The Laffer Curve is a very straightforward concept.

It graphically illustrates why politicians are wrong if they think you can double tax revenue by doubling tax rates (or that revenues will drop by 50 percent if tax rates are cut in half).

Simply stated, you also have to look at what happens to taxable income.

In cases where taxpayers have a lot of control over the timing, level, and composition of their income, changes in tax rates may cause big changes in taxable income (or “tax base” in the jargon of economists).

None of this should be controversial. Even Paul Krugman agrees that the Laffer Curve exists.

Today, we are going to see that the pro-tax International Monetary Fund also admits there is a Laffer Curve.

Indeed, a new study authored by David Amaglobeli, Valerio Crispolti, and Xuguang Simon Sheng openly states that politicians should be very cognizant of the fact that some tax policy changes can have a big effect on the “tax base.”

This paper investigates the potential revenue impact of different tax policy changes using the Tax Policy Reform Database (TPRD)… Revenue responses to tax policy changes depend on many factors… However, one of most important factors is the nature of the tax policy change itself. For example, while a tax rate cut will directly lower revenue intake, it could also encourage more economic activity, hence expand the tax base. Estimating the revenue response to a tax policy change, therefore, requires granular information on the nature of this change, including on the tax instrument used (e.g., VAT or personal income tax), the type of change adopted (e.g., tax base, tax rate), and its timing and size.

Here are some of the findings.

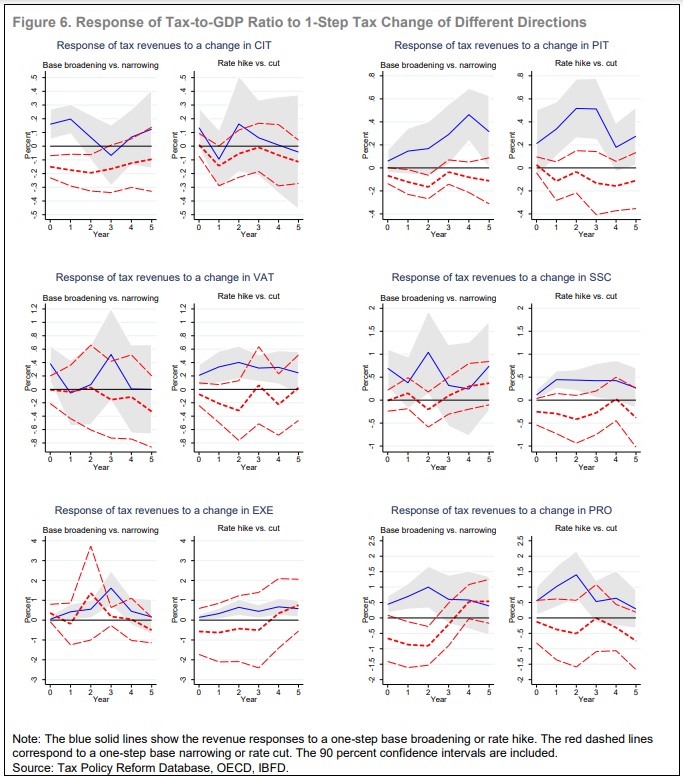

We assess the impact of tax policy changes on tax revenues using Jordà (2005)’s local projections method. Our baseline results are based on tax shocks identified in the year when a tax change is announced. Our main empirical findings suggest that the revenue yield of tax policy changes varies significantly across taxes and types of changes, with tax rate changes generally having a more transitory revenue impact than tax base changes for most taxes. Specifically, base broadening changes in PIT, CIT, EXE, and PRO have on average a more significant and long-lasting impact on tax collection than rate changes. At the same time, rate hikes have relatively more significant effects on taxes in the case of VAT and SSC measures.

Most notably, the report finds tax increases hurt prosperity, especially higher marginal tax rates.

Gechert and Groß (2019) conclude that measures to broaden the tax base are less harmful to economic growth than tax hikes. Dabla-Norris and Lima (2018) find that during fiscal consolidations, tax base-broadening measures lead to smaller output and employment declines compared to measures to increase tax rates.

And we learn that it is very foolish to raise corporate tax rates.

Mertens and Ravn (2013) find that…increases in CIT are approximately revenue neutral for the United States. …Announcements of CIT increases are associated with a somewhat transitory rise in tax collection, suggesting that companies have quickly adapted their business to reduce the tax burden.

For wonky readers, here’s a chart from the study. Note how, in many cases, there’s not much difference in revenue between tax increases (blue line) and tax cuts (red lines).

P.S. One big takeaway is that there is not a single Laffer Curve. There are multiple Laffer Curves depending on the tax that’s being changed and the ability of taxpayers to change their behavior.

P.P.S. A less-obvious takeaway is that class-warfare taxes cause the most economic damage, meaning the most harm to ordinary people.

P.P.P.S. You can call it the “Khaldun Curve” if you prefer.

P.P.P.P.S. I have trouble deciding what evidence is most powerful, the views of CPAs or the data from the OECD?