I’m not a big fan of Moody’s, Fitch, and Standard & Poor’s. As I explained in this 2011 interview, these credit rating firms don’t provide much insight, at least with regards to assessing whether governments can be trusted to honor their debts.

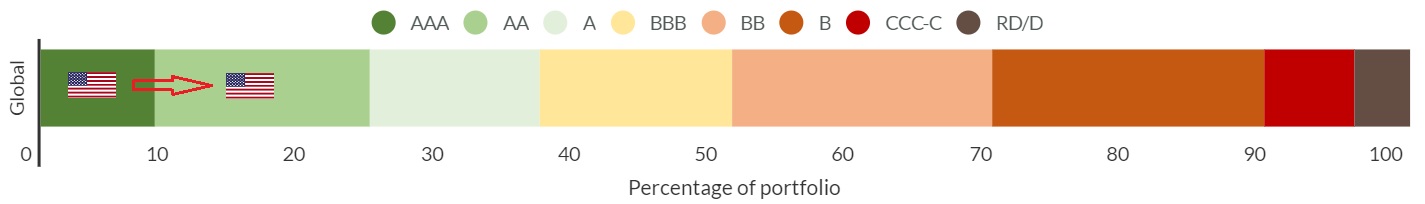

That being said, I don’t object to Fitch’s decision to reduce America’s rating from AAA to AA.

Here’s some of what the company wrote.

Fitch Ratings has downgraded the United States of America’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘AA+’ from ‘AAA’. …The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions. …Additionally, there has been only limited progress in tackling medium-term challenges related to rising social security and Medicare costs due to an aging population.

While I agree with the downgrade, I have a couple of observations.

- The US is in strong shape in the short run: There is zero chance that bondholders will lose money in the next 20 years. Even if Republicans and Democrats had a bigger-than-normal fight over the debt limit, leading to some bondholders not getting paid on time, lawmakers would fully compensate them in any eventual agreement.

- The US is in terrible shape in the long run: American politicians are grotesquely irresponsible. They mostly understand that America faces an entitlement crisis, but most of them are unwilling to address the problem. Heck, some of them want to dig the hole deeper by expanding the welfare state.

- America’s long-run fiscal problem is bipartisan: Starting with LBJ and Nixon, politicians from both parties have expanded the burden of government. The deterioration has continued this century with two Republican presidents and two Democratic presidents pushing for more spending.

By the way, there’s little reason for future optimism. Trump and Biden attack anyone who wants to do the right thing on entitlements, so that makes it more likely that politicians eventually will compound the damage of higher spending by enacting higher taxes.

P.S. A big problem with the credit rating firms is that they seemingly think tax increases and spending restraint are equally acceptable ways of reducing red ink and improving creditworthiness. But since higher taxes lead to less growth and encourage more spending, the inevitable result is that tax increases lead to more debt. Just look at what’s happened in Europe.