I have a seven-part series (here, here, here, here, here, here and here) comparing Texas and California, mostly to demonstrate that the not-so-Golden State has hurt itself with excessive taxation and a bloated government.

Today, we’re going to augment our comparisons by looking at a very practical example of how California’s approach is much worse.

The National Association of State Budget Officers publishes an interesting document (at least if you’re a budget wonk) entitled State Expenditure Report.

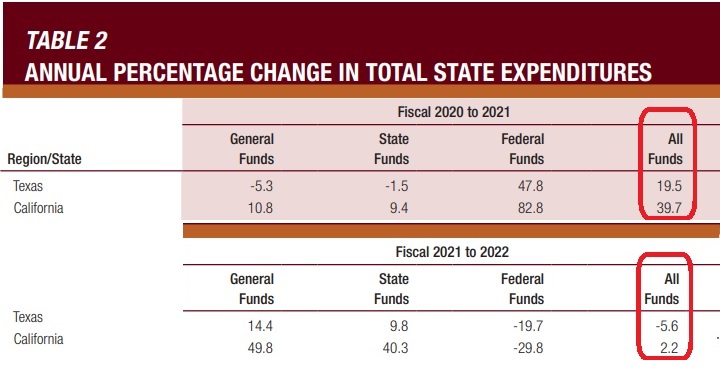

And if you to to Table 2 of that report, you’ll find the most important measure of state fiscal policy, which shows how fast the burden of government spending increased over the past two years.

Lo and behold (but to no one’s surprise), California politicians increased the spending burden much faster than their Texas counterparts.

As you can see, both states were irresponsible the first year, thanks in large part to the all the pandemic-related handouts approved by Trump and Biden.

But California was twice as bad. Politicians in Sacramento used federal handouts to finance a grotesque spending binge (whereas the spending binge in Texas deserves a more mild adjective, such as massive).

Both states were better the second year, with California’s spending burden climbing by 2.2 percent in 2022 and Texas actually delivering a spending cut.

Remember, though, that the spending burden exploded between 2020 and 2021, so the 2022 numbers only look reasonable compared to the bloated trendline.

Now let’s consider whether California’s grotesque spending binge had negative consequences.

The answer is yes, according to a Wall Street Journal editorial.

Gov. Gavin Newsom last year touted a $100 billion budget surplus as evidence of California’s progressive superiority. He was less triumphant…when announcing a $22.5 billion deficit in the coming year, a contrast to Texas’s record $32.7 billion surplus. …California’s problem, as usual, is that Democrats baked too much spending into their budget baseline. They expanded Medicaid to undocumented immigrants over the age of 50, enacted universal pre-school and school lunches, extended paid family leave by two weeks, and boosted climate spending by $10 billion. …Much of Texas’s surplus this year owes to surging sales-tax revenue from inflation and population growth—i.e., Californians moving to Texas and spending their tax savings. Mr. Newsom claimed Tuesday that California has a more “fair” tax system than the Lone Star State and that Texans pay more in taxes. This is disinformation. According to the Census Bureau, California’s per capita state tax collections ($6,325) were second highest in the country in 2021 after Vermont. Texas’s ($2,214) were second lowest after Alaska. …California’s budget problems will grow as more of its rich and middle class move to lower-tax states like Texas.

Per-capita state tax collections are the most striking numbers in the editorial. The average Californian is paying $6,325 for state government, nearly three times as much as the $2,214 that is paid by the average Texan.

Does anyone think that Californians are getting nearly three times as much value as their counterparts in the Lone Star State?

Based on how people are voting with their feet, the answer is obvious. But if you prefer more technical measures of state government value, California loses that contest as well.