I have been very pessimistic in recent years about the United Kingdom. Now, having just finished giving speeches in Bristol and London, I’m even more pessimistic.

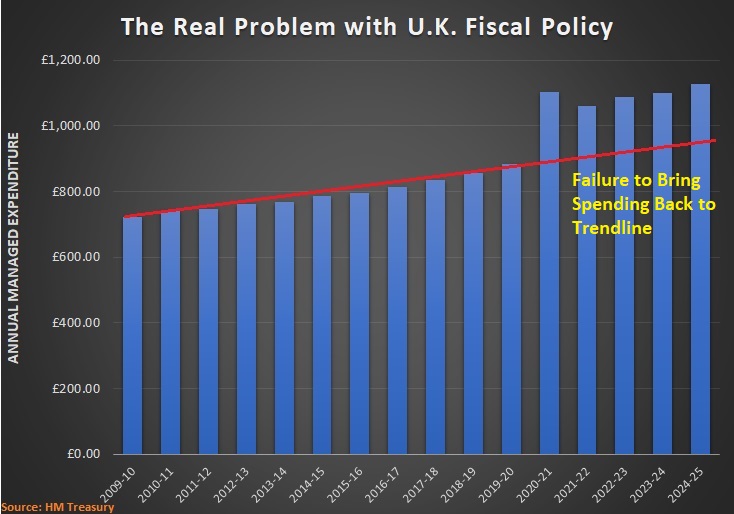

The core problem is that the burden of government spending has expanded dramatically in recent years, in part because of the pandemic.

But there’s been no move to undo the damage. Instead, the (supposedly) conservative governments of Boris Johnson and Rishi Sunak have kept the spigots open.

So there’s a new spending baseline showing a permanent expansion in the fiscal burden.

And this does not even include all the additional spending that almost surely will get added because of demographic change.

Sadly, none of the experts I met with on my trip expressed much hope of reversing the nation’s fiscal decline.

Indeed, most of them have a a glum outlook. Including the ones I didn’t talk to. For instance, Fiona Bulmer authored some depressing analysis for CapX about the U.K.’s faux conservatives.

Now a Tory government boasts that it is spending “£407 billion on support for families, jobs and businesses”, borrowing is at its highest level since the war – and that’s only the start. …Ministers, commentators, the Bank of England…seem to believe that we have now finally created a climate in which the magic money tree can flourish. …spending discipline has been completely abandoned over the past year. …We used to believe that individuals and businesses would always be better at spending their own money than government, instead we must now celebrate that the Department of Transport is giving people £50 vouchers to get their bikes mended. The problem is that once public spending becomes celebrated as a virtue then the culture of cost constraint disappears and every part of government will adopt the Oliver Twist approach and constantly come back for more.

As you might expect, governments that spend too much also have bad tax systems.

That certainly is true in the United Kingdom. But, as reported by the Economist, the U.K. seemingly tries to make taxes as punitive as possible.

People in England, Wales and Northern Ireland pay a basic rate of income tax of 20% on annual earnings over £12,570 ($15,612)… Britons must also pay national-insurance contributions (NICS) of 12% of weekly earnings over £242… Recent university graduates with student debt must pay an additional 9% on anything they earn over £27,295. A 40% income-tax rate kicks in at slightly over £50,000, which is when parents also begin to be taxed on a welfare payment known as child benefit. The result can be a 60% marginal tax rate for those with two children and a 70% rate for those with three. For every £1 earned above £100,000, you lose 50p of the £12,570 tax-free allowance; the allowance falls to zero if your income is £125,140 or more. That means at least a 60% marginal tax rate for high-earning taxpayers—rising to over 100% for parents who start losing tax-free child-care benefits as well. …Value-added tax…is levied at a 20% rate on most final purchases by consumers. …Britain has some of the highest taxes on property of any country in the OECD.

Is there any hope of fixing this mess?

That is unlikely, given the profligacy of today’s Tory politicians.

But there is a solution if any of them eventually decide to be on the side of taxpayers. Writing for CapX, Gavin Rice opines that it is time to reform the welfare state and limit spending growth.

Despite Thatcher’s revolutionary attempt to shift responsibility back onto individuals and families, …the welfare state has grown and grown. Since 1948, welfare spending has risen from £11bn to well over £200bn, in today’s money – that’s 18 times more spent on social security than under Clement Attlee’s supposedly socialist Labour government. …spending…has also risen as a proportion of national income from around 4% in 1947 to over 10% by 2019, and is projected to rise to over 12% by 2065. …to sustain even pre-Covid spending habits over the medium term, the Office for Budget Responsibility has estimated that taxes would need to rise by one third in order to stabilise debt… Britain has an ‘inverse pyramid’ society with a minority of working adults sustaining a majority of economically inactive citizens. …when public spending requirements outstrip that growth, there’s a problem.

Since it reflects my Golden Rule, I particularly appreciate the last sentence in the above excerpt.

But I don’t appreciate how recent British Prime Ministers have violated that rule.

Makes me wonder whether Boris Johnson and Rishi Sunak are doing more damage to good fiscal policy in the U.K. than George Bush and Donald Trump did to good fiscal policy in the U.S.?

———

Image credit: David Iliff | CC BY-SA 3.0.