While most people pay attention to which political party enjoys success when there’s an election, I think it’s also important to look at ballot initiatives.

- In 2021, voters in the left-leaning state of Washington overwhelmingly registered their opposition to capital gains taxation.

- In 2020, voters in the deep-blue state of Illinois said no to the big spenders by voting to preserve the state’s flat tax.

- In 2019, voters in left-leaning Colorado also said no to the big spenders by voting to protect the state’s spending cap.

But, as we’ve seen in California and Oregon, not every referendum produces a sensible result.

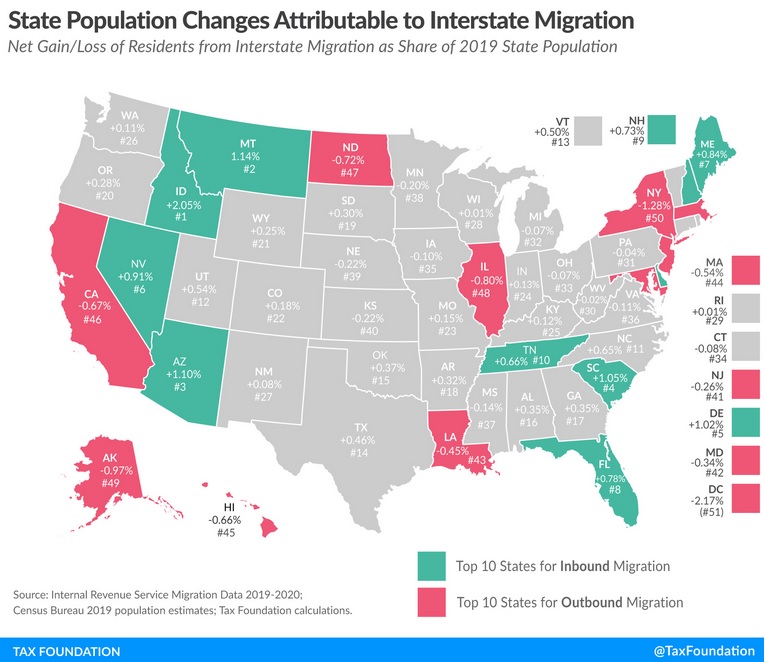

Today, we’re going to look at the most important ballot initiative of 2022. But before looking at the details, here’s a map showing the states gaining and losing population when Americans move across borders.

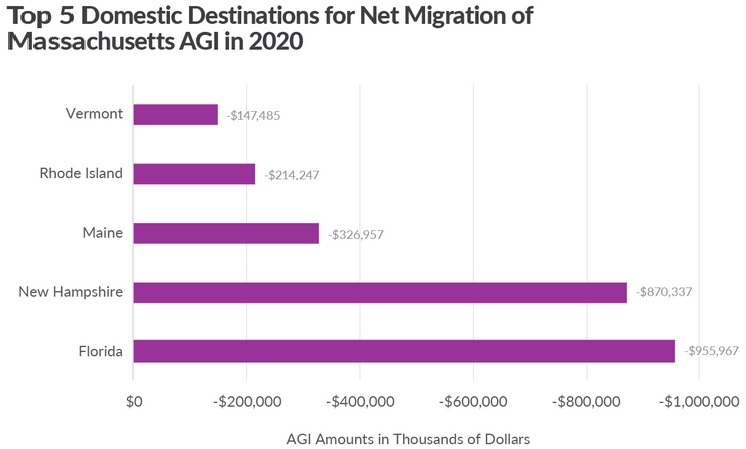

You’ll notice that Massachusetts is one of the top states for outbound migration, which means people are “voting with their feet” against the Bay State.

But bad news can become worse news. And that will definitely be the case if voters in Massachusetts approve a referendum next month to junk the state’s flat tax and replace it with a class-warfare system that has a top rate of 9 percent.

Jeff Jacoby wrote last year about the idea in a column for the Boston Globe.

A century-old provision of the Massachusetts Constitution commands that if the commonwealth taxes income, it must do so at a “uniform rate.” Five times in the modern era — in 1962, 1968, 1972, 1976, and 1994 — tax-and-spend liberals have invited voters to discard that rule and make it legal to soak the rich at higher tax rates. Five times voters have said no. …There is considerable arrogance in the way advocates of the surtax blithely disregard the voters’ repeated refusal to overturn the constitutional ban. Their attitude seems to be that no matter how many times the people uphold the uniform-rate rule, there is no reason to take them seriously. …more than 150 Massachusetts businesses representing almost 16,000 workers sent lawmakers an open letter imploring them not to hobble the state’s economy with a stiff new tax, and expressing “alarm” at the proposed constitutional amendment. They…know that a surtax aimed at millionaires is bound to injure countless people who will never earn anywhere close to a million bucks.

