In my recent interview with John Stossel, I explained that America’s entitlement programs are unsustainable because of demographic change.

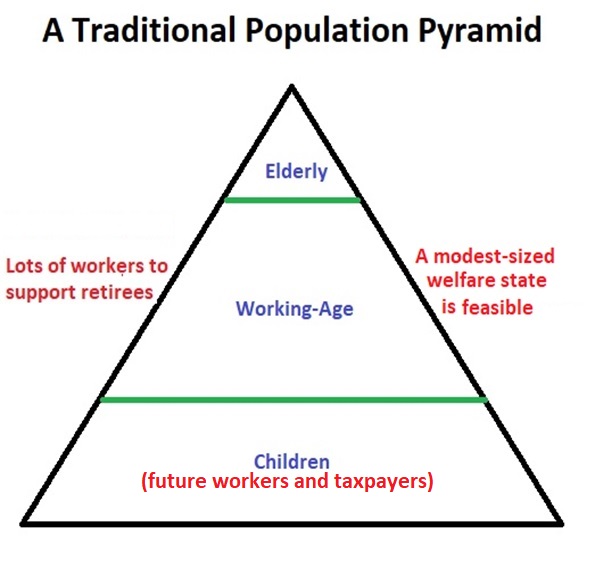

Our population pyramid is turning into a population cylinder, so there will not be enough working-age taxpayers in the future to finance all the benefits promised to the elderly. Not even close.

This inevitably and unavoidably means one or more of the following options.

- Massive tax increases.

- Massive benefits cuts.

- Massive borrowing.

- Massive money printing.

- Genuine entitlement reform.

Given those choices, entitlement reform is the only sensible path. Both for the United States and for other nations.

Some readers may think I’m exaggerating in order to push a libertarian agenda. So let’s look at some analysis from non-libertarian sources.

We’ll start with some excerpts from a recent report by the St Louse Federal Reserve Bank. Authored by Amy Smaldone and Mark L.J. Wright, it warns that the collapse in fertility is going to be a major problem for tax-and-transfer welfare states.

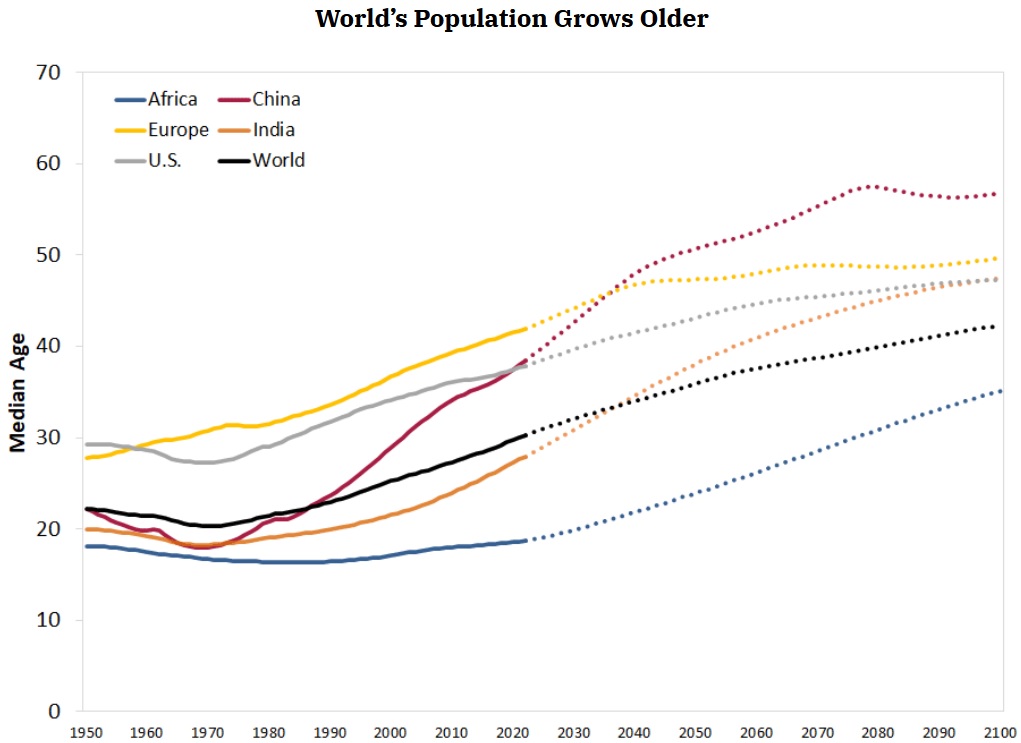

…the era of rapid population growth is coming to an end. …the world’s population will peak at around 10.5 billion people later this century before beginning to decline. …China’s population is expected to rapidly decline, ending the century around 800 million. Europe’s population has plateaued at approximately three-quarters of a billion people and will decline below 600 million by the end of the century, while the U.S. population is expected to level off at around 400 million. …The slowdown in population growth is due to a collapse in childbirth around the world. …the total fertility rate (TFR)—which represents the expected number of births over a woman’s life…for the world as a whole has fallen from about 5 in 1950 to around 2.3 today. Current TFRs are well below the “replacement rate” (or level needed to keep the population constant) of 2.1 in European countries (where they average 1.5), as well as in China (1.2), South Korea (0.9) and Japan (1.3)… Declining fertility and increased lifespans have resulted in a rapidly aging population. The figure below plots the median age of the population—the age at which half of the people are younger and half are older—around the world. As recently as 1973, half of the world’s inhabitants were under age 21. By the end of the 21st century, more than half will be middle-aged or elderly (40 or older). …the world as a whole will need to contend with a declining share of young workers. It is likely that pension and health care benefits will come under pressure with a shrinking tax base to pay for them.

I’ll add an editorial comment. It’s not “likely” that pension and health care benefits will come under pressure. That’s a given.

To understand why it’s a given, here’s a chart from the report.

As you can see, the average age is going to dramatically increase in all parts of the world.

The U.K.-based Economist also wrote about this topic in its latest issue. It also concludes that changing demographics could lead to fiscal crises.

Across much of the world the fertility rate, the average number of births per woman, is collapsing. Although the trend may be familiar, its extent and its consequences are not. …The largest 15 countries by GDP all have a fertility rate below the replacement rate. That includes America and much of the rich world, but also China and India… a shrinking population creates problems. …The obvious one is that it is getting harder to support the world’s pensioners. …whereas the rich world currently has around three people between 20 and 64 years old for everyone over 65, by 2050 it will have less than two. The implications are higher taxes, later retirements, …and, possibly, government budget crises.

Once again, I’ll add an editorial comment. It’s not that budget crises will “possibly” happen. They will happen.

However, I’ll conclude with a bit of optimism for the United States.

Greece’s fiscal crisis (starting in 2009) was a teachable moment. Republicans actually realized it was a warning sign and took a more-serious approach to the entitlement issue, supporting budgets with genuine Medicaid reform and Medicare reform.

Unfortunately, that reformist energy was blunted by Obama and it then largely evaporated under Trump.

But something similar may happen again. Other nations (probably led by Italy) are going to suffer a fiscal crisis in the not-too-distant future. And when that happens, I hope it will be another learning experience for American lawmakers.

Maybe, just maybe, they’ll then decide to do what’s best for the country.

P.S. For more information about the demographic change and entitlement crisis, click here and here.

———

Image credit: Pedro Ribeiro Simões | CC BY 2.0.