At the state level, we have another victory for good tax policy.

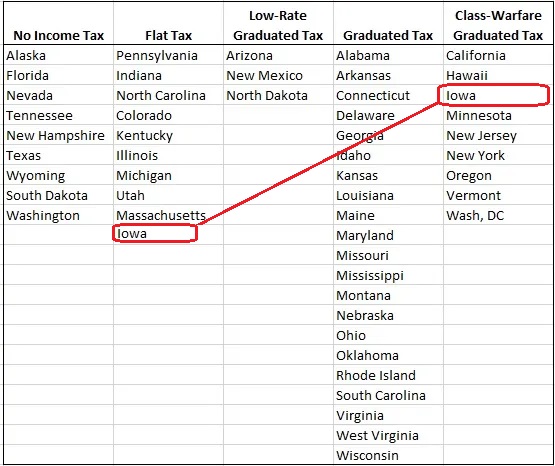

I wrote last month that Iowa might replace its discriminatory tax regime with a simple and fair flat tax.

And I pointed out that this reform would help the state jump several spots in my ranking of state tax systems.

Well, the proposed reform has been approved by the state legislature and Iowa will now have a much better (i.e., less destructive) tax system.

Here are some details of the new law, as reported by Stephen Gruber-Miller and Ian Richardson for the Des Moines Register.

Iowa will move to a 3.9% flat income tax rate under a compromise between legislative Republicans and Gov. Kim Reynolds… …It would also exempt retirement income such as 401(k)s, pensions and IRAs from state taxes… Along the way, the bill would eliminate Iowa’s progressive income tax system, where wealthier Iowans pay higher rates than lower-income Iowans. Iowa would join 10 other states with some form of flat income tax. …The new proposal would build upon a series of tax cuts that were previously set to start for Iowans in 2023, meaning multiple new tax laws would take effect during the same year. Iowa is already set to reduce the number of tax brackets from nine to four starting in 2023. …It will drop the corporate tax rate to a 5.5% flat rate over time.

I could end today’s column at this point.

After all, what happened in Iowa is a triumph for tax reform and another case study on the benefits of tax competition (just like we’ve seen in states such as Kentucky and North Carolina).

But I want to take this opportunity to address another big-picture issue.

Earlier this month, James Lynch wrote a column for the Des Moines Register on the potential impact of tax reform in the state.

He contrasted the views of both proponents and opponents.

Flattening state income tax rates and exempting retirement income would either lead to growth in businesses and jobs and increase Iowans wealth, or simply make wealthy Iowans wealthier, according to speakers at a public hearing…speakers at the Monday evening public hearing were divided between those who said a flatter tax rate would make Iowa a more attractive place for businesses to locate and expand — as well as a more attractive place for employees to live and work — and those who said the plan largely benefits the wealthy while doing little to help lower-income workers.

At the risk of sounding mushy, both supporters and critics are right.

Iowa’s tax reform will encourage more growth. And it’s also true that the rich will benefit.

But opponents are guilty of a sin of omission. That’s because tax reform will benefit lower-income and middle-class taxpayers as well.

And I think “sin of omission” is the right term. That’s because a big moral shortcoming among our friends on the left is that they are sometimes tempted to go along with policies that will hurt the less fortunate so long as they impose even greater damage on upper-income taxpayers.

P.S. Adopting a flat tax is progress, but the ultimate goal should be abolishing the state income tax.

———

Image credit: 401(K) 2012 | CC BY-SA 2.0.