To explain why politicians should not interfere with prices, I’ve shared videos from Marginal Revolution, Don Boudreaux, Learn Liberty, and Russ Roberts.

To add to that collection, here’s part of a lecture by Professor Antony Davies.

The bottom line is that price controls have a history of failure, anywhere and everywhere they’ve been tried.

- They have led to catastrophic outcomes when implemented as part of command-and-control socialism, as we saw in the Soviet Union and Maoist China.

- They have produced terrible consequences when imposed on an economy-wide basis to ostensibly fight inflation, as was the case in post-war West Germany and in the United States with the (pro-statism) Nixon Administration.

- And they have generated awful results when politicians interfere with prices in specific sectors of the economy (rent control, community rating, minimum wages, gouging laws, etc).

But some folks on the left want to resuscitate this awful idea, as reported in an article in the New York Times by Ben Casselman and Jeanna Smialek.

America’s recent inflation spike has prompted renewed interest in an idea that many economists and policy experts thought they had long ago left behind for good: price controls. …the phrase “price controls” has, at least for many people, called to mind images of product shortages and bureaucratic overreach. …As consumer prices soared this fall, however, a handful of mostly left-leaning economists reignited the long-dormant debate, arguing in opinion columns, policy briefs and social-media posts that the idea deserves a second look. …Few economists today defend the Nixon price controls. But some argue that it is unfair to consider their failure a definitive rebuttal of all price caps. …Democrats and the administration have stopped short of suggesting actual price limits.

In a column for the U.K.-based Guardian, Professor Isabella Weber of the University of Massachusetts Amherst argues for price controls to counter corporate greed.

Inflation is near a 40-year high. …In 2021, US non-financial profit margins have reached levels not seen since the aftermath of the second world war. This is no coincidence. …large corporations with market power have used supply problems as an opportunity to increase prices and scoop windfall profits. …we need…a serious conversation about strategic price controls… Price controls would buy time to deal with bottlenecks that will continue as long as the pandemic prevails. Strategic price controls could also contribute to the monetary stability needed to mobilize public investments towards economic resilience, climate change mitigation and carbon-neutrality. The cost of waiting for inflation to go away is high.

For what it’s worth, I agree that businesses want as much profit as possible (just as workers want wages to be as high as possible).

But the notion that corporate greed is causing inflation is laughable. After all, weren’t businesses also greedy in the 1990s, 2000s, and 2010s? Yet we didn’t see a big uptick in consumer prices.

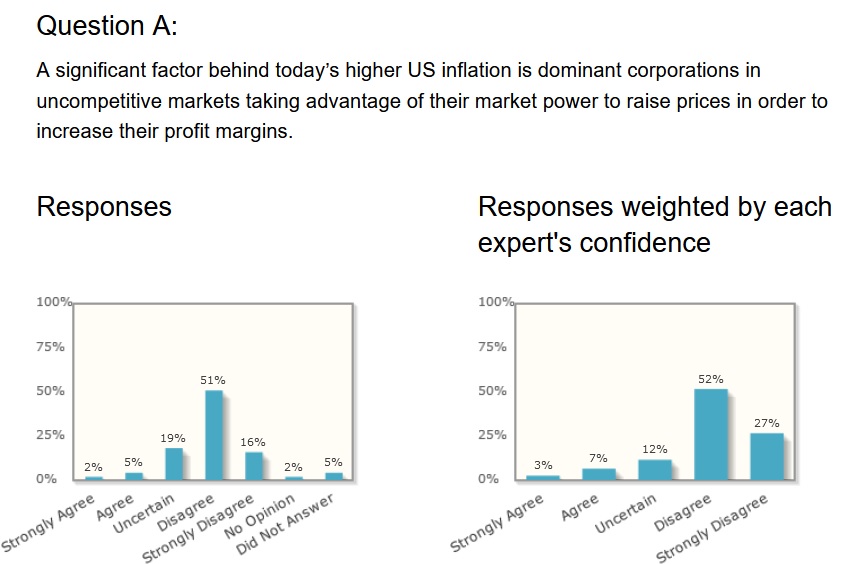

So we shouldn’t be surprised that the vast majority of economists, both right and left, reject Prof. Weber’s hypothesis.

Needless to say, the Federal Reserve deserves blame for inflation, not greedy companies (or greedy workers).

It’s possible, of course, that today’s rising prices are partly or even mostly transitory. But, given the easy-money policy we’ve had (including under Trump), it’s perhaps more likely that prices are going up as an inevitable consequence of mistakes by the central bank.

Let’s close with Alberto Mingardi’s 2020 column in the Wall Street Journal about how a product-specific price control failed.

Italy is trying to control the price of face masks, …a fixed price of 50 European cents… The Italian newspaper Il Foglio reports that the government is buying face masks wholesale at a price between 38 and 70 European cents each—essentially admitting it can’t abide by its own price controls. …The Civil Protection Department, Italy’s national body that deals with emergencies, …discouraged entrepreneurs from importing masks, right as more masks were needed. …Those who were buying up masks to hoard risked government confiscation. These moves clamped down on price gouging but created a shortage. …pharmacists can’t get masks cheap enough to sell at a retail price of 50 European cents. …The price fixers have promised a subsidy to pharmacists to mitigate losses. But the price was fixed by executive order, whereas the subsidy was merely promised. Quite a few pharmacists elected to stop selling masks.

P.S. Politicians in Washington want to impose price controls on the pharmaceutical industry. That concerns me since I’m getting older and might be in a position where I would benefit from new therapeutics. But companies will have much less incentive for research and innovation if government makes it very difficult to make money.

———

Image credit: U.S. National Archives and Records Administration | Public Domain.