Looking at reforms at the state level, the past two years have produced very good news on education policy and tax policy.

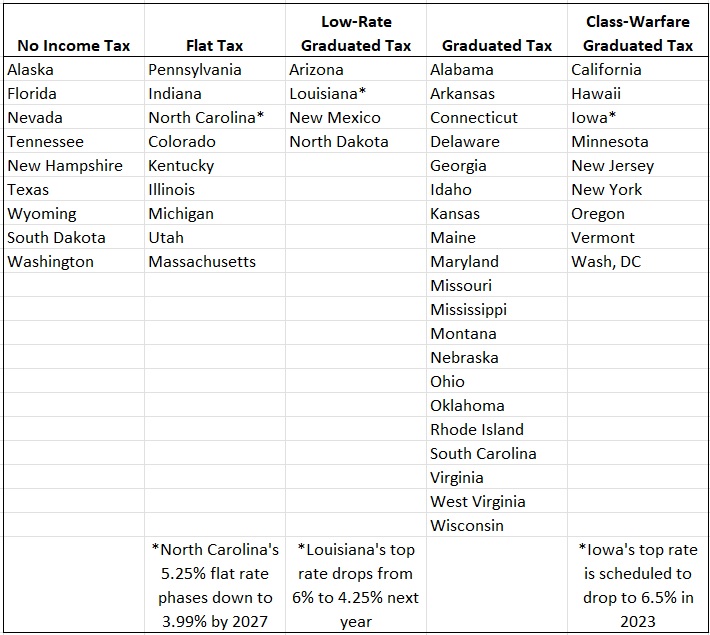

Regarding the latter, many states have lowered tax rates and several of them have junked so-called progressive tax systems and replaced them with simple and fair flat taxes.

But I’m greedy for even bigger improvements.

I want to see some states move not just to Column 2 in my ranking of state tax policy. I want them to be in Column 1.

And that means they need to get rid of income taxes.

The good news is that some states are having that discussion.

Here are some excerpts from an Associated Press report from Mississippi, written by Michael Goldberg.

Mississippi Gov. Tate Reeves promised to push for a full elimination of the state’s income tax during the 2023 legislative session. The move would make Mississippi the 10th state with no income tax. …Mississippi’s Republican-controlled legislature passed legislation in 2022 that will eliminate the state’s 4% income tax bracket starting in 2023. In the following three years, the 5% bracket will be reduced to 4%. …Supporters of the 2022 Mississippi tax cut said it would spur economic growth and attract new residents to Mississippi. …Republican House speaker Philip Gunn has said full elimination of the state income tax is “achievable,” though he hasn’t committed to doing so in the 2023 session. …Tax-cut proposals are a direct effort to compete with states that don’t tax earnings, including Texas, Florida and Tennessee.

And here are portions of an article in National Review about Colorado, authored by Ben Murrey, which also notes that the TABOR spending limit will need to be strengthened if lawmakers are serious about getting rid of the state’s income tax.

When an interviewer recently asked Colorado’s Democratic governor Jared Polis what the state’s income-tax rate should be, he answered without hesitation: “It should be zero.” …The effort to chisel away at the income tax has already gained steam in the state. Last year, voters reduced the tax with Proposition 116 — a ballot initiative that brought the rate from 4.63 percent to 4.55 percent. …Eliminating the tax would provide an enormous direct windfall to Colorado households. …every reduction in income tax will allow Coloradans to keep more of every dollar they earn, and it invites more jobs and opportunities for residents. …To eliminate the income tax entirely, the state would probably need to begin lowering the revenue limit along with the rate reductions in the future. …these two reforms would put the state on a road to zero.

By the way, Colorado voters once again just cut the state’s flat tax in a referendum earlier this month.

Would Mississippi and Colorado be doing the right thing if they joined the zero-income-tax club?

Yes. I cited some evidence on this issue about 10 years ago.

Here’s some updated analysis from Chris Edwards.

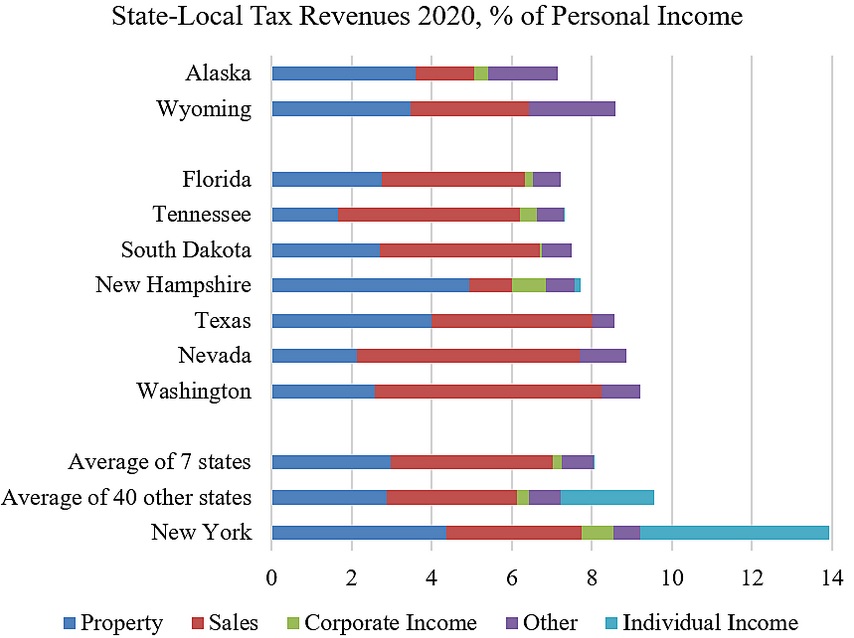

The nine states without an individual income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. …What they have in common is providing needed state‐local services to their residents without complex, anti‐freedom, and anti‐growth individual income taxes. Most of the nine run leaner and more efficient governments than most other states. They only partly make up for the income tax revenue gap with other revenues. In terms of overall tax burdens, eight of the nine states are toward the bottom of the 50 states and Washington is in the middle. …Total taxes in the seven states average 8.1 percent of income. The average in the 40 other states is 9.6 percent. Thus, the lack of individual income tax restrains the overall tax burden. …Repealing state individual income taxes is a good goal. …Residents get the state‐local services they need, but at lower cost.

Here’s the chart that accompanied Chris’ article. He separates Alaska and Wyoming because they get so much money from energy taxes and are not realistic role models for other states.

The bottom line is that states without an income tax tend to have smaller government.

This is especially true for Florida, Tennessee, South Dakota, and New Hampshire. And Texas may join those states now that it has strengthened its spending cap.

One should-be-obvious conclusion from this data is that states with no income taxes should not make the mistake of adopting that punitive levy. Unless, of course, they want to repeat Connecticut’s unhappy experience.