Here is the argument why corporate tax rates should be as low as possible.

- High corporate tax rates discourage investment.

- Less investment reduces worker productivity.

- Lower rates of productivity result in lower wages.

In an ideal world, there would be no corporate income tax (or any income tax).

But I’ll gladly accept any movement in the right direction, which is why the reduction in the corporate tax rate was the crown jewel of Trump’s 2017 tax plan.

The bad news is that Biden wants to undo much of that progress.

Today, let’s look at some new academic evidence on the issue. A new study from the National Bureau of Economic Research, authored by Professors James Cloyne, Joseba Martinez, Haroon Mumtaz, and Paolo Surico, finds that lower corporate rates are especially beneficial for long-run prosperity.

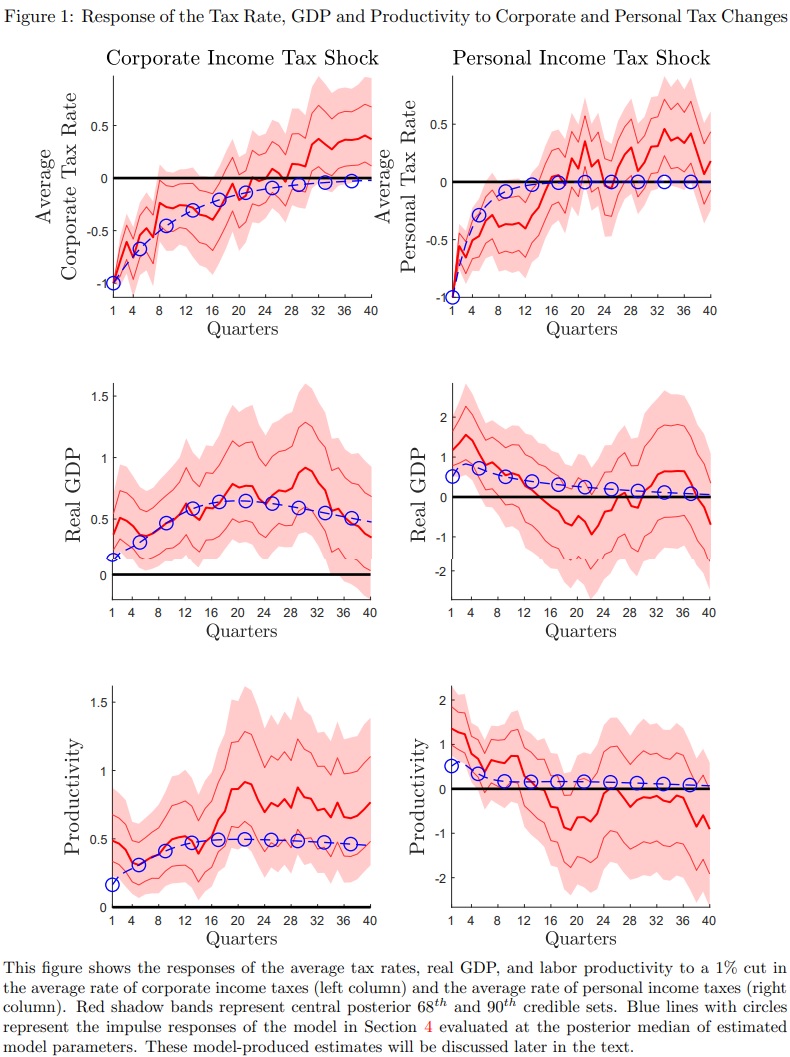

We use…post-WWII U.S. data on output, taxes, productivity and R&D spending to estimate the dynamic effects of income tax changes…and focus on personal and corporate income tax changes separately. …In Figure 1, we present our first set of main results. The figure contains two columns. On the left, we show the IRFs to a reduction in the average corporate tax rate. On the right, we show the results for a reduction in the average personal tax rate. …The first row in Figure 1 reveals that, following a shock to corporate and personal income taxes, the average tax rates decline temporarily. …The second row in Figure 1 shows the impulse response functions for the percentage response of real GDP. … Looking at the first column it is clear that, despite the transitory nature of the corporate tax reduction, there are very persistent effects on real GDP, whose short-run increase of 0.5% persists throughout the ten year period shown in the figure. In other words, the corporate income tax cut has disappeared after 5 years, but the effect on the level of economic activity is still sizable and significant after 8 years. …A similar picture emerges for productivity, as shown in the third row of Figure 1. Both tax rate cuts boost productivity on impact, with the size of the initial response to a personal income tax cut being much larger than for a cut to corporate taxes. On the other hand, the effects of corporate tax cuts grow over time and remain significant even after 10 years.

Here’s the aforementioned Figure 1 from their research.

I’ll conclude by noting that permanent tax cuts are much better than temporary tax cuts.

But if taxes are being cut, regardless of duration, the goal should be to get the most bang for the buck. And there’s plenty of evidence (from the United States, Australia, Canada, Germany, and the United Kingdom) that lowering corporate tax rates is a smart place to start.

P.S. It’s unfortunate that Biden wants a higher corporate tax burden in the United States. It’s even more disturbing that he wants a global tax cartel so the entire world has to follow in his footsteps. But he apparently does not understand the topic.

———

Image credit: N i c o l a | CC BY 2.0.