Most people don’t know how to define a “tax haven,” but we assume places with no income tax are on the list. And there’s a lot to admire when looking at jurisdictions such as Bermuda, Monaco, and the Cayman Islands.

But what if we want to identify the opposite of a tax haven. What is a “tax hell” and how can they be identified?

A new study for the 1841 Foundation undertakes that task and it lists 12 nations that deserve this unflattering label. Belarus is the worst of the worst, followed by Venezuela, Argentina, and Russia.

But this isn’t just a list of places with high tax burdens.

To be a tax hell, a nation has to have punitive taxation and a lousy government. Here’s how the report describes the methodology.

The Tax Hells Index is an in-depth look at both the qualitative and quantitative data that is released annually by both the IMF and The World Bank. By drawing out critical insights from this data, The 1841 Foundation was able to create a comprehensive index and critically examine 94 countries against a stringent framework. …we believe that a “Tax Hell” is not only a country with high taxes, but rather a country with a weak rule of law and where the rights to privacy and property are not enforced or protected as required. …Therefore, when considering the results, countries with high government quality and economic and legal stability may have high taxes (i.e., Denmark), but are very far from being considered Tax Hells. In fact, there are countries with both low and high taxes in the Top-12 tax hells; all of them, however, have low quality of government, high levels of corruption and discretion, poor economic management, and weak institutions.

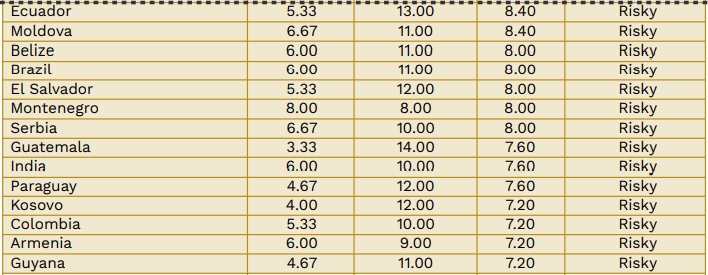

By the way, the report identified 12 tax hells, but also lists 14 other nations that are “risky.”

These are countries that should be perceived as high risk.

I’ll close by noting that the report only considers nations in North America, Europe, and South America. If subsequent editions include Asia and Africa, I’m sure there will be more tax hells and more risky jurisdictions.

P.S. The five best-scoring nations are Ireland, Denmark, San Marino, Switzerland, and Luxembourg. Remember, these are not necessarily low-tax jurisdictions. Indeed, Denmark is a high-tax nation. But all of these jurisdictions at least provide high-quality governance.

P.P.S. If you want a defense of tax havens, click here, here, and here.

———

Image credit: Pixy.org | CC0 Public Domain.