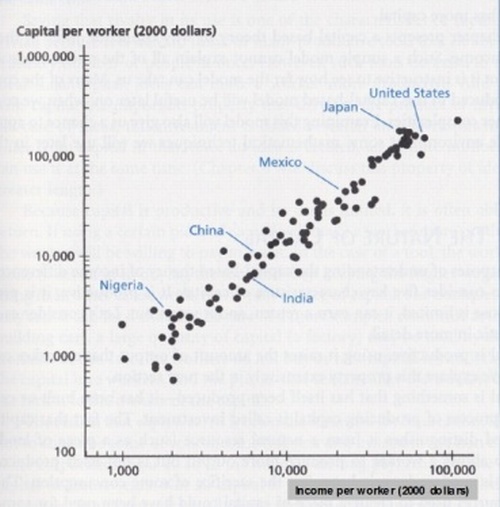

Whenever I discuss the varying types of double taxation on saving and investment (capital gains tax, dividend tax, corporate income tax, death tax, wealth tax, etc), I always emphasize that such levies discourage capital (machinery, tools, technology, etc) which leads to lower levels of productivity.

And lower levels of productivity mean less compensation for workers.

Some of my left-leaning friends dismiss this as “trickle-down economics,” but the relationship between capital and wages is a core component of every economic theory.

Even socialists and Marxists agree that investment is a key to rising wages (though they foolishly think government should be charge of making investments).

I’m providing this background because today’s column explains that politicians made a mistake when they included a tax on “stock buybacks” in the misnamed Inflation Reduction Act.

I’ve written once on this topic, mostly to explain that buybacks should be applauded. They are a way for companies to distribute profits to owners (shareholders) and have the effect of freeing up money for better investment opportunities.

Let’s look at some more recent analysis.

In a column for today’s Wall Street Journal, two Harvard Professors, Jesse Fried and Charles Wang, debunk the anti-buyback hysteria.

A 1% tax on stock buybacks is poised to become law as part of the Inflation Reduction Act just passed by the Senate. This is a victory for critics… But those critics are dead wrong. If anything, American corporations should be repurchasing more stock. Taxing buybacks will increase corporate bloat, lead to higher CEO pay, harm employees and reduce innovation in the economy. …A tax on buybacks will harm shareholders. It creates an incentive for managers to hoard cash, leading to even more corporate bloat and underused stockholder capital. Because CEO pay is tied closely to a firm’s size, this bloating will drive up executive compensation, further hurting investors. …Taxing buybacks will harm employees as well. …Our research shows that 85% of this value flows to employees below the top executive level. Increasing the tax burden will tend to lower equity pay, to the detriment of workers. …A tax that inhibits buybacks will also reduce the capital available to smaller private firms. The cash from shareholder payouts by public companies often flows to private ones, such as those backed by venture capital or private equity. These private firms account for half of nonresidential fixed investment, employ almost 70% of U.S. workers, are responsible for nearly half of business profit, and have been important generators of innovation and job growth. Bottling up cash in public companies will reduce the capital flowing to private ventures—and thus their ability to invest, innovate and hire more workers.

Professor Tyler Cowen of George Mason University makes similar points, in a very succinct manner.

This is flat out a new tax on capital, akin to a tax on dividends. …Are you worried about corporations being too big and monopolistic? This makes it harder for them to shrink! Think of it also as a tax on the reallocation of capital to new and growing endeavors.

Catherine Rampell of the Washington Post is far from a libertarian, but even she warned that the hostility to stock buybacks makes no sense.

You’ve probably heard some ranting recently about “stock buybacks,” the term for when a public company repurchases shares of its own stock on the open market. …Why do Democrats hate buybacks so much? …they proposed legislation to ban buybacks. They excoriated companies for returning cash to shareholders… Share buybacks themselves aren’t necessarily bad — particularly when the alternative is wasting investor money… Yelling at companies to stop their buybacks won’t cause them to increase investment… In fact, some policy measures Democrats are considering, ostensibly to discourage firms from returning so much cash to shareholders, would do the opposite.

The only good news to share is that the tax being enacted by Democrats is just 1 percent, so the damage will be somewhat limited (the main economic damage will be because of another provision in the legislation, the tax on “book income“).

Though I suppose we should be aware that a small tax can grow into a big tax (the original 1913 income tax had a top rate of just 7 percent and we all know that the internal revenue code has since morphed into an anti-growth monstrosity).

The bottom line is that the crowd in Washington has made a bad tax system even worse.

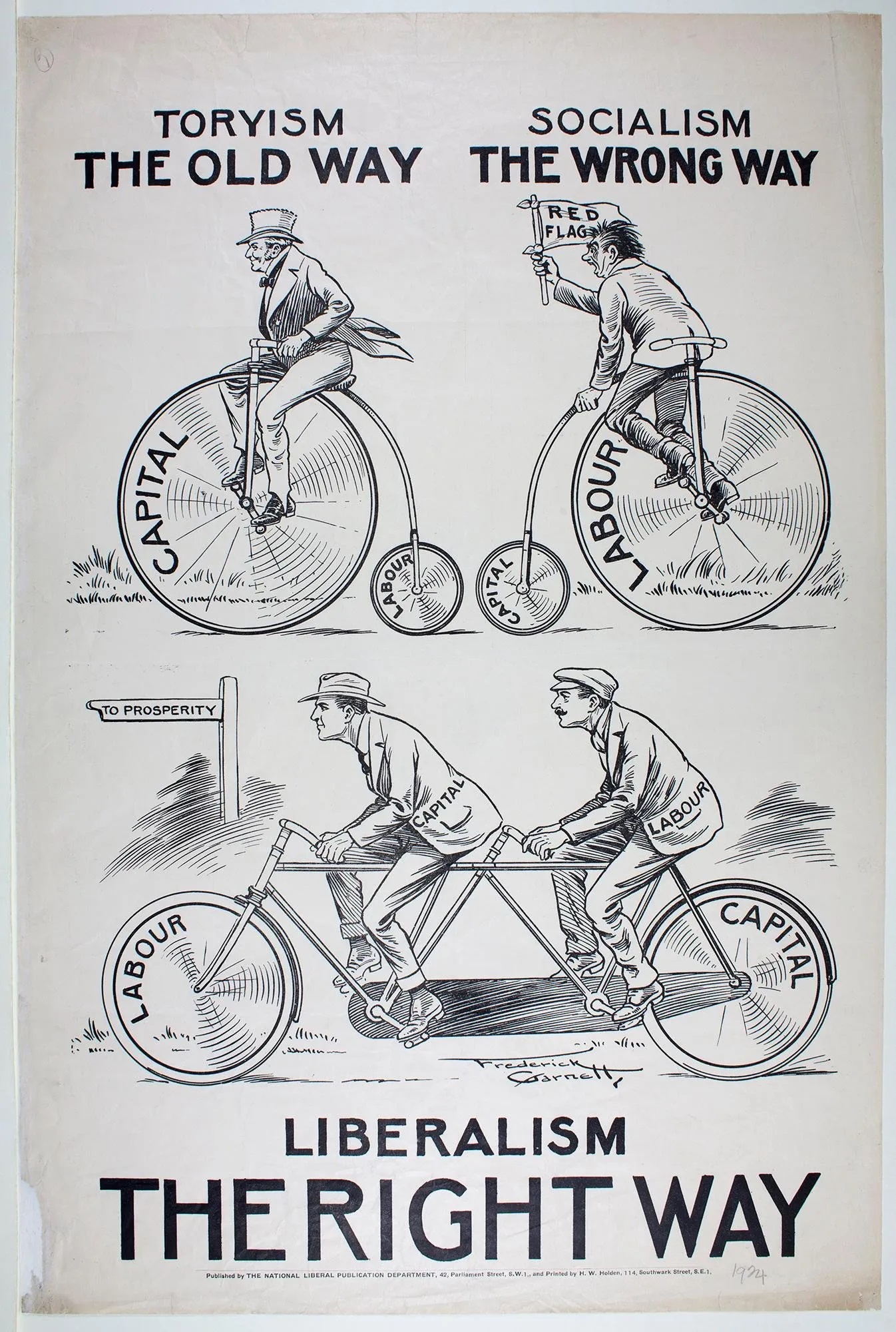

P.S. Since we have been discussing how taxes on capital are bad for workers, this is an opportunity to share an old cartoon from the British Liberal Party (meaning “classical liberal,” of course). The obvious message is that labor and capital are complementary factors of production.

And the obvious lesson is that you can’t punish capital without simultaneously punishing labor. Sadly, I’m not holding my breath waiting for Washington to enact sensible tax policy.

———

Image credit: geralt | Pixabay License.