The 21st Century has been bad news for advocates of limited government. Every president over the past two decades has been a big spender.

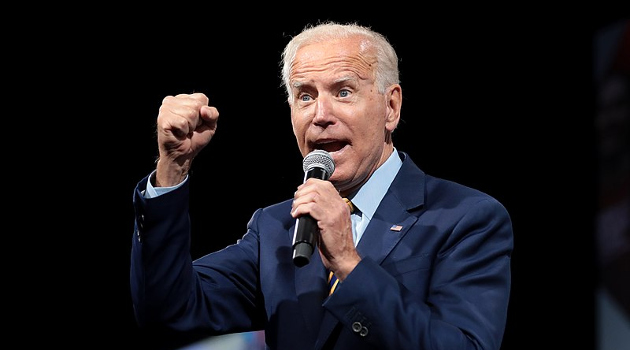

Including Joe Biden.

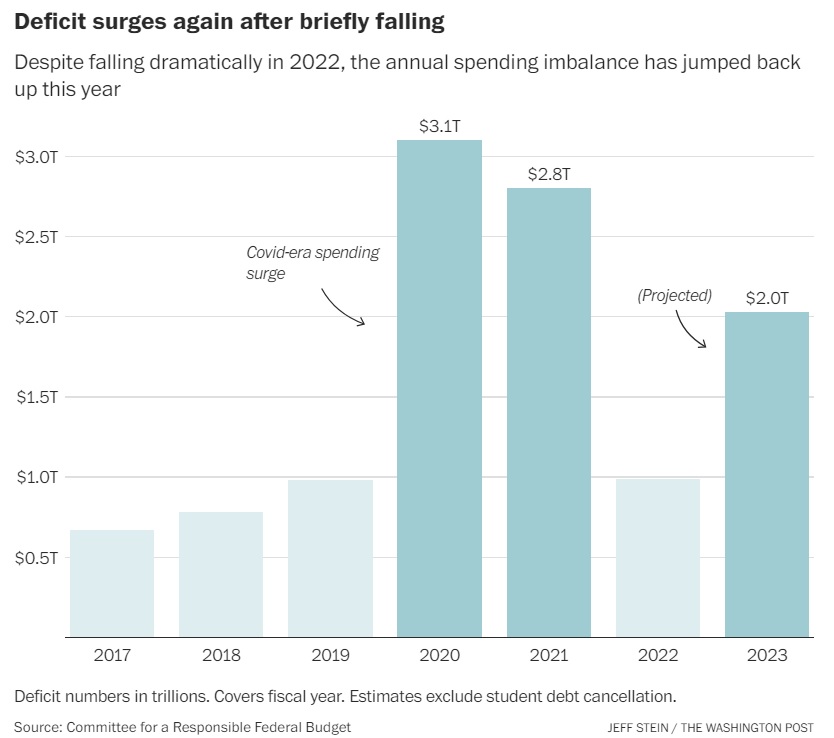

Yes, there was a brief dip in the spending burden in 2022, but that was only because of the massive temporary surge of pandemic-related spending in 2020 and 2021.

Now that we’re back to normal (at least by Washington standards), the fiscal situation once again is heading in the wrong direction.

The above chart is featured in an article in the Washington Post about America’s budgetary woes.

The good news is that the article, authored by Jeff Stein, calls attention to the nation’s fiscal problems. The bad news is that it mostly focuses on the symptom of red ink rather than the real problem of excessive spending.

The federal deficit is projected to roughly double this year… Budget experts now project that it will probably rise to about $2 trillion for the fiscal year that ends Sept. 30… The unexpected deficit surge, which comes amid signs of strong growth in the economy overall, is likely to shape a fierce debate on Capitol Hill about the nation’s fiscal policies… Biden and House Speaker Kevin McCarthy (R-Calif.) approved a deal in June to raise the nation’s borrowing limit, but it did little to alter the long-term debt trajectory. …The surge in red ink has confounded many economists’ expectations. Typically, deficits contract when the economy grows, because businesses and consumers owe more in taxes and the government does not need to spend as much to protect those who have lost their job.

If you read to the ninth paragraph, though, you eventually discover the real problem. There’s too much irresponsible spending.

From August 2022 to this July, the federal government spent roughly $6.7 trillion…. That represents a total increase in spending of 16 percent relative to last year…a number of…spending increases contributed to the rising deficit — Social Security payments increased because they are indexed to inflation; the government spent more on education, veterans benefits and health care; and the bipartisan infrastructure law, as well as the 2022 Inflation Reduction Act, started sending billions of dollars out from the government’s accounts.

That 16 percent increase between August 2022 and July 2023 is utterly reckless and that includes what must be a one-month record of more than $917 billion in spending last September (presumably bureaucrats rushing to spend money before the end of the fiscal year), according to data from the Treasury Department’s Monthly Statement.

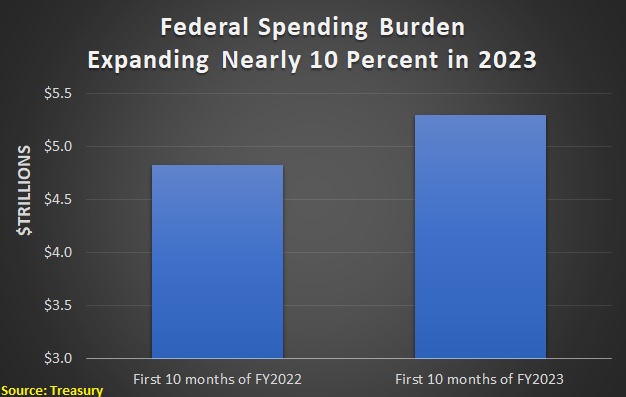

But even if we ignore that monthly spending binge and just look at spending for the 2023 fiscal year (which started last October), we find that the spending burden is about 10 percent higher than it was in the 2022 fiscal year.

At the risk of repeating what I’ve stated before (over and over again), bad fiscal policy is when the spending burden grows faster than the economy.

So America is getting bad fiscal policy now and 30-year projections show bad fiscal policy in the future. Staying on our current budgetary path is a sure-fire recipe for a very grim outcome, regardless of whether spending is financed by taxes or borrowing.

P.S. There is a solution to America’s fiscal mess.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.