I’m not a fan of the International Monetary Fund, in part because the international bureaucracy is infamous for pressuring nations to impose higher taxes.

The bureaucrats at the IMF have even claimed that higher taxes somehow will produce more economic growth.

Even worse, the IMF has argued for class-warfare taxes that do the most economic damage, even using the twisted rationale that it is okay to hurt the poor so long as the rich suffer even greater losses.

To be fair, there are some good fiscal economists at the IMF (even with regards to tax policy), but the political types who run the bureaucracy almost always ignore their research.

Instead, the bureaucracy highlights second-rate analysis in pursuit of bad policy.

The latest example if that the IMF is pressuring Bulgaria to replace its flat tax with a system based on discriminatory rates.

Fiscal policy needs to be flexible given the large uncertainty, but some changes are already advisable in the mid-year budget revision. …Room to address long-term social and investment needs could be significantly increased by…Reviewing the tax system to increase revenue and redistribution . A reform of the low flat personal income tax rate could help create fiscal space and reduce inequalities.

By the way, just in case it’s not obvious, “social and investment needs” is bureaucrat-speak for more redistribution spending.

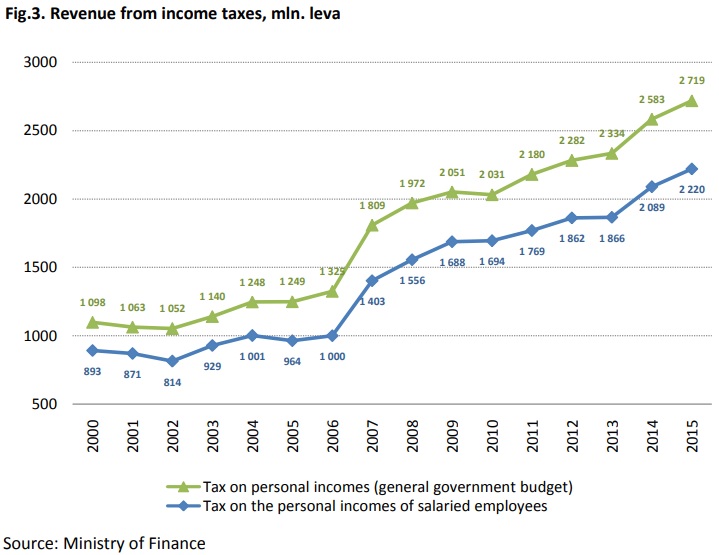

Some of you may be wondering whether a new system is needed because the flat tax caused a big drop in revenue.

But as you can see from this chart, income tax revenues continued to grow after the flat tax was approved in 2008.

I’ll close by noting that Bulgaria is ranked #36 in the latest edition of Economic Freedom of the World, which is a good but not great score.

But it gets its lowest score for “size of government,” which is the measure for fiscal policy. The flat income tax is a positive, of course, but that policy is offset by low scores for other features of fiscal policy (payroll tax, redistribution, etc).

So the bottom line is that the IMF wants to get rid of the good part of Bulgaria’s fiscal policy and drive its overall score even lower.

P.S. I also disapprove of the IMF because it subsidizes and encourages debt and instability with endless bailouts.

P.P.S. And I am disgusted that IMF bureaucrats get tax-free salaries while advocating for higher taxes for everyone else.

P.P.P.S. The IMF has a reprehensible track record of bullying nations in Eastern Europe. Though, to be fair, they also push for bad tax policy in big and powerful nations. And in weak and poor nations.

P.P.P.P.S. Here’s my solution to the IMF problem.

———

Image credit: IMF | Public Domain.