At the start of the year, I wrote that so-called tax expenditures were a “boring but important issue.”

Well, it’s time to once again put readers to sleep.

Let’s start with a definition. A tax expenditure is basically a loophole in the tax code. And these loopholes are called tax expenditures because they are seen as being equivalent to a spending program.

For instance, the crowd in Washington could pass a $100 billion spending program to benefit an interest group, or it could create a special preference in the tax code that is worth $100 billion to the same interest group.

Libertarians don’t view these things as morally equivalent. A spending program takes money from other people and gives those funds to an interest group, whereas a tax loophole simply lets people keep their own money.

But that does not mean tax loopholes are good policy. They are a form of industrial policy in the tax code.

The pro-market view is that loopholes should be eliminated so long as every penny of the revenue is used to lower tax rates (a core premise of tax reform).

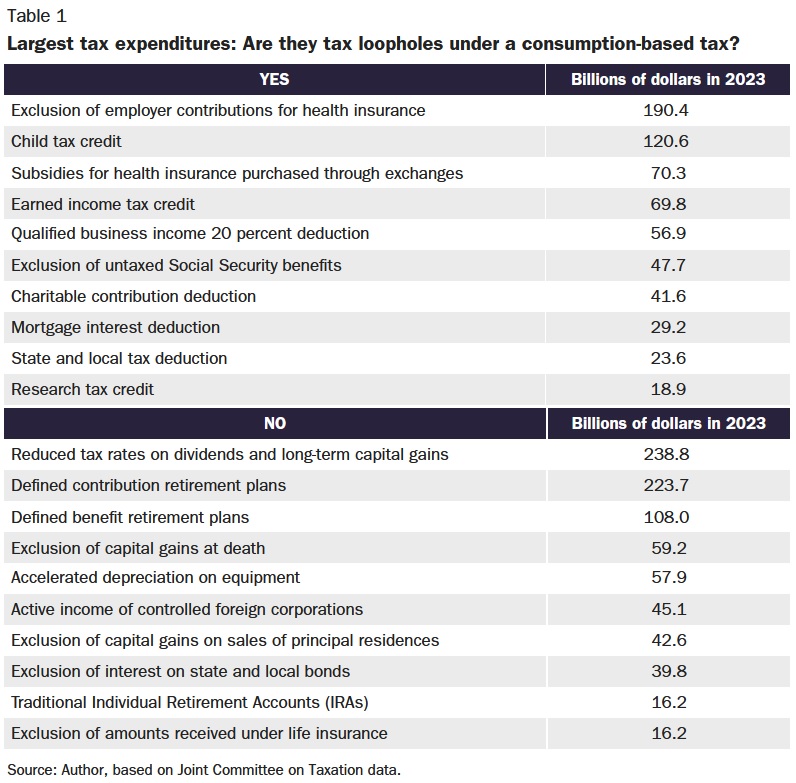

This sounds simple and straightforward, but there is a big controversy over the benchmark (or “tax base“) that gets used when measuring loopholes.

- Is is the Haig-Simons tax base, which assumes that there should be double taxation of income that is saved and invested (in effect, taxing income plus changes in net worth)?

- Is is the consumption tax base, which assumes that income should be taxed only one time (thus creating neutrality between current consumption and future consumption)?

Official Washington (primarily the Treasury Department and the Joint Committee on Taxation, but also CBO, GAO, ) uses the Haig-Simons tax base.

And left-leaning groups understandably like the Haig-Simons approach.

Needless to say, pro-market organizations have a different perspective.

Chris Edwards has a new study that reviews the official list of tax expenditures and identifies which ones actually are loopholes.

The Tax Foundation did something similar back in February.

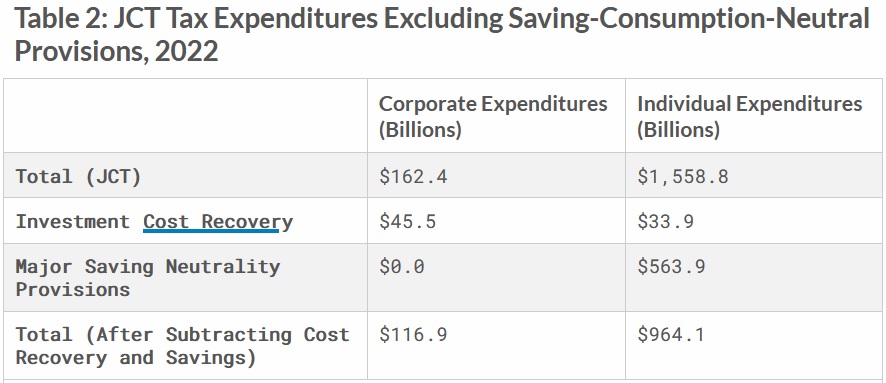

Here’s a table showing how so-called expenditures dramatically shrink when getting rid of tax penalties on business investment and tax penalties on personal savings and investment.

For those who want to finance genuine tax reform, there are genuine loopholes that could be eliminated or curtailed, most notably the fringe benefits exclusion and the muni-bond exemption.

P.S. The fringe benefits exclusion is such bad policy (contributing to third-party payer) that I even wrote something nice about Obamacare.

P.P.S. Our friends on the left genuinely seem to think that the government has an automatic claim to people’s income.

———

Image credit: geralt | Pixabay License.