Good tax policy should strive to solve the three major problems that plague today’s income tax.

- Punitive tax rates on productive behavior.

- Double taxation of saving and investment

- Corrupt, complex, and inefficient loopholes.

Today, let’s focus on the second item. If the goal is to minimize the economic damage of taxation, both labor and capital should be taxed at the lowest-possible rate.

But, as illustrated by the chart, the internal revenue code imposes widespread “double taxation” on income that is saved and invested.

Actually, it’s more than double taxation. Between the capital gains tax, corporate income tax, double tax on dividends, and death tax, there are multiple layers of tax on income from saving and investment.

So even if statutory tax rates are low, effective tax rates can be very high when you consider how the IRS gets several bites at the apple.

This is why good tax reform plans eliminate the tax bias against capital.

But we don’t want the perfect to be the enemy of the good. Simply lowering tax rates on capital also would be a step in the right direction.

And such an approach would produce meaningful economic benefits, as explained in a new Federal Reserve study by Saroj Bhattarai, Jae Won Lee, Woong Yong Park, and Choongryul Yang.

…capital tax cuts, as expected, have expansionary long-run aggregate effects on the economy. For instance, with a permanent reduction of the capital tax rate from 35% to 21%, output in the new steady state, compared to the initial steady state, is greater by 4.24%… A reduction in the capital tax rate leads to a decrease in the rental rate of capital, raising demand for capital by firms. This stimulates investment and capital accumulation. A larger amount of capital stock, in turn, makes workers more productive, raising wages and hours. Finally, given the increase in the factors of production, output expands.

This is all good news.

But our left-leaning friends might not be happy because some people get richer faster than other people get richer.

This aggregate expansion however, is coupled with worsening…inequality in our model. For instance, skilled wages increase by 4.66% while unskilled wages increases by only 0.56%, driven by capital-skill complementarity.

For what it is worth, I agree with Margaret Thatcher about adopting policies that help all groups enjoy higher living standards.

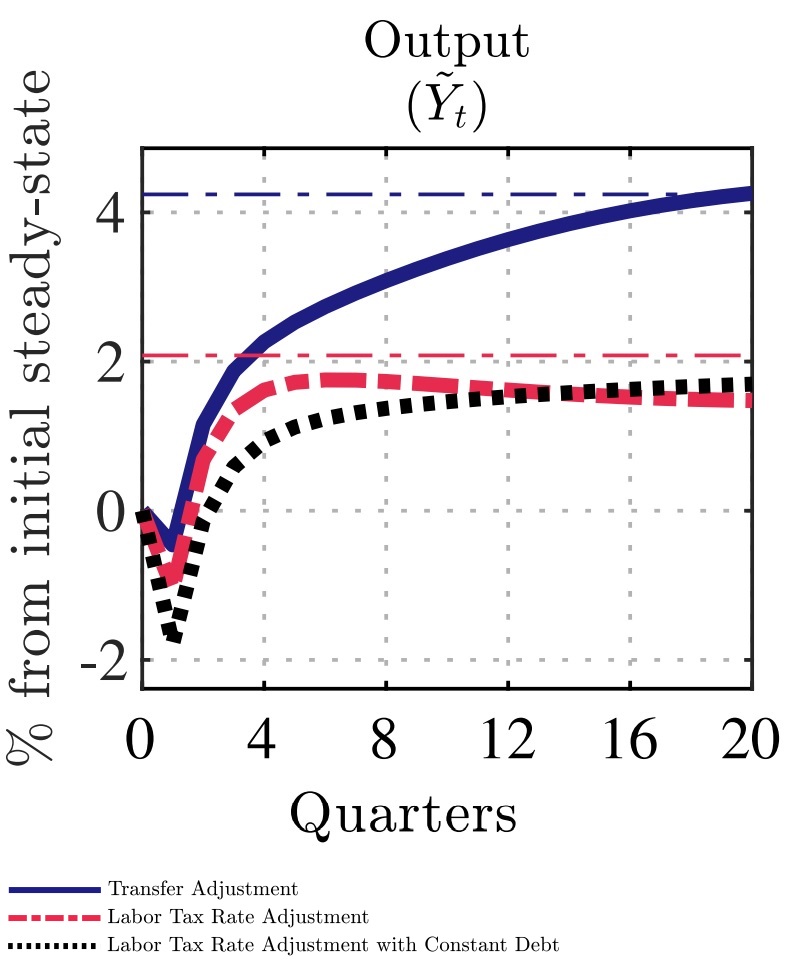

Here’s a chart for wonky readers. It shows how quickly the economy grows depending on how lower capital taxes are offset.

And here’s some of the explanatory text.

The main takeaway if that you get the most growth when you also lower the burden of redistribution spending.

The three financing schemes under consideration…produce different effects on aggregate output because each scheme influences workers’ labor supply decisions differently. …lump-sum transfer cuts…boosts unskilled hours and in turn, contributes to greater aggregate output… In comparison, a rise in the labor or consumption tax rate decreases the effective wage rate (as is well-understood) and additionally, weakens the wealth effect for the unskilled household. These two mechanisms work together to generate a smaller aggregate expansion under the distortionary tax adjustments. …we show that the capital tax cut has different welfare implications for each type of household depending on time horizon and policy adjustments. …The tax reform benefits the skilled households the most when transfers adjust, whereas the unskilled households prefer distortionary financing to avoid a significant reduction in transfer incomes.

The secondary takeaway from this research is that it would be bad for the economy (and bad for both rich people and poor people) if Joe Biden’s class-warfare tax policy was enacted.

But if you read this, this, this, and this, you already knew that.

———

Image credit: Nick Youngson | Pix4free | CC BY-SA 3.0.