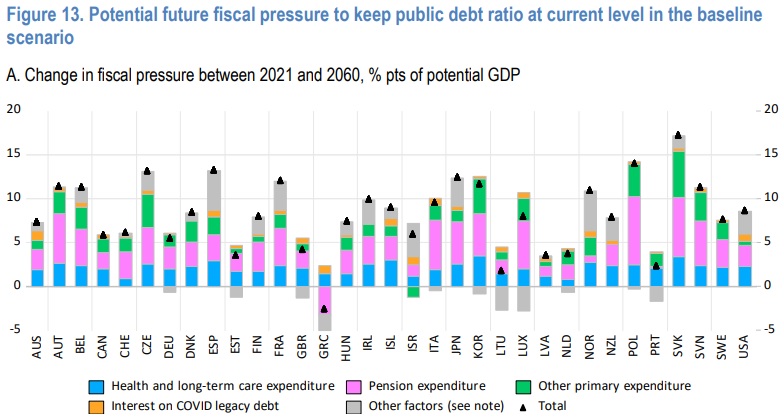

These numbers are very depressing, but they are going to get worse over time.

Like most nations in Europe, France is dealing with demographic decline. People are living longer, and also having fewer children.

And that means fewer people pulling the wagon and more people riding in the wagon.

The net result is that the burden of government spending is going to climb by another 12 percentage points of GDP over the next four decades.

Looking at the two charts, it’s obvious that France has a massive fiscal problem.

If it stays on its current course, a Greek-style fiscal collapse is inevitable.

Which explains why President Macron has proposed to take a small step in the right direction by raising the retirement age from 62 to 64.

But even this modest reform is an outrage to some French leftists. In a column for the Washington Post, Rokhaya Diallo denounces the proposed change as an assault on “the French welfare model.”

Like tens of thousands of others, I was proud to be on the Place de la République recently to defend the legacy of the French welfare state. …Across the country, millions have gathered in periodic protests to defend one of the crown jewels of the French welfare model: the pension system. President Emmanuel Macron is determined to reform the pension system and to increase the retirement age from 62 to 64 (he first intended to push it to 65). …According to Macron, the calculus is simple: The French system cannot sustain itself financially, and because life expectancy is increasing, people have to work longer. …Big companies, however, have far more resources at their disposal than individual citizens, and raising corporate taxes would be a fairer way of increasing government revenue. …The fact that we live longer does not mean that we should spend our lives working for companies. Why should we subordinate our lives to the needs of capitalism?

At the risk of being snarky, Ms. Diallo is complaining about the reality of math rather than “the needs of capitalism.”

Though, by proposing higher taxes on French companies, she sort of acknowledges that the status quo is untenable.

So is Ms. Diallo’s proposed policy of higher taxes on workers, consumers, and shareholders a feasible solution to France’s ever-growing fiscal burden? Could all the built-in new spending (12 percentage points of GDP) be financed by a higher corporate tax rate?

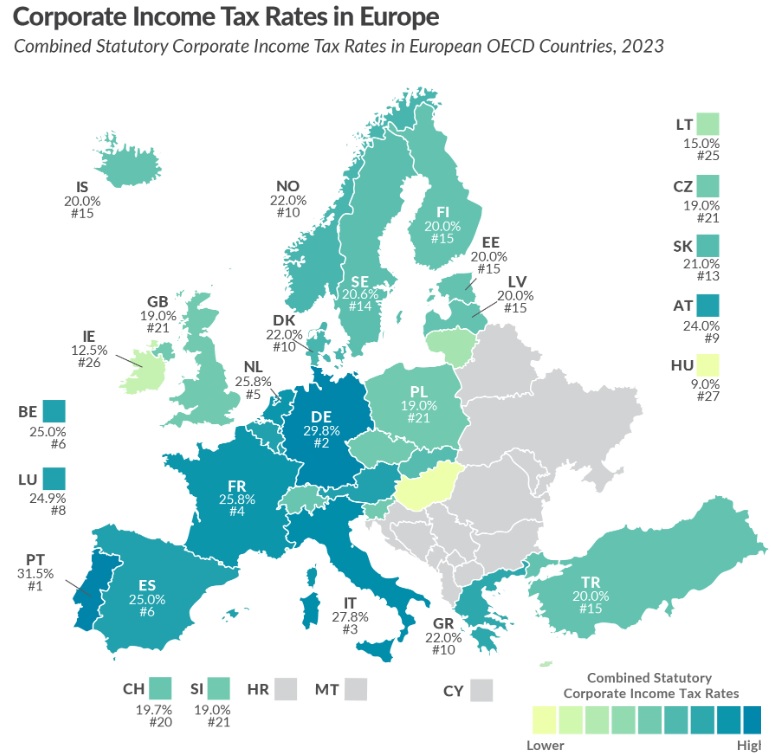

No. Not even close. The French corporate tax rate currently is 25.8 percent and it collects about 2.3 percent of GDP according to OECD data.

Given her economic naivete, Ms. Diallo might support a very radical approach, such as doubling the corporate rate to more than 50 percent. And she might think that change would boost receipts from 2.3 percent of GDP to 4.6 percent of GDP.

But she would be wrong. Wildly wrong. As shown by this map from the Tax Foundation, France already has the fourth-highest corporate tax rate in Europe. Any increase (especially a big increase) will simply cause more business activity to leave France and go to nations with less-onerous tax policy.

In other words, a higher rate would not lead to a big increase in revenue. Indeed, it might do so much damage to the business climate that the government would collect less revenue.

And don’t forget that an additional 2.3 percent of GDP in revenue (assuming it magically materialized) is still far less than the built-in spending increase of 12 percent of GDP. So her math is wrong in two ways.

The bottom line is that France has two choices.

- Stick with the status quo and eventually suffer a horrific fiscal crisis.

- Enact reforms to prevent an ever-growing spending burden.

Macron’s reforms are grossly inadequate, but at least he wants to take a small step in the right direction. Ms. Diallo wants to put her head in the sand.

P.S. In her column, Ms Diallo notes that lower-income workers don’t live as long.

…mortality numbers vary among social classes. Nurses live seven years less than other women: 20 percent of them and 30 percent of nursing assistants retire with disabilities. Blue-collar workers live six years less than executives, so that one-quarter of the poorest men die by age 62, while 94 percent of the rich are still alive at 64. Only 40 percent of the poorest survive to 80, whereas 75 percent of the wealthiest do.

I want to congratulate her. She accidentally has provided a very good argument for why folks on the left should support personal retirement accounts.

———

Image credit: Jeanne Menjoulet | CC BY 2.0.