The Wall Street Journal has editorialized against the proposal.

…progressives in Boston want to join New York and other nearby states in a high-tax arms race. …Bay State ballots in November will give voters the choice to place a 4% surtax on incomes above $1 million, bringing the top rate to 9% from 5%. The proposal would amend the state constitution to remove its flat-tax mandate. Passing the measure would rocket Massachusetts to seventh from 31st on the list of states with the highest marginal income-tax rates. …A $2.3 billion revenue surplus shows that the state is already taxing more than it needs. This year’s tax haul was so big it triggered a largely forgotten state law that caps revenue. Residents may soon receive checks that refund a portion of last year’s taxes. …Approving the tax would speed up a wealth exodus already under way. The Pioneer Institute last year noted that Massachusetts’ tax base has been eroding, and there’s no surprise about where the escapees are going. The top two destinations are Florida and New Hampshire, both of which lack an income tax. …The constitution’s flat rate mandate is a crucial limit on the demands of interest groups for ever-more spending. If tax rates rise and the revenue cap goes away, spending will soar to snatch the new revenue and soon the politicians will return to seek even higher rates, as they always do.

The economic consequences of class-warfare taxation are never positive.

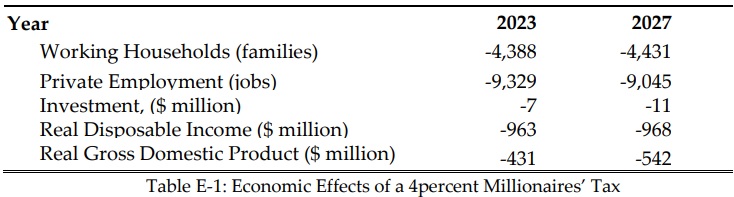

And that will be true in Massachusetts. A study from the Beacon Hill Institute in Massachusetts estimates the economic damage that the surtax would cause.

…we find, using our in-house computer model (MA-STAMP) that the effects on the economy will be as follows: In its first year of implementation, the amendment will cause the state to lose 4,388 working families due to outmigration. This outmigration plus a reduction in labor hiring and labor-force participation will cause a loss of 9,329 jobs. …the state economy, real (inflation-adjusted) gross domestic product, will shrink by $431 million… Advocates of the measure claim that it will make possible a $2 billion annual in state spending. …Instead, we find that the revenue yield of the tax will be far less, the result of the expected shrinkage in economic activity. (See Table E-2.) In its first year of implementation, combined state and local revenues will rise by only about $1.2 billion.

Here’s a table showing some of the negative effects.

Alex Brill of the American Enterprise Institute also estimated that revenues would be lower than expected once the effects of the Laffer Curve are incorporated into the analysis.

Here are some excerpts from his article in the Hill.

Modifying the revenue forecast to incorporate evidence from the academic literature about likely behavioral changes yields a significantly lower estimated revenue pickup. I estimate that about 400 of the 22,000 taxpayers affected by the surtax would exit the state and many others would reduce work or shift and relabel their income to avoid the tax. By my estimate, the surtax would generate approximately $1.5 billion in 2023, since these behavioral responses would offset 32 percent of the revenue gain that would occur if taxpayers kept their behavior unchanged. Using a similar approach, Tufts University’s Center for State Policy Analysis recently estimated that the proposed surtax would generate only $1.3 billion in 2023.

Last but not least, the Tax Foundation crunched the numbers and also found the surtax would cause significant economic damage.

…while no one would mistake Massachusetts for a low-tax state, it has carved out a place as a competitive area to live and work within the Northeast corridor. …but consider the Commonwealth’s ranking on the Tax Foundation’s State Business Tax Climate Index…in 2022, the Bay State still ranked 34th overall on the Index—well below the median. …Massachusetts’ competitive tax advantage in New England is primarily due to its individual income and sales tax systems, which rank 11th and 12th on the Index, respectively. With regard to its neighbors, only New Hampshire has a better overall Index ranking than Massachusetts. …In 2007, Christina Romer and David Romer, professors of economics at the University of California Berkeley, conducted a study to determine the impact of legislated tax changes on the economy. …The study found that a tax increase equal to 1 percent of gross domestic product (GDP) resulted in an estimated 3 percent decline in GDP after three years. …If the Romer and Romer study were applied to the Massachusetts surtax it would result in a 0.942 percent decline in GDP after three years. In other words, the Commonwealth’s total economic output could contract by $5.98 billion by the end of 2025.

Here’s a table from the report, showing that zero-income tax New Hampshire and Florida already are big winners when people escape Massachusetts.

If the referendum is approved, we can easily predict that future versions of this chart will show much bigger numbers.

Simply stated, some of the geese with the golden eggs will fly away (while the ones that stay will decide to produce fewer eggs – as well as figure out ways to protect the eggs that remain).