Because I dedicated last week to European fiscal policy, I didn’t get a chance to write about the Tax Foundation’s latest version of the State Business Tax Climate Index, which was released October 25.

Last year, the top-4 states were Wyoming, South Dakota, Alaska, and Florida. This year’s report, authored by Janelle Fritts and Jared Walczak, says the top-4 states are… (drum roll, please) …exactly the same.

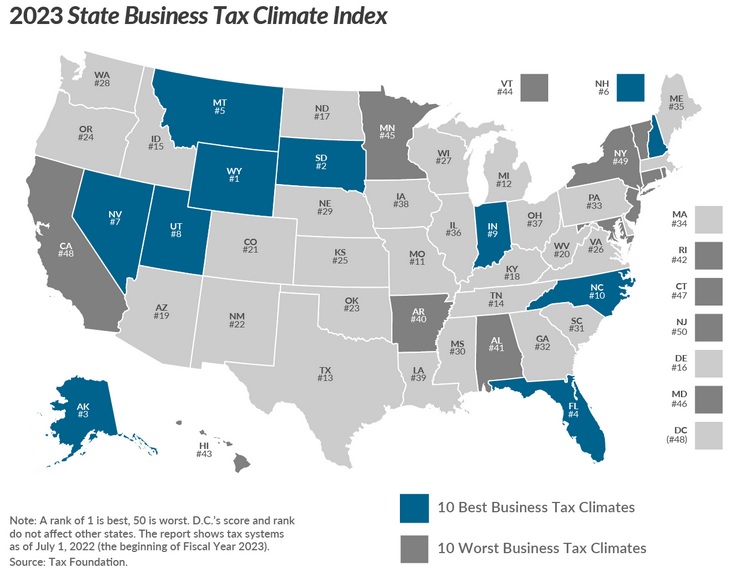

Here’s the map showing how states rank. The best states are blue and the worst states are dark grey.

Coincidentally, the bottom-4 states also stayed constant. New Jersey is in last place, followed by New York, California, and Connecticut.

But there were some very interesting changes if you look at the other 42 states.

Thanks to pro-growth tax reforms, Arizona and Oklahoma both jumped 5 spots in the past year.

The state of Washington suffered a huge fall, dropping 13 spots thanks to the imposition of a capital gains tax (the state constitution supposedly bars any taxes on income – and voters last fall overwhelmingly voted against the capital gains tax – but it appears the state’s politicians and a negligent judiciary may combine to put the state on a very bad path).

It’s also interesting to look at long-run trends. If you compare this year’s Index with the original 2014 Index, you’ll find that three states have jumped by at least 10 spots and three states have dropped by at least 10 spots.

Since I’m a Virginia resident, this is not encouraging news.

P.S. As I’ve noted before, the rankings for Alaska and Wyoming are somewhat misleading. Both states have lots of energy production and their state governments collect enormous amounts of taxes from that sector. This allows them to keep other taxes low while still financing bloated state budgets.