The central message of “Mitchell’s law” is certainly not something I concocted.

Economists and other policy experts have known for a couple of hundred years that politicians have a tendency to makes mistakes and then use the resulting damage as a justification for even more intervention.

I simply gave this phenomenon a name so I didn’t have to offer repeat explanations.

Over and over and over and over again.

Today we’re going to look at another example of politicians demanding more intervention to address a problem caused by previous interventions.

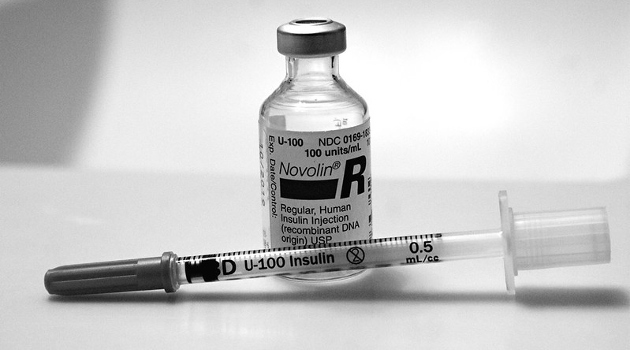

In an article for National Review, Michael Cannon has a very depressing explanation of how government has messed up the market for insulin.

…a proposal by congressional Democrats to mandate that private insurance companies cap out-of-pocket spending on insulin…neglects to address the way the government drives up the cost of insulin. Further intervention would make matters worse. …government makes it both unnecessarily difficult and expensive for diabetics to access this lifesaving drug. …Thanks to government, new insulin is expensive to bring to market. …The high cost of government regulation discourages the development of new insulin products, reduces the number of insulin manufacturers, and increases the prices of any products that do make it through that process… Government increases the cost of insulin by requiring diabetics to get prescriptions before purchasing many insulin products. …Canada generally allows diabetics to purchase any insulin product without a prescription. If the FDA or Congress were to remove those requirements, both the price of insulin and the ancillary costs of obtaining it would fall. …Thanks to government, most people end up with excessive insurance coverage and little awareness of how much things cost. …excessive health insurance encourages providers to increase prices because heavily insured patients care less about price increases.

I’ll augment these observations by explaining that “excessive insurance coverage” refers to how the tax code’s exclusion for fringe benefits leads both employees and employers to use health insurance as a way of not only covering large, unexpected costs, but also as a way of pre-paying for health care.

Unfortunately this pre-payment system has turned much of the health care system into an all-you-can-eat buffet, but with (the perception of) someone else paying the bill.

At the risk of understatement, this system of government-created third-party payer has produced an extraordinarily expensive and inefficient health system.

But I’m digressing. Let’s get back to the column.

So what’s the bottom line? As Cannon explains, the right answer is less government rather than more government.

Had government never intervened in the health sector, private insurance companies might already be offering more comprehensive cost-sharing for insulin than congressional Democrats propose, without driving insulin prices higher. Or perhaps insulin prices would be so low that no one would feel the need to purchase insurance that covers it. All we know for sure is that, like past government interventions, attempts by government to cap cost-sharing for insulin will have unintended consequences that make matters worse for diabetics and all consumers.

P.S. In his column, Cannon observed that, “When Congress capped cost-sharing for contraceptives at $0, prices for hormones and oral contraceptives skyrocketed.”

This is illustrated very clearly by this chart.

As you might expect, deregulation would be the way to lower the cost of birth control (just like deregulation would be the way to lower the cost of insulin).

———

Image credit: 2C2K Photography | CC BY 2.0.