It is economically foolish to have high tax rates, double taxation, and corrupt loopholes.

The answer, as Steve Forbes explains in this video, is the flat tax.

He makes excellent points, similar to the analysis I shared in my 2010 video.

Though there’s one difference. He got to share the good news about the wave of tax reform taking place at the state level.

In my video, by contrast, I got to share the good news about the tax reform that was taking place in Eastern Europe.

And what happened in Eastern Europe is our topic for today.

A new study by Brian Wheaton, a professor at UCLA who examined what happened after those nations adopted flat tax systems after the breakup of the Soviet Empire.

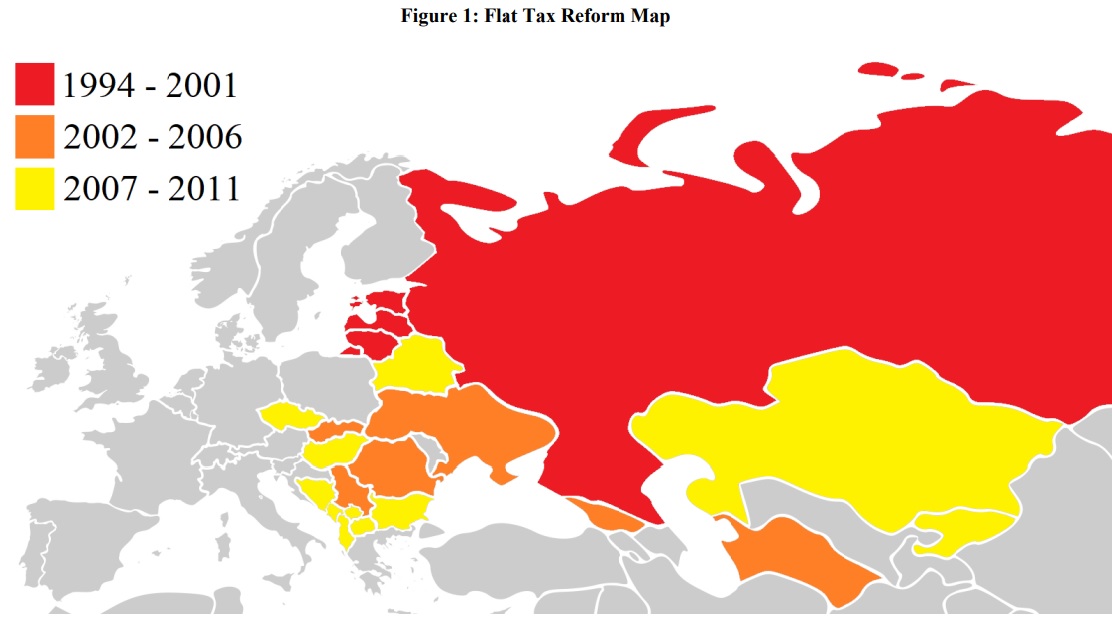

Here’s a map from the study, showing the nations that adopted the flat tax.

What were the economic results?

Here are some excerpts from Prof. Wheaton’s study.

Would a flat income tax substantially improve…incentives? To answer these questions, I study the experience of twenty post-Communist countries, which introduced flat taxation on income. I find that the flat tax reforms increase annual per-capita GDP growth by 1.38 percentage points for a transitionary period of approximately one decade. …Further, I find that the growth effect primarily operates through increases in investment and, to a lesser extent, labor supply. It is driven by the reductions in progressivity resulting from the reforms rather than merely the reductions in the average marginal tax rate.

