It is easy to criticize the many types of bad tax policy in the United States.

- High marginal tax rates

- Pervasive double taxation

- Mind-boggling complexity

- Grotesque unfairness

- The Internal Revenue Service

But let’s not forget other nations have bad policy as well. I have written many times, for example, about the stunning greed of many European nations (including effective tax rates of more than 100 percent!).

Today, though, let’s look at a couple of examples from the developing world.

We’ll start in Afghanistan, where we learn that bad tax policy helped bring the Taliban back to power. Here’s some of what Ashley Jackson wrote for CapX.

When the Taliban dramatically gained control of Afghanistan in August 2021, they used bombs and guns to swiftly overcome state security forces. But they also had another valuable and effective weapon at their disposal: taxes. Long before the withdrawal of US troops, the Taliban had developed a remarkably state-like system of taxing citizens on everyday goods like cigarettes and perfume. The money raised turned out to be an essential part of the Taliban’s military strategy… Many of the Afghans we spoke to felt that the Taliban’s taxes were fairer than those imposed by the government, which often involved bribery and complex bureaucracy. By being relatively less onerous and less corrupt, the Taliban exploited widespread Afghan frustration with government incompetence. …One truck driver told us that unlike with the Taliban, he had “to pay a bribe to pay tax to the Afghan government”. …when Afghanistan’s major border crossings and several provincial capitals fell in July 2021, many wondered why they fell so quickly and with relatively little violence. It quickly emerged that local business owners…were motivated to encourage a quick and orderly handover.

One obvious takeaway is that the Taliban tax people are smarter than the ISIS tax people.

Now let’s travel to Africa, where we learn about how high tax burdens make private car ownership well nigh impossible.

Here are some excerpts from Emmanuel Igunza’s report for the BBC.

Owning a car for many Ethiopians – even those with ready cash to spend in one of the world’s fastest-growing economies – remains a pipe dream. “I have been saving for nearly four years now, and I still can’t afford to buy even the cheapest vehicle here,” a frustrated Girma Desalegn tells me….they are prohibitively expensive because the government classifies cars as luxury goods. This means even if a vehicle is second hand, it will be hit with import taxes of up to 200%. …the Toyota Vitz..cost about $16,000 in Ethiopia; in neighbouring Kenya the same car costs not more than $8,000. It seems little wonder that Ethiopia has the world’s lowest rate of car ownership, with only two cars per 1,000 inhabitants… The Ethiopian Revenues and Customs Authority says both commercial and private vehicles imported into the country can be subjected to five different types of taxes.

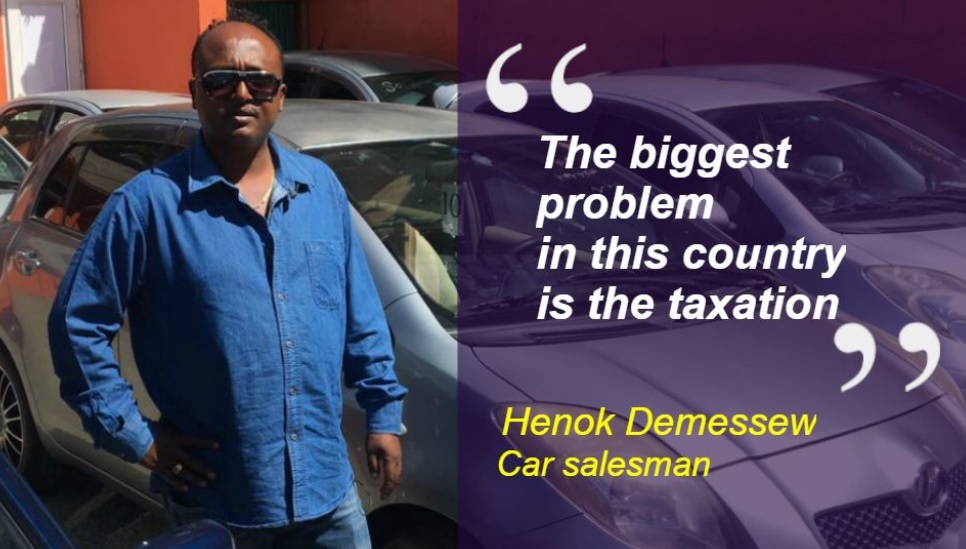

The story contains a picture with a caption that is universally applicable.

This sentences matches perfectly with the sentence I shared earlier this month.

P.S. If you want other odd examples of international taxation, click here, here, here, here, here, here, here, and here.

———

Image credit: geralt | Pixabay License.