Back in 2018, I shared some academic research on the relationship between state tax rates and the performance of professional football teams.

The main takeaway is that teams based in high-tax states did not win as many games, on average, as teams based in low-tax states.

So if you want your favorite team to win, support better tax policy.

Though there are no guarantees. A team from high-tax California just won the Super Bowl, so it goes without saying that taxes are not the only factor that determines team success.

But it presumably means that teams in states like California and New York have to overcome a built-in disadvantage.

Let’s take a look at some new research on this issue. Professor Erik Hembre of the University of Illinois at Chicago authored a study that’s been published by International Tax and Public Finance.

Here’s the question he wanted to answer.

Do higher state income taxes harm firms? …This paper examines the state income tax burden in a unique market, professional sports, where teams—the capital in question—are highly immobile and players—the labor—are highly mobile to test whether higher state income tax hinders team performance. Anecdotal evidence suggests higher state income taxes disadvantage professional sports teams. Across the four major US sports leagues, of the forty-nine franchises with long championship droughts, only four are from states that do not have an income tax, while twenty are from the highest taxed states.

Here’s his methodology, which takes advantage of the fact that free agency gave players new-found ability to play where they could keep more of their earnings.

To test the link between state income taxes and team performance, this paper analyzes team performance in the four major US professional sports leagues: the National Basketball Association (NBA), the National Football League (NFL), the National Hockey League (NHL), and Major League Baseball (MLB). To address concerns that the association between team performance and income tax rates may be coincidental, I examine how the tax rate effect changed with the adoption of free agency. Achieving free agency has been a milestone for players’ associations, paramount both for increasing player mobility across teams and for forcing teams to compete for player services without restrictions.

Since athletes respond to incentives (just like entrepreneurs, inventors, and scientists), we should not be surprised that Prof. Hembre found that teams in lower-tax states now enjoy more success.

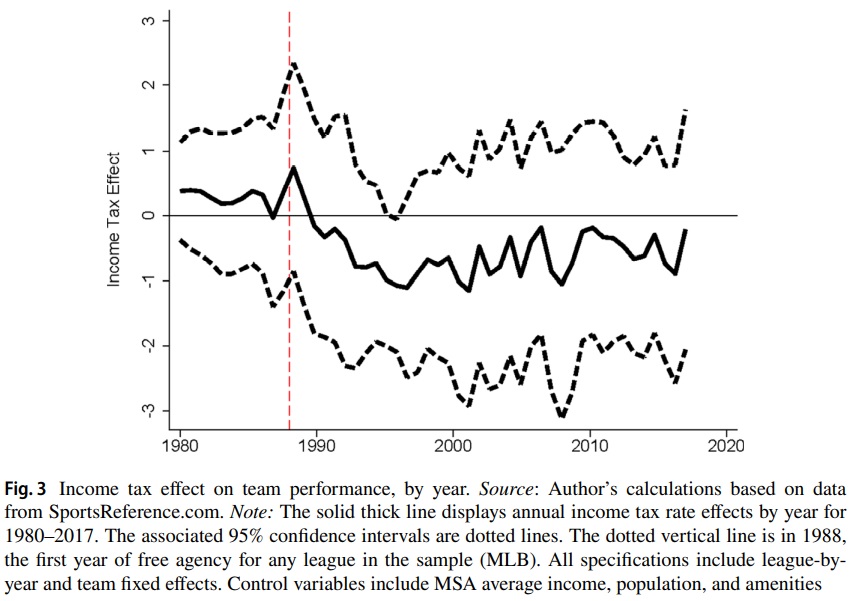

I compare the link between tax rates and team winning percentage before and after the introduction of free agency in each league using within-team variation in top state marginal income tax rates. Prior to free agency, there was a small positive association between income tax rates and winning. After the introduction of free agency, changes in state income tax rates significantly influence team performance. Each percentage point increase in the top marginal income tax rate is associated with a 0.70 percentage point decrease in win percentage. The tax rate effect on team performance is robust to a variety of specifications, such as controlling for sales and property taxes or alternative tax rate measures. Changing the outcome measure to be championships or finals appearances also yields similar results. The estimated effect size is non-trivial. The main analysis effect size of − 0.70 means that a one standard deviation increase in tax rate will result in 2.05 fewer wins over an 82 game season. …Figure 3 presents the annual point estimates (훽2) and 95% confidence intervals of the income tax rate effects between 1980 and 2017. …in all 9 years prior to any league having free agency, there was a positive income tax effect estimate. This relationship changed shortly after the introduction of free agency and since 1990 the annual income tax effect has remained negative.

Here’s the aforementioned Figure 3 for my wonky readers.

As a fan of better tax policy, I like Prof. Hembre’s findings.

As a fan of the New York Yankees, I don’t like his findings

P.S. Here’s one final tidbit that will appeal to fans of the Raiders.

Considering an extreme case, the recent relocation of the Oakland Raiders from a high income tax state (California) to a no income tax state (Nevada) projects a winning percentage increase of 8.6 percentage points or about 1 game per NFL season

P.P.S. I’ll close by reiterating my caveat about taxes being just one piece of the puzzle. After all, I speculated that taxes may have played a role in LeBron James going from Cleveland to Miami many years ago. But he has since migrated to high-tax California. Though many pro athletes have moved away from the not-so-Golden States, so the general points is still accurate.

P.P.P.S. I feel sorry for Cam Newton, who paid a marginal tax rate of nearly 200 percent on his bonus for playing in the 2016 Super Bowl.

P.P.P.P.S. Taxes also impact choices on how often to box and where to box.

P.P.P.P.P.S. Needless to say, these principles also apply in other nations.

———

Image credit: Lorie Shaull | CC BY-SA 2.0.