A few months ago, I reiterated my opposition to Biden’s proposed corporate tax cartel as part of a longer discussion with Australia’s Gene Tunny.

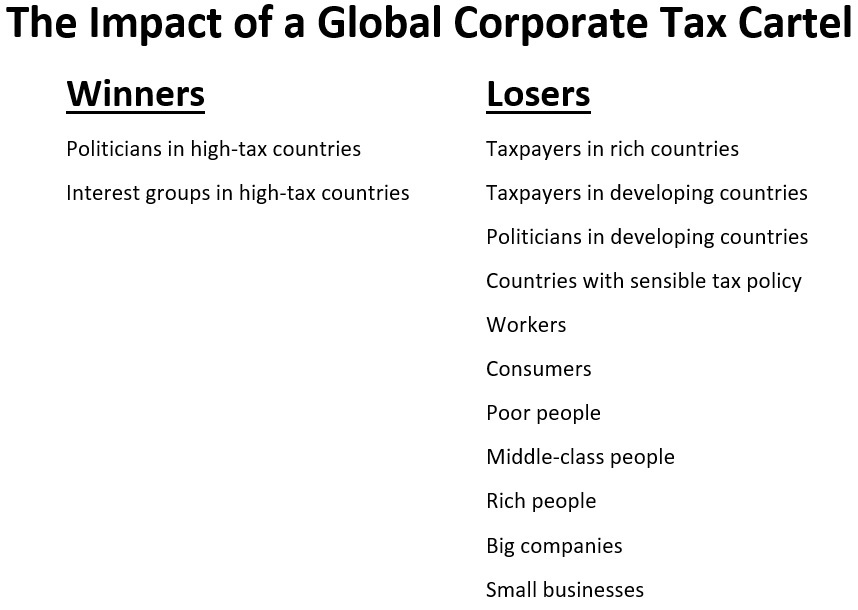

The main takeaway is that the proposed “minimum global tax” is an agreement by politicians for the benefit of politicians.

As I stated in the discussion. companies do not bear the burden of corporate taxes. Those costs are borne by workers, consumers, and shareholders.

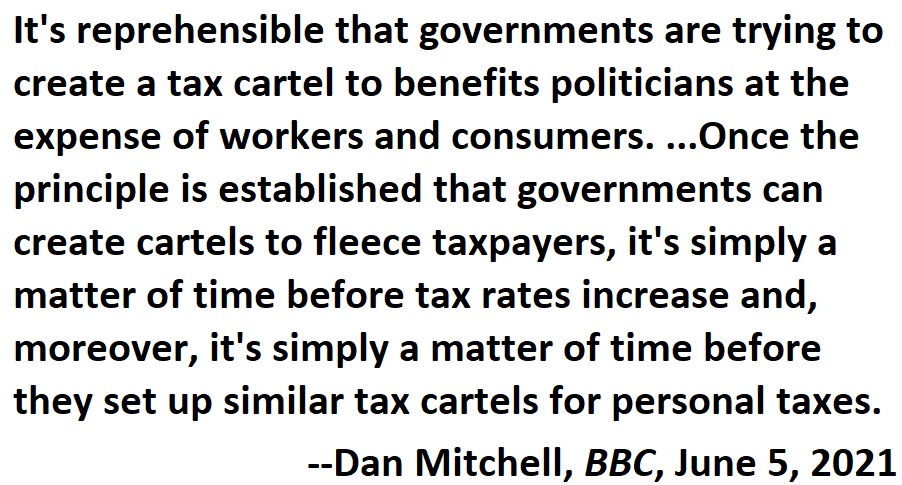

Sadly, those costs will increase if the agreement is finalized. Politicians openly admit they are pushing this cartel to undermine jurisdictional tax competition.

At the risk of stating the obvious, their plan is to give themselves more leeway to increase tax rates.

I’m sharing the above interview and rehashing some of these basic arguments because Barack Obama’s former top economist, Jason Furman, has a column in today’s Wall Street Journal.

Here’s some of what he wrote in favor of the scheme.

Policy makers have the best chance in generations to reform and improve this system while bringing the rest of the world along. Treasury Secretary Janet Yellen has already helped craft an international agreement signed by more than 130 countries. Congress now needs to do its part and lock it in. …The arguments for…fixing Mr. Trump’s reforms were already strong, but the global agreement secured by Ms. Yellen makes them much stronger. In particular, the global agreement removes the main objection to more aggressively taxing overseas income because other countries have all agreed to adopt similar systems. The concerns that U.S. companies would be less competitive or would try to avoid U.S. taxes by incorporating overseas are considerably smaller than they would otherwise be. …The global minimum tax agreement signals the dawn of a new era of international economic cooperation. It will be good for the countries involved and…relatively minimal in only establishing a 15% rate floor.

Notice that Mr. Furman openly acknowledges that the goal is to create a cartel so that politicians will feel less constrained by the liberalizing force of tax competition.

For what it’s worth, I think Professor Bruce Gilley had better analysis in his column, which appeared in the WSJ earlier this year..

World leaders announced a new global corporate minimum tax to great fanfare last year. …The contorted language of the guidance, as well as political foot-dragging in several countries, makes clear that the ballyhooed global tax plan would be a great and expensive flop. Better to let this hydra-headed monster die. The agreement was always a tax grab. …Europe wanted to raise revenue by taxing U.S. companies. The Biden administration has cheered the agreement along with familiar claims that big companies should “pay their fair share.” …Digital multinationals like Amazon, Google, Airbnb and Meta are the target. …the agreement…seeks to establish a 15% minimum global tax rate for international companies… The only plausible way the tax leads to more revenue for the U.S. is if it is used as a cover to raise corporate taxes here, which was perhaps why the Biden administration joined. …According to an International Monetary Fund study, 45% to 75% of the burden of corporate taxes is recouped through lower employee wages.

The bottom line is that the proposal for a global minimum tax is being sold as a way to go after big business and rich shareholders, but ordinary people will be the biggest victims.

We will pay more for products because as the higher taxes filter through the economy and we will have less disposable income because of a diminished job market.

P.S. I have written several times about the utterly fraudulent argument that supposedly profitable companies do not pay corporate taxes.

So this is a good opportunity to share this part of Professor Gilley’s column, which notes that companies are (currently) required to keep two different sets of books (which demagogues then deliberately mix up to advance their false claims).

Public companies already have to keep two sets of books, one for the Securities and Exchange Commission and one for the Internal Revenue Service. The first tells shareholders how well the business is doing; the second tells the government how much is owed and to whom. The new global tax would require multinationals to keep a third set of books to avoid being the target of tax raids by, say, France. The agreement would create many new jobs for accountants and lawyers.

Needless to say, requiring companies to keep a third set of books is a remarkably bad idea.

P.P.S. Here’s a primer on corporate taxation.

P.P.P.S. The bureaucrats at the OECD are big advocates of a global minimum tax. I wonder whether they are so pro-tax because they get tax-free salaries and thus are protected from the awful policies they pursue?