Washington has a spending addiction. And it’s bipartisan.

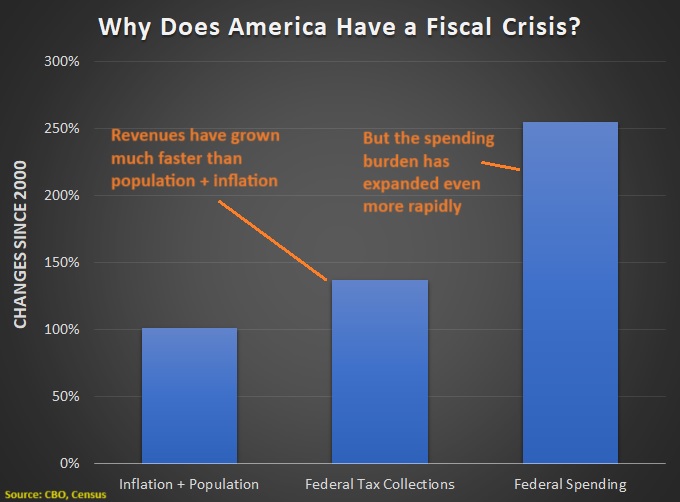

To understand the magnitude of the problem, let’s look at how fast taxes and spending have increased this century compared to population plus inflation.

There are two obvious takeaways from this data.

- Washington receives more than enough tax revenue. Receipts have increases 137 percent since 2000, well beyond the 101 percent combined increase of inflation and population.

- The crowd in Washington is grotesquely profligate. The federal spending burden has jumped 255 percent since 2000, more than 2-1/2 times faster than needed to keep pace with inflation plus population.

I’m sharing this data because reckless fiscal policy at some point will probably produce a crisis. James Capretta of the American Enterprise Institute recently wrote on this topic.

Here are some excerpts.

…the only reason a debt crisis has not already occurred is that market participants assume a tax and spending correction is coming at some point. …if and when the market consensus shifts toward assuming a fix is not coming after all, a debt crisis would emerge in short order. Demand for U.S. debt would fall, interest rates would rise (thus causing deficits to widen still further), and a crisis will have begun. …the U.S. has only about 20 years left before debt reaches a level that it could not be brought back under control without a wrenching break from today’s benign economic environment, such as an extended period of hyperinflation. …The U.S. is now operating with no margin for error… It would not take much at this point for the market to conclude that U.S. political dysfunction is a hardening reality and not a passing phenomenon. The follow-on conclusion that a rational and planned course correction will never be forthcoming could be the match that lights the fire.

The bottom line is that the profligacy of Bush, Obama, and Trump has led to anemic growth and rising dependency.

For what it’s worth, I think that’s already a crisis, albeit a slow-acting crisis akin to cancer.

Capretta is writing about a different kind of crisis, mostly likely a sudden panic in financial markets (like Greece back in 2009-10), which is more akin to a heart attack.

Either option is bad.

I’ll close with good news and bad news.

The good news is that we know how that spending restraint is en effective way to reduce debt. We even know that’s the way to reduce enormous levels of debt.

The bad news is that politicians will want to impose tax increases. And history tells us that will simply lead to more spending and more debt.