Every American school kid presumably learns about the Boston Tea Party and other events that culminated with the United States gaining independence from from the rule of King George III.

Think of it as America’s first tax revolt.

But that’s not the only interesting story regarding taxes and English royalty.

I wrote in both 2017 and 2020 that Prince Harry and Meghan Markle (now the Duke and Duchess of Sussex) were going to suffer some adverse tax consequences by residing in the United States.

The recent death of Queen Elizabeth II gives us another opportunity to comment about tax policy. It seems the royal family has some very nice tax preferences.

For some background, Jyoti Mann reported on the topic for Business Insider.

King Charles III..spent half a century turning his royal estate into a billion-dollar portfolio and one of the most lucrative moneymakers in the royal family business. …Over the past decade, he has assembled a large team of professional managers who increased his portfolio’s value and profits by about 50 percent. …The conglomerate’s holdings are valued at roughly $1.4 billion, compared with around $949 million in the late queen’s private portfolio. These two estates represent a small fraction of the royal family’s estimated $28 billion fortune. …The growth in the royal family’s coffers and King Charles’s personal wealth over the past decade came at a time when Britain faced deep austerity budget cuts. …the Duchy of Cornwall…has funded his private and official spending, and has bankrolled William, the heir to the throne, and Kate, William’s wife. It has done so without paying corporation taxes like most businesses in Britain are obliged to, and without publishing details about where the estate invests its money. …leaked financial documents known as the Paradise Papers revealed that Charles’s duchy estate had invested millions in offshore companies, including a Bermuda-registered business.

Before continuing, I can’t resist making two comments.

First, the United Kingdom has not “faced deep austerity” or “budget cuts.” The most that can be said is that spending “only” grew at the rate of inflation when David Cameron and Theresa May were in charge.

Second, it is not newsworthy that the royal family uses so-called offshore companies. It’s probably safe to say that 99 percent of people with cross-border investments (including people like you and me with IRAs and 401(k)s) benefit from some form of financial interaction with tax-neutral jurisdictions such as Bermuda and the Cayman Islands.

Now let’s peruse a story for the New York Times by Jane Bradley and Euan Ward about tax preferences.

King Charles will not have to pay inheritance tax on the Duchy of Lancaster estate he inherited from the Queen due to a rule allowing assets to be passed from one sovereign to another. Charles automatically inherited the estate, the monarch’s primary source of income… The new king will avoid inheritance tax on the estate worth more than $750 million due to a rule introduced by the UK government in 1993 to guard against the royal family’s assets being wiped out if two monarchs were to die in a short period of time… The clause means that, to help protect its assets, members of the royal family do not have to pay the 40% levy on property valued at more than £325,000 ($377,000) that non-royal UK residents do. …The Queen began voluntarily paying income and capital gains tax on the estate in 1993 and Charles may decide to follow suit.

Let’s focus specifically on the death tax.

Is it unfair for the royal family to benefit from good tax policy (such as no death tax) when other residents of the United Kingdom don’t get the same treatment? The answer is yes, of course.

But the right way to deal with that inequity is for the U.K. to eliminate its death tax, not to extend it to Kings, Queens, and Princes.

Let’s focus, though, on a passage from the article that deserves a lot of attention. We are told that the exemption from the death tax was designed to “guard against the royal family’s assets being wiped out if two monarchs were to die in a short period of time.”

Technically, the assets wouldn’t be wiped out. But that scenario would result in a loss of nearly 65 percent of the family’s wealth.

I’m not expecting anyone to shed many tears about the plight of British royalty.

Instead, I want everyone to think about investors, entrepreneurs, and business owners in the United Kingdom. Is it okay for them to lose 65 percent of their money simply because there are two deaths “in a short period of time”?

The answer is no. The death tax is an evil and destructive tax. That’s true for royalty.

And, notwithstanding predictably bad analysis from the OECD, it’s true for us peasants as well.

———

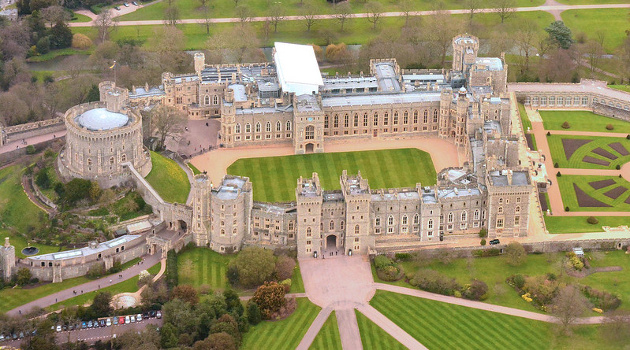

Image credit: Mike McBey | CC BY 2.0.