A big division among economists is whether taxes have a big or small impact on incentives.

If taxpayers are very responsive, that means more economic damage (to use the profession’s jargon, a greater level of deadweight loss).

If you’re wondering which economists are right, there’s a lot of evidence that taxpayers are sensitive to changes in tax rates, Especially upper-income taxpayers, in part because they have significant control over the timing, levels, and composition of their income.

This is why entrepreneurs, innovators, inventors, and investors respond to difference in tax rates.

And athletes also make decisions based on tax policy. Here’s a tweet about Tyreek Hill, one of the best wide receivers in the National Football League. When deciding which team to sign with for this year, he picked the Miami Dolphins, located in a state with no income tax.

Mr. Hill also had the option to sign with the New York Jets.

But that would have meant letting greedy politicians in either New York or New Jersey (where the Jets play their home games) grab almost 11 percent of each additional dollar he earns.

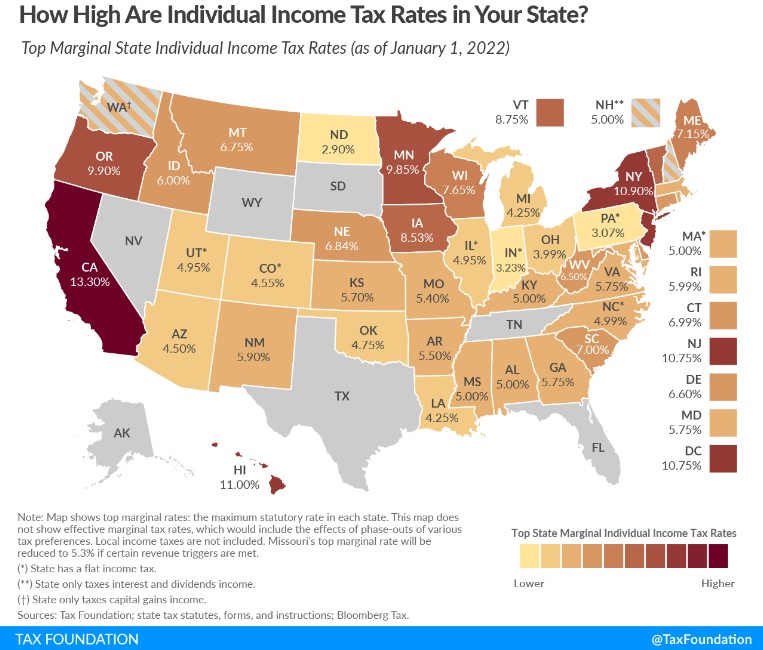

According to this map, star athletes should be big fans of gray states and steer clear of dark-brown (or is that maroon?) states.

There’s research, incidentally, showing that teams based in low-tax states actually win more games.

P.S. I’ll close by reiterating my caveat about taxes being just one piece of the puzzle. After all, I speculated many years ago that taxes may have played a role in LeBron James going from Cleveland to Miami. But he then migrated to high-tax California. Though many pro athletes have moved away from the not-so-Golden States, so the general points is still accurate.

P.P.S. I feel sorry for Cam Newton, who paid a marginal tax rate of nearly 200 percent on his bonus for playing in the 2016 Super Bowl.

P.P.P.S. Taxes also impact choices on how often to box and where to box.

P.P.P.P.S. Needless to say, these principles also apply in other nations.

———

Image credit: DonkeyHotey | CC BY 2.0.