When leftists (or misguided rightists) tell me that Americans are under-taxed and that the government has lots of red ink because of insufficient revenue, I sometimes will direct them to the Office of Management and Budget’s Historical Tables in hopes of changing their minds.

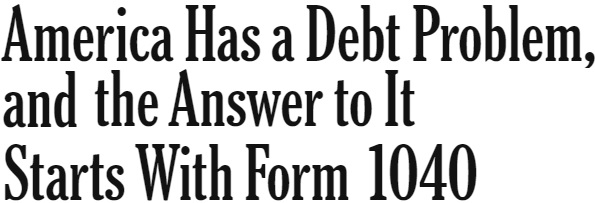

I’ll specifically ask them to look at the data in Table 1-3 so they can see what’s happened to federal tax revenue over time. As you can see from this chart, nominal tax revenues have skyrocketed.

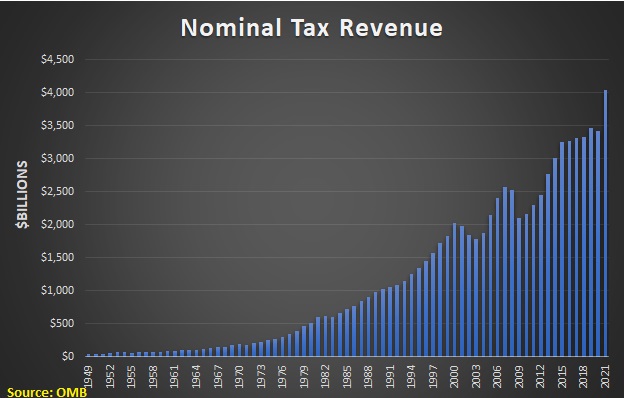

The reason that I send them to Table 1-3 is that they can also peruse the numbers after adjusting for inflation.

On that basis, we see the same story. Inflation-adjusted federal tax revenues have grown enormously.

The two charts we just examined are very depressing.

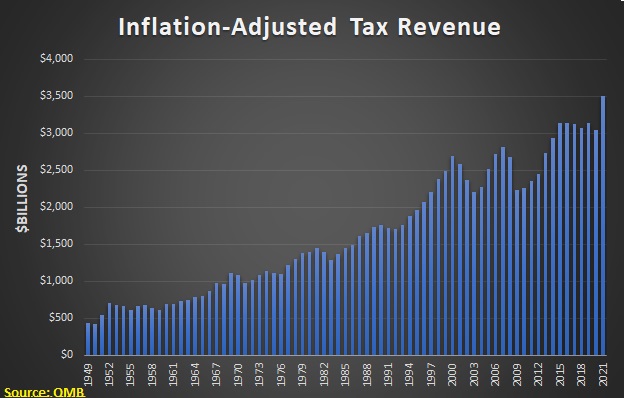

So now let’s peruse at a chart that is just mildly depressing.

If you look at federal tax revenues as a share of economic output, you’ll see that Uncle Sam currently is collecting slightly more than 18 percent of economic output. Since the long-run average is about 17 percent of GDP, that’s not a horrific increase.

However, there are still some reasons to be quite concerned.

- The Congressional Budget Office projects the tax burden as a share of GDP will expand even further over the next few decades.

- That means that politicians in DC not only are getting more money because of inflation, but also because the economy is expanding.

- Third, not only are politicians getting more money because the economy expanding, they’re slowly but surely expanding their share.

That’s very bad news for those of us who don’t like higher taxes and bigger government.

Some people, however, have a different perspective

In one of his columns for the New York Times, Binyamin Appelbaum argues that Americans are undertaxed.

…the United States really does have a debt problem. …Americans need more federal spending. The United States invests far less than other wealthy nations in providing its citizens with the basic resources necessary to lead productive lives. …Measured as a share of G.D.P., public spending in the other Group of 7 nations is, on average, more than 50 percent higher than in the United States. …There is another, better way to fund public spending: collecting more money in taxes. …If the debt ceiling serves any purpose, it is the occasional opportunity for Congress to step back and consider the sum of all its fiscal policies. The nation is borrowing too much but not because it is spending too much. The real crisis is the need to collect more money in taxes.

I give Appelbaum credit for honesty. He openly advocates for higher taxes and bigger government, explicitly writing that “Americans need more federal spending.”

And he is envious that spending in other major nations is “more than 50 percent higher than in the United States.”

But this raises the very obvious point about whether we should copy other nations with their bigger welfare states and higher tax burdens. After all, European nations suffer from weaker economic performance and lower living standards.

Does Appelbaum think we’ll have “productive lives” if our living standards drop by 50 percent?

Does he think that “invest” is the right word for policies that lead to lower economic performance?

The bottom line is that I’m completely confident that Appelbaum would be stumped by the never-answered question.

P.S. Dishonest leftists claim tax increases will lead to less red ink while honest leftists like Appelbaum admit the real goal is a bigger burden of government.

———

Image credit: Andy Withers | CC BY-NC-ND 2.0.