I’m not a big fan of the Internal Revenue Service, but our awful (and anti-growth) tax system is mostly the fault of politicians.

Ever since that dark day in 1913 when the income tax was enacted, presidents and members of Congress have been making the system more and more complicated.

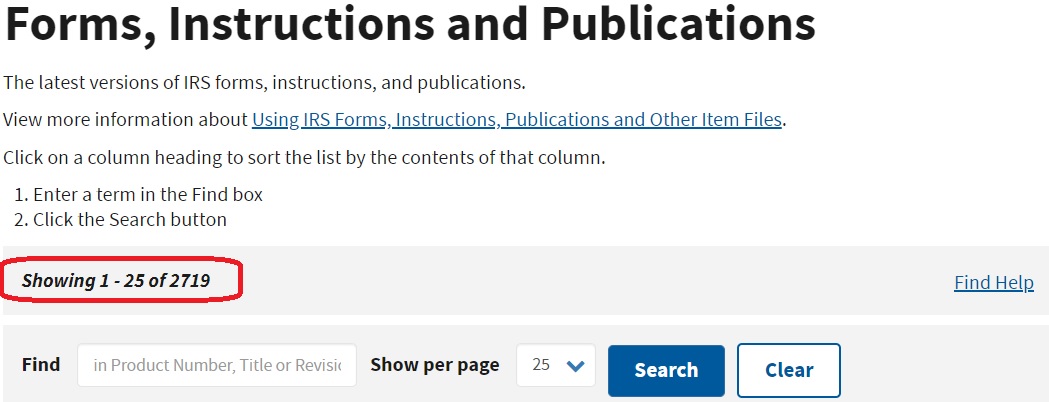

The net result is that we now have a tax system that – according to the IRS website – requires more than 2,700 separate forms, instructions, or publications (a huge increase over the past two decades).

In my fantasy world, we would throw all those forms in the trash and replace today’s convoluted tax system with a simple and fair flat tax.

Instead of 2,700-plus forms, we would have one simple postcard-sized tax return for households and another simple postcard-sized tax form for businesses.

Yes, there would be a few other forms for instructions and things like that, but compliance costs would drop by more than 90 percent.

Seems like a win-win approach, but the Washington Post has a different perspective, editorializing instead in favor of simply giving the IRS more money and power.

For the past three years, the IRS has failed to do its most basic job: processing tax returns in a timely manner. There are many reasons. The pandemic upended almost everything for a while. …Ancient computer systems hampered operations. And Congress kept asking the IRS to do more: implement the sweeping 2017 GOP tax code overhaul, then send stimulus checks — three times — to the vast majority of Americans during the pandemic. …Yet House Republicans made it their first priority this year to pass legislation slashing IRS funding, which would worsen the agency’s problems — and the service it provides Americans. …Congress’s priority should be modernizing the IRS and getting it back to full functionality. That’s why Democrats passed $80 billion in extra funding for the agency… This isn’t the time to cut. It’s the time to resuscitate.

By the way, “slashing” is a very inaccurate word when describing the GOP plan to cancel a giant budget increase for the IRS. Indeed, the IRS budget (adjusted for inflation) has dramatically expanded in recent decades.

But we should expect misleading analysis from the Washington Post.

So let’s conclude by instead asking a fundamental question: Is it better to continue on the current path (an ever-more-complex tax system requiring ever-more-money for the IRS) or is it better to have a clean tax system?

The answer should be obvious.

P.S. I’m sure that not every additional form on the IRS website represents additional complexity. But I’m also sure that the tax code is far worse than it was in the past. Perhaps the most compelling evidence is the huge increase in the number of pages needed for the instruction manual for the 1040 tax form.

P.P.S. Also keep in mind that there is a lot of evidence that tax complexity is a major source of political corruption.

P.P.P.S. If you like gallows humor, click here.

———

Image credit: TravelingOtter | CC BY-SA 2.0.