I’m currently in Tanzania as part of a speaking tour in Africa. My remarks today largely repeated the message I gave to an audience last week in Nigeria.

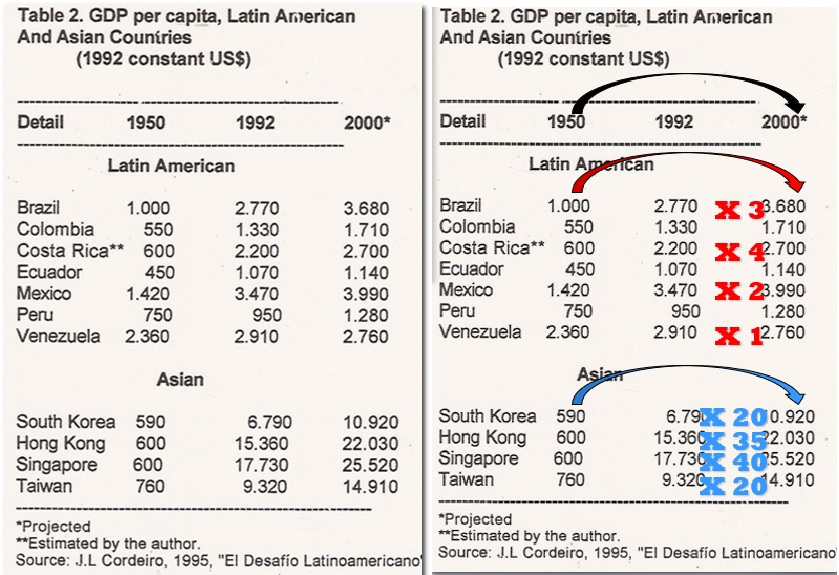

So I won’t bother sharing anything from my presentation. Instead, I want to highlight some numbers from a presentation by Professor Ken Schoolland.

He shared some data showing how the “Asian Tigers” grew far faster than major Latin American nations between 1950 and 2000.

These are very impressive examples of convergence (as the Asian Tigers caught up with Latin America) followed by divergence (as the Tigers then continued to grow much faster).

I’ll be adding this data to my “anti-convergence club.”

But I also noticed that Professor Schoolland was sharing some old data from 1995.

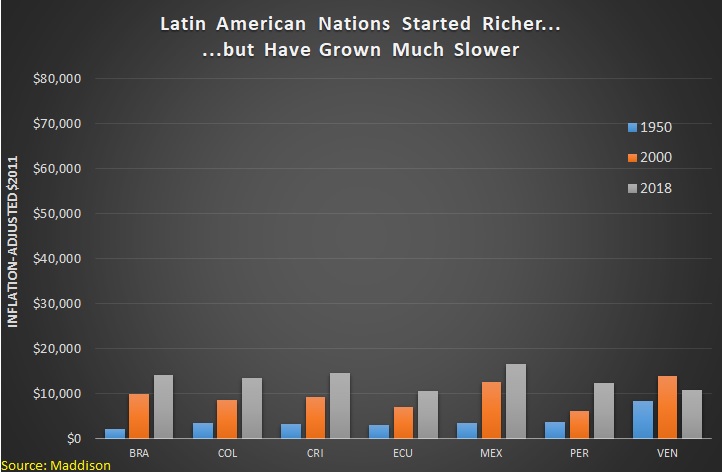

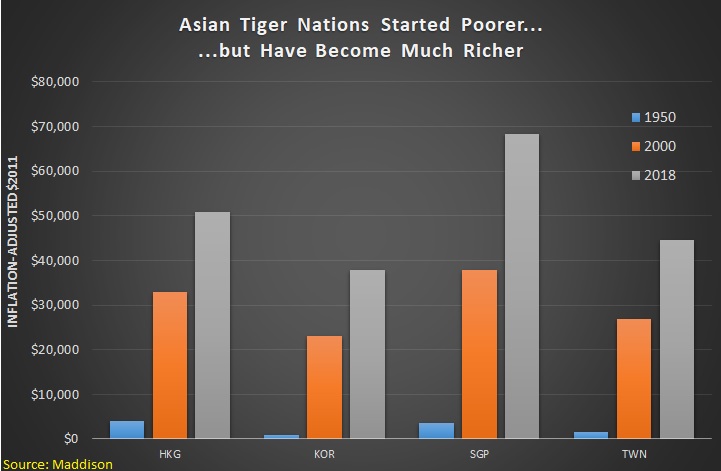

So I went to the Maddison website and created some new charts based on the latest-available data.

As you can see, the Latin American nations were richer in 1950, but they have not enjoyed fast growth in the past 70 years.

By contrast, the Asian Tigers have enjoyed spectacular growth since 1950.

So not only are these nations much more prosperous than nations in Latin America, in most cases they have even surpassed European countries and Singapore is now richer than the United States.

Since I’m writing about the success of the Asian Tigers, let’s address the myth that they became rich because of industrial policy.

Sam Gregg of the Acton Institute examined this controversy in an article for Law & Liberty.

…what about some of the East Asian Tiger countries? Aren’t they proof that, when devised and implemented by wise governments guided by even cleverer experts, industrial policy can work? …There is, however, a wealth of evidence indicating that these policies produced similarly pedestrian outcomes in these countries. As for the Tigers, what primarily took them from the status of economic backwaters to first-world economies was economic liberalization and especially trade openness… Even the most devoted industrial policy advocates hesitate to present two of the Tigers, Singapore and Hong Kong, as industrial policy successes. They do nevertheless regard South Korea and Taiwan’s postwar histories as demonstrating why industrial policy should play a major role.

Gregg takes a close look at what actually happened in South Korea.

Beginning in 1954 and until about 1963, Korea’s government focused upon import-substitution industrialization policies… however,…economic growth in Korea only began taking off between 1963 and 1973 following a decisive shift towards export-orientated development and trade openness. …Industrial policy assumed a larger place in Korea’s economy in the mid-1970s. …Korea’s turn towards industrial policy in this period does not appear to have produced spectacular results. Economic growth during this period—whether in terms of GDP, trade, employment, manufacturing output, or exports in goods and services—was actually lower than what had been realized in the 1960s. …These results may help explain why Korea’s drift towards industrial policy was reversed, beginning in the late-1970s. …The overall result was a return to high growth throughout Korea’s economy.

And here’s his analysis of what happened in Taiwan.

…the Kuomintang government adopted an import-substitution approach to trade characterized by high tariffs and import quotas. The Taiwan Production Board oversaw the extensive use of industrial policy, especially through preferential loan-treatment… In the mid-1950s, key Taiwanese officials and their American advisors recognized that Taiwan could not keep going down this path. Hence in the late-1950s, decisions were made that re-orientated Taiwan’s economy towards competition and trade openness by, among other things, liberalizing imports and foreign investment rules as well as beginning a process of steadily removing export controls and gradually giving more and more exporters what amounted to a free trade status. As in Korea’s case, growth in Taiwan took off. …the general direction of Taiwan’s economy from 1958 onwards was away from industrial policy and tariffs and towards increasing integration into global markets. Like Korea, Taiwan underwent a limited return to interventionist policies in the mid-1970s, but, again, like Korea, this did not last.

The bottom line is that South Korea and Taiwan are not as rich as Hong Kong and Singapore and one reason they are lagging is that their governments tried to pick winners and losers.

But both those nations largely have abandoned industrial policy, so at least they recognized their mistakes.

P.S. A big issue at the conference is whether the “China Model” should be emulated. I shared some data showing why that would be a big mistake.

———

Image credit: Merlion444 | CC0 1.0.