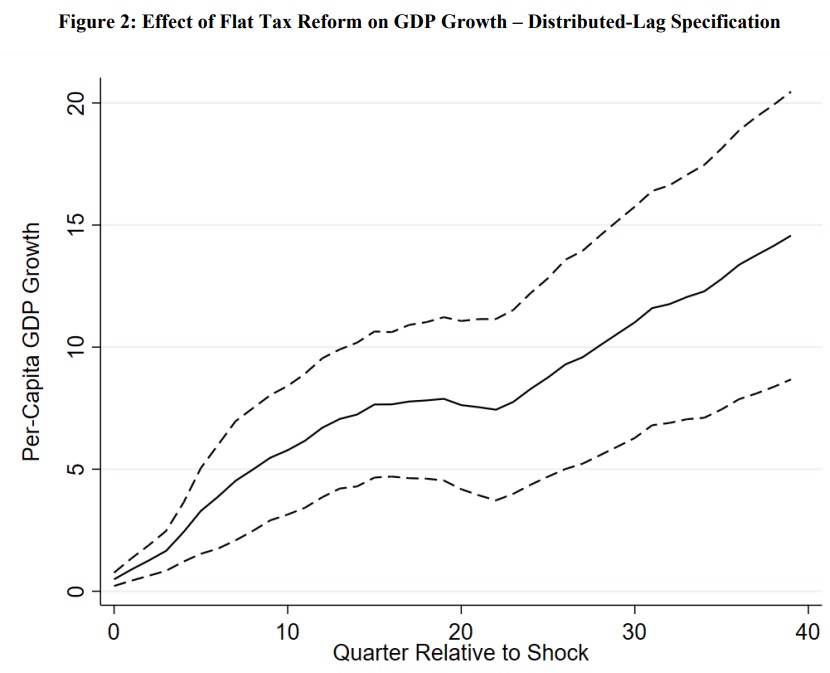

And here’s a chart showing the pro-growth impact.

I wrote a column about this study yesterday for Townhall.

Here’s some of my analysis.

Starting about 30 years ago, there was serious interest in replacing the internal revenue code with a simple and fair flat tax. What motivated the desire to adopt a system based on one low rate, no double taxation of saving and investment, and no special loopholes? In part, it may have been because lawmakers at the time had a decent understanding of fiscal policy, having spent much of the 1980s lowering tax rates and seeing how that led to better economic performance. …With Bill Clinton in the White House, however, it was not possible to turn enthusiasm into reality. And in the following few decades, tax reform has fallen off the radar. …That’s unfortunate. America’s tax system has punitive features that reduce incentives for productive behavior. ..it would be a very good idea to resuscitate tax reform.

I explain that Professor Wheaton’s growth estimates are very important.

By the way, 1.38 percentage points of additional annual growth may not sound like much to some people, but the net effect is that flat tax nations wound up with about 15 percent more economic output after a decade. And that’s in addition to whatever growth they would have experienced without tax reform. A similar boost in growth in the United States would means several thousand dollars of additional economic output for every man, woman, and child.

And I close with a political observation.

It will be interesting to see whether some of the potential 2024 presidential hopefuls decide to battle these people and make tax reform part of their campaigns. Combined with other good ideas such as spending caps and federalism, there might be a winning message for the right candidate.

By the way, I’m not the only person to write about resuscitating tax reform.

Here are some excerpts from a column earlier this year by Cal Thomas for Jewish World Review.

The next time Republicans control all three branches of government they may wish to visit an old idea – the flat tax. …The Tax Code is a foreign language to many. As of 2018, it comprised 60 thousand pages in 54 volumes. According to The Tax Foundation, …the U.S. ranks 21st out of 37 nations in tax simplicity. Estonia has been first for eight straight years. Maybe we could learn from them. Look at states with no state taxes to see their prosperity. It is a major reason so many Americans are moving from high tax states to those with lower, or no state taxes. Unfortunately, one cannot escape the long arm of the IRS. A flat tax and the elimination of the IRS might help reduce the anger many people have about Washington and big spending politicians.

Since I’m a policy wonk, I mostly care about tax reform in hopes of reducing what economists refer to as “deadweight loss” in the economy.

But let’s also remember what Steve Forbes said in the video about the current system being corrupt.

———

Image credit: Chris Tolworthy | CC BY 2.0.