Modern tax systems tend to have three major deviations from good fiscal policy.

- High marginal tax rates on productive behavior like work and entrepreneurship.

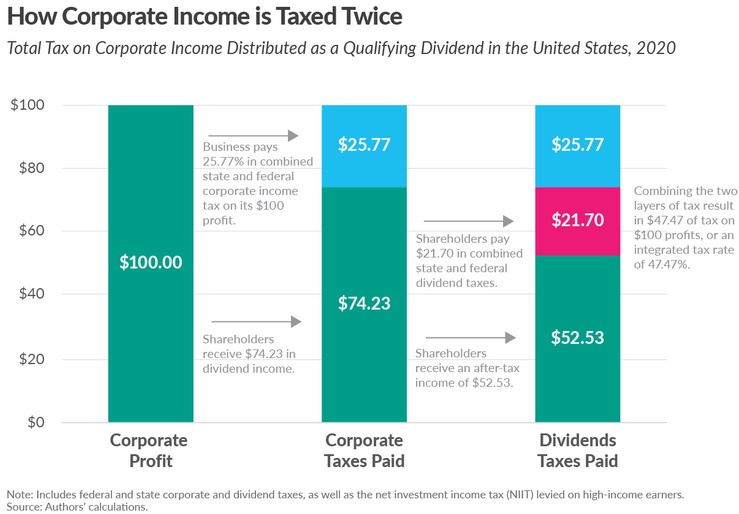

- Multiple layers of taxation on income that is saved and invested.

- Distortionary loopholes that reward inefficiency and promote corruption.

Today, let’s focus on an aspect of item #2.

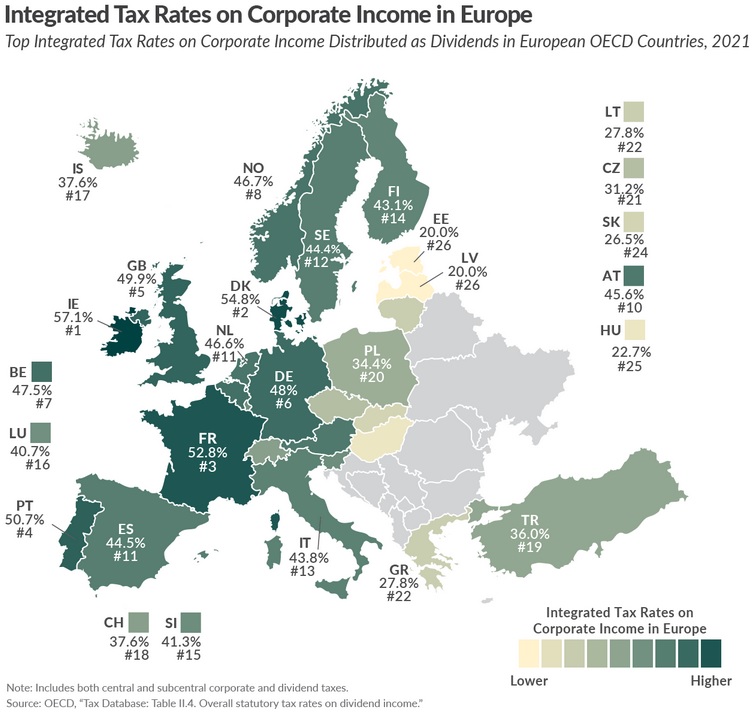

The Tax Foundation has just released a very interesting map (at least for wonks) showing the total tax rate on dividends in European nations, including both the corporate income tax and the double-tax on dividends.

Because it has a reasonably modest corporate income tax rate, some of you may be surprised that Ireland has the most onerous overall burden on dividends. But that’s because there are high tax rates on personal income and households have to pay those high rates on any dividends they receive (even though companies already paid tax on that income).

It’s less surprising that Denmark is the second worst and France is the third worst.

Meanwhile, Estonia and Latvia have the least-onerous systems thanks to low rates and no double taxation.

But what about the United States?

There’s a different publication from the Tax Foundation that shows the extent – a maximum rate of 47.47 percent – of America’s double taxation.

The bottom line is that the United States would rank #7, between high-tax Belgium and high-tax Germany, if it was included in the above map.

That’s not a very good spot, at least if the goal is more jobs and more competitiveness.

