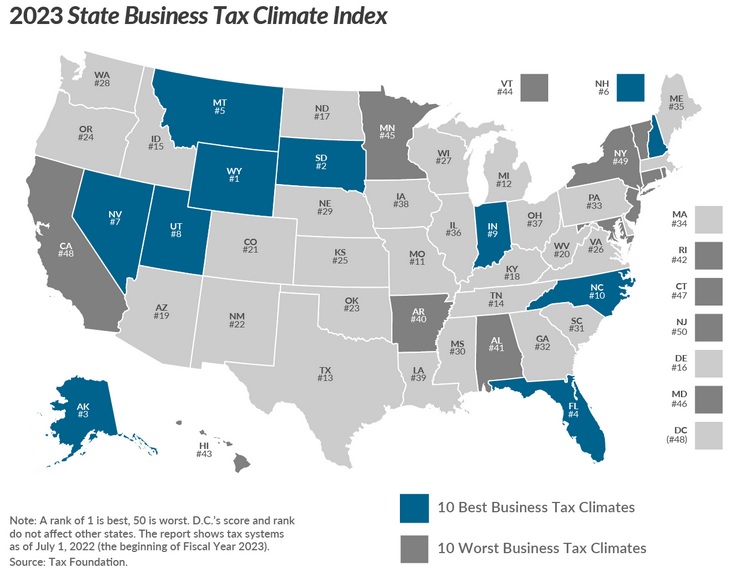

When I first started citing the Tax Foundation’s State Business Tax Climate Index back in 2013, North Carolina was one of the 10 worst states.

In a remarkable turnaround, North Carolina is now one of the 10 best states.

The big improvement is partly because the state joined the flat tax club.

But there were other tax cuts as well, along with some much-needed spending restraint.

Sounds like great news, but you won’t be surprised to learn that not everyone is happy about what’s happened in the Tarheel State.

In a column for the Raleigh News & Observer, Ned Barnett opined yesterday against tax cuts – both the ones that already have occurred and the new ones that the state legislature is considering.

Republican state lawmakers think cutting taxes makes North Carolina more attractive to new businesses, but cutting taxes too much has the opposite effect. …Now, with the General Assembly back in session, they’re looking to cut some more. It’s a reckless path… Since Republicans began aggressively cutting taxes in 2013, the state has lost billions of dollars in revenue. …North Carolina has excess revenue because the state has reduced what it has historically spent as a share of the state economy – a drop from 5.8 percent to 4 percent… The state corporate tax has fallen from 6.9 percent to 2.5 percent and will be phased out by 2030. The personal income tax has been stepped down from a two-tier progressive tax with a top rate of 7.75 percent to a flat tax of 4.75 percent today. Now state Senate leader Phil Berger says the legislature should consider cutting the personal income tax to 2.5 percent.

The most important data cited above is that the burden of state government spending has dropped from 5.8 percent to 4 percent of the state economy.

This upsets Mr. Barnett, but the rest of us should view this as a major triumph for genuine fiscal responsibility.

And by imposing genuine spending restraint, North Carolina lawmakers created the “fiscal space” for meaningful tax cuts.

So why is Mr. Barnett upset? In the column, he complains that some parts of the budget are not increasing as fast as he would like. But he never offers any evidence that the state is suffering economic harm.

I suspect he offered no evidence because he has no evidence.

Or perhaps he offered no evidence because the data shows that he’s wrong.

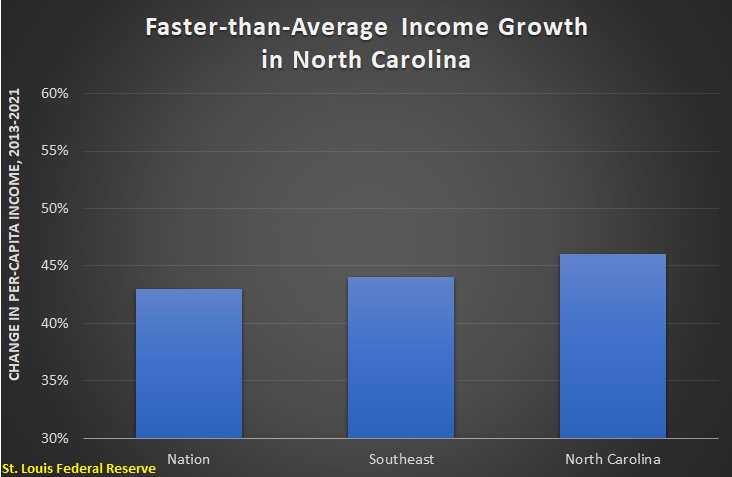

And that’s exactly what I discovered when I checked the St. Louis Federal Reserve Bank’s per-capita income data. Lo and behold, incomes in North Carolina are growing faster than the national average and faster than the regional average.

The differences are not huge, but it’s nonetheless better to have faster income growth rather than slower income growth.

Some of my more sophisticated friends on the left doubtlessly will point out that states in other regions still have higher overall levels of average income, which is a fair point, but it’s also fair for me to respond by noting that the cost-of-living is generally much lower in North Carolina.

The bottom line is that North Carolina’s better tax policy has the state moving in the right direction while high-tax states are moving in the wrong direction.

P.S. North Carolina also is close to being among the 10 best states for educational freedom.

———

Image credit: geralt | Pixabay License.