Adding to already voluminous research in the area (including studies from Australia, Canada, Germany, and the United Kingdom), I wrote yesterday about a new study showing that lower corporate tax rates produce more economic growth.

Not that these results should be a surprise.

Anyone with a basic understanding of economics realizes that taxes discourage the activity that is being taxed (something politicians understand when they discuss levies on tobacco).

And the higher the tax, the greater the damage.

Today, let’s revisit the 2017 Trump tax cuts, particularly the reduction in the corporate tax rate.

The International Monetary Fund has published new research on the issue, looking specifically at the impact of cross-border investment. Here are some excerpts from the study, which was written by Thornton Matheson, Alexander Klemm, Laura Power, and Thomas Brosy.

The 2017 Tax Cuts and Jobs Act (TCJA) sharply reduced effective corporate income tax rates on equity-financed US investment. This paper examines the reform’s impact on US inbound foreign direct investment (FDI) and investment in property, plant and equipment (PPE) by foreign-owned US companies. …We find that both PPE investment and FDI financed with retained earnings responded positively to the TCJA reform, but FDI financed with new equity or debt did not. …the increase in PPE investment after TCJA was driven by general economic growth. In regressions of FDI financed with retained earnings, however, tax coefficients were robust to inclusion of macroeconomic controls. As the literature predicts, EATRs have a greater impact on cross-border investment than EMTRs.

These results are interesting, but not overwhelming.

So why am I citing this research?

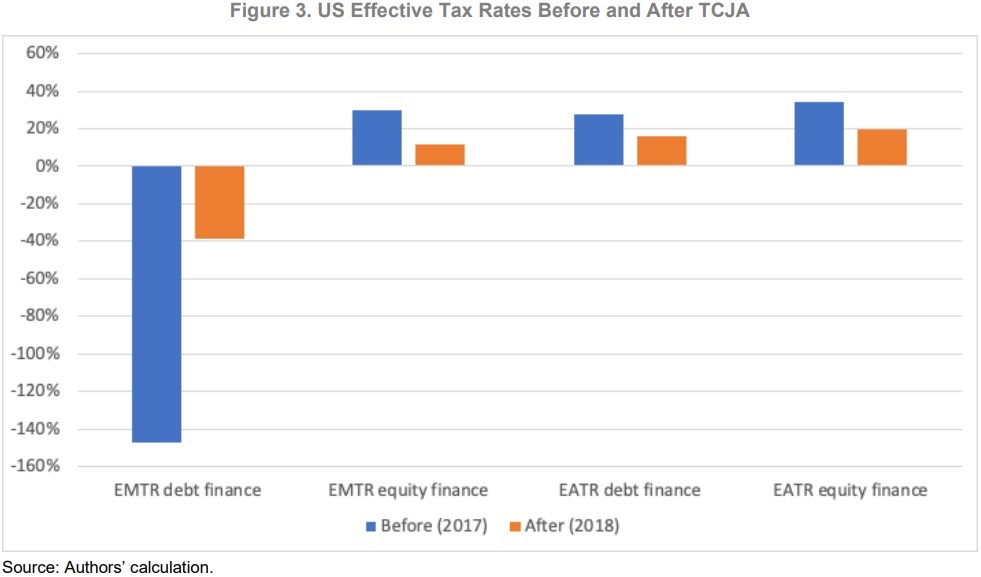

Because of the following chart, which shows two very important and very desirable results of the 2017 tax bill.

- First, we see lower average tax rates and lower marginal tax rates for the three types of business financing on the right.

- Second, we can see from “EMTR debt finance” on the left that the legislation significantly reduced the tax code’s bias for debt.

Here’s the chart, with the blue bars representing pre-2017 tax rates and the orange bars showing today’s tax rates.

The bottom line is that the 2017 law moved tax policy in the right direction. In a big way.

We got lower rates and moved closer to neutrality.

And I say that as someone who has no problem criticizing some of the other policies we got during that era.

———

Image credit: Trump White House Archived | Public Domain.