Back in 2009, I narrated a video about the downsides of class-warfare tax policy.

But if you don’t want to spend eight minutes watching the video (or 14 minutes watching this video), here’s a visual that summarizes why high tax rates discourage people from engaging in productive behavior.

The most important thing to understand is that a high marginal tax rate (i.e., the tax rate on earning more money) has a big effect on incentives to work, save, invest, and be entrepreneurial.

But how big is that effect?

Let’s review some new research from Professor Charles Jones.

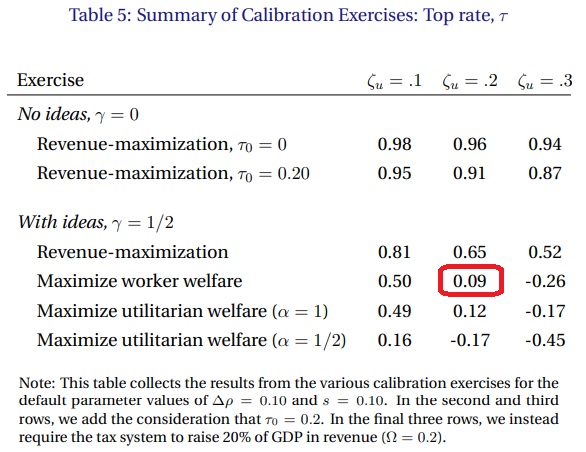

The classic tradeoff in the optimal income tax literature is between redistribution and the incentive effects that determine the “size of the pie.” …However, what is in some ways the most natural effect on the size of the pie has not been adequately explored. …To the extent that top income taxation distorts…innovation, it can impact not only the income of the innovator but also the incomes of everyone else in the economy. …High incomes are a prize that partly motivates entrepreneurs to turn basic insights into a product or process that ultimately benefits consumers. High marginal tax rates deter this effort and therefore reduce innovation and overall GDP. …For example, consider raising the top marginal tax rate from 50% to 75%. …the change raises about 2.5% of GDP in revenue before the behavioral response. In the baseline calibration…, this increase in the top tax rate reduces innovation and lowers GDP per person in the long run by around 7 percent. …even redistributing the 2.5% of GDP to the bottom half of the population would leave them worse off on average: the 7% decline in their incomes is not offset by the 5% increase from redistribution. In other words, raising the top marginal rate from 50% to 75% reduces social welfare…the rate that incorporates innovation and maximizes the welfare of workers is much lower: the benchmark value is just 9%.

Here’s a table from the study showing how the optimum tax rate is very low if the goal is to help workers and society rather than politicians.

If you want more evidence, there’s a never-ending supply.

But if we want to be concise, start with this list.

- Higher tax rates on the rich will reduce capital formation.

- Higher tax rates on the rich will lower economic output.

- Higher tax rates on the rich will shrink the labor supply.

- Higher tax rates on the rich will depress levels of entrepreneurship.

- Higher tax rates on the rich will lead to lower middle-class wages.

- Higher tax rates on the rich will reduce economic mobility.

- Higher tax rates on the rich will drive away superstar inventors.

- Higher tax rates on the rich will lower levels of innovation.

- Higher tax rates on the rich will lead to higher taxes for everyone else.

- Higher tax rates on the rich will encourage tax complexity.

Heck, higher tax rates can even hurt your favorite sports team.

P.S. Joe Biden wants people to think that it’s patriotic to pay more tax, though he exempts himself with clever tax planning.

———

Image credit: Chris Tolworthy | CC BY 2.0.