I’ve already shared the “feel-good story” for 2022, so today I’m going to share this year’s feel-good map.

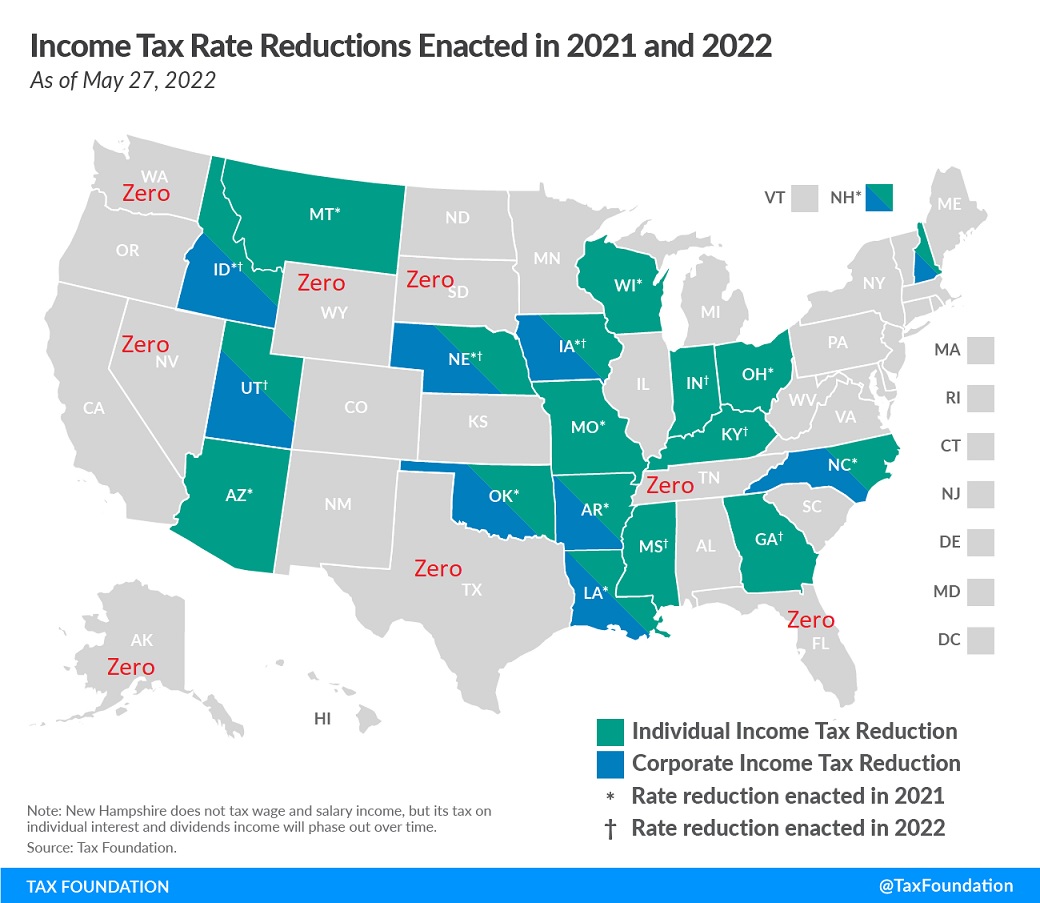

Courtesy of the Tax Foundation, here are the states that have lowered personal income tax rates and/or corporate income tax rates in 2021 and 2022. I’ve previously written about these reforms (both this year and last year), but more and more states and lowering tax burdens, giving us a new reason to write about this topic.

The map is actually even better than it looks because there are several states that don’t have any income taxes, so it’s impossible for them to lower rates. I’ve labelled them with a red zero.

And when you add together the states with no income tax with the states that are reducing income tax rates, more than half of them are either at the right destination (zero) or moving in that direction.

That’s very good news.

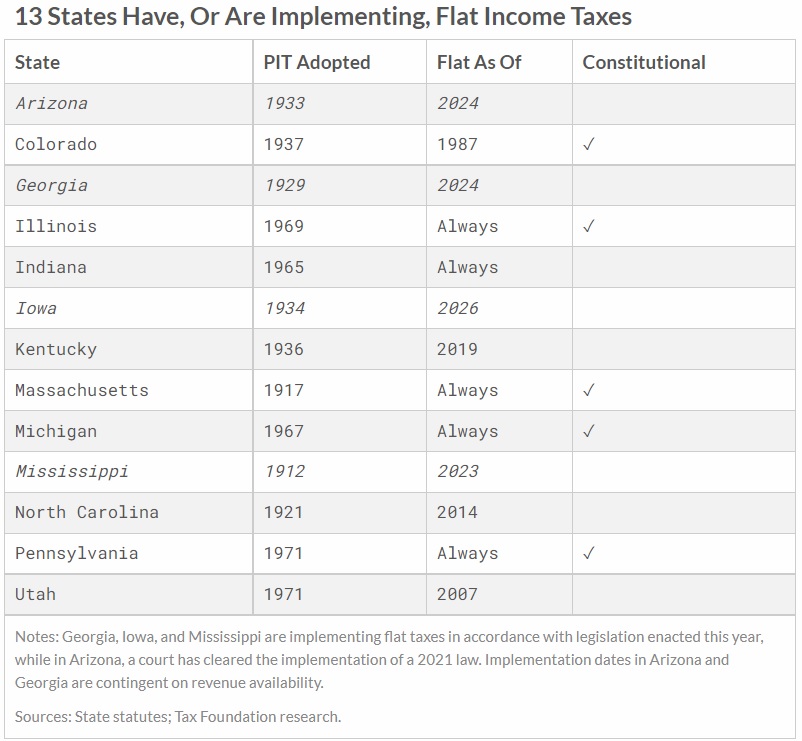

And here’s more good news from the Tax Foundation. The flat tax club is expanding.

I prefer the states with no income taxes, but low-rate flat taxes are the next best approach.

P.S. According to the Tax Foundation, New York and Washington, D.C. have moved in the wrong direction. Both increased income tax burdens in 2021. No wonder people are moving away.

P.P.S. If I had to pick the states with the best reforms, I think Iowa and Arizona belong at the top of the list.