There are many reasons to admire Switzerland.

- The nation’s very effective spending cap.

- The nation’s libertarian-leaning governance.

- The nation’s system of private pensions.

- The nation’s genuine decentralization.

- The nation’s support for gun rights.

- The nation’s high public sector efficiency.

For today, let’s focus on how tax competition is one of the benefits of Swiss decentralization.

More specifically, most fiscal policy (both taxes and spending) takes place at the cantonal and municipal level. And this means that the Swiss can vote with their feet if they want more government or less government.

Not surprisingly, they tend to move to lower-tax areas. In a summary for VoxEU, Isabel Martínez shares some of her research on the impact of tax cuts and tax competition in the canton of Obwalden.

…economic research has made important contributions, showing that top earners indeed relocate across borders for tax reasons. …And as relocating within a country is typically less costly than moving across national borders, top earners tend to be even more sensitive to tax differences…ample evidence exists that lowering taxes is an effective means to attract top earners… I study a tax cut by the small Swiss canton of Obwalden, located in central Switzerland. The goal explicitly was to attract high-income taxpayers… In 2006, Obwalden changed its tax code and introduced falling marginal tax rates…in 2008 the canton introduced a flat rate tax, which lowered the tax load for top earners …the reform had the intended effect: by 2016, the share of high-income taxpayers in Obwalden had grown by 0.53 percentage points relative to other cantons. This is an increase of 100% compared to Obwalden’s initial share of top earners. Net income per taxpayer had risen by 17%. …I find a large elasticity of in-migration in the five years after the reform. A 1% increase in the net-of-average-tax rate increased the inflow of top earners by up to 7.2%.

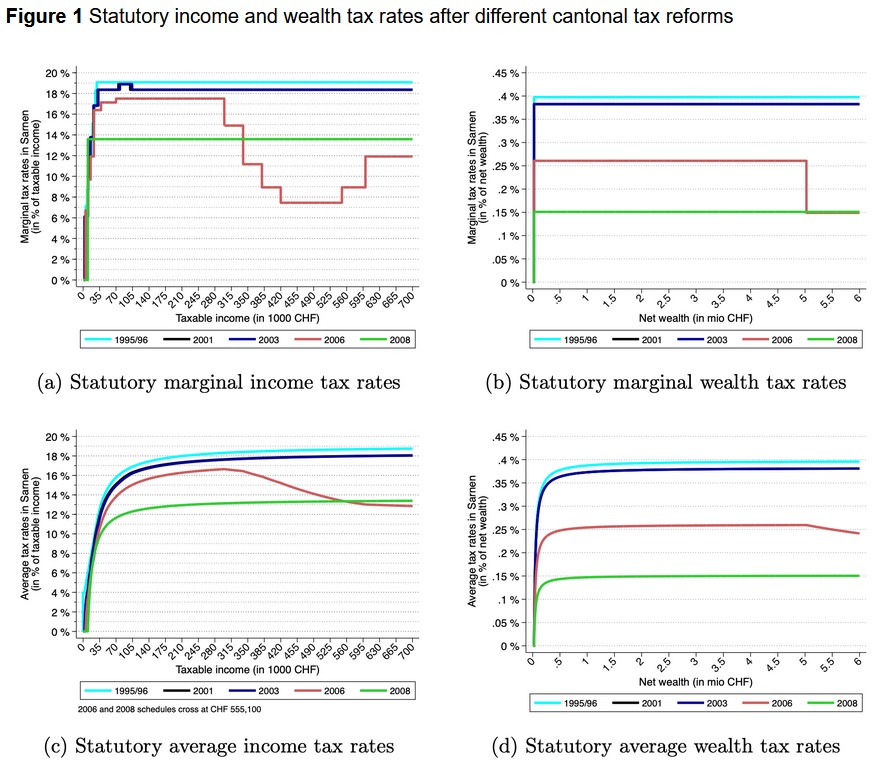

For those who like getting into the weeds, here’s a chart from her report that shows how income taxes and wealth taxes dropped from 1995 (light blue) to 2001 (dark blue) to 2006 (red) to 2008 (green).

Ms. Martinez speculates whether these lower taxes were a net positive.

…besides having more high-income earners living in the canton, how much did Obwalden really gain? …Obwalden’s total tax revenue rose over time, but personal tax revenue in other cantons rose even more in comparison. …Where does this leave us? Attracting high-skilled top earners might have positive spillovers to the local economy. …between 2005 and 2008, the number of full-time equivalent (FTE) jobs rose by 11%, compared to a 4.3% increase in all Switzerland over the same period. This is even more remarkable as the total number of FTE jobs had been constant in Obwalden between 1995 and 2005. …However, these increases may not be solely due to the personal income tax reform: in 2006, Obwalden also substantially reduced its corporate tax rates to a uniform rate of 6.6%, the lowest in the country at the time.

While the headline of the article indicates that Obwalden’s reforms “might not be a winning strategy,” all of Ms. Martinez’s data shows good results.

Maybe the government isn’t collecting as much revenue, but that’s a good outcome from my perspective.

And the increase in jobs and income should be good news from everybody’s perspective.

By the way, tax competition is continuing to produce good results for Switzerland.

An article from SwissInfo catalogues some of the more-recent tax cuts by Swiss cantons.

In 2021, the average corporate tax rate dropped slightly from 14.9% to 14.7% in Switzerland. This is largely due to tax cuts made in three cantons… Canton Zug, home to several major companies including commodities giant Glencore, maintains the lowest corporate tax rate (11.9%) followed by the cantons of Nidwalden (12%) and Lucerne (12.2%). …The KPMG analysis found that the Swiss tax rates for high-income earners declined slightly compared to the previous year, from 33.7 to 33.5% due to the fact that 12 cantons cut tax rates for top incomes. The biggest cuts were made by the cantons of Schwyz (-1.5 percentage points), Schaffhausen (-1.0 percentage points), Thurgau and Lucerne (roughly -0.6 percentage points each). Top incomes are taxed at the lowest rates in canton Zug (22.2%).

P.S. There is some federalism in the United States and this means many Americans also can vote with their feet and benefit as various states lower tax rates and embrace tax reform.

P.P.S. For more data on the benefits of decentralization, click here, here, here, and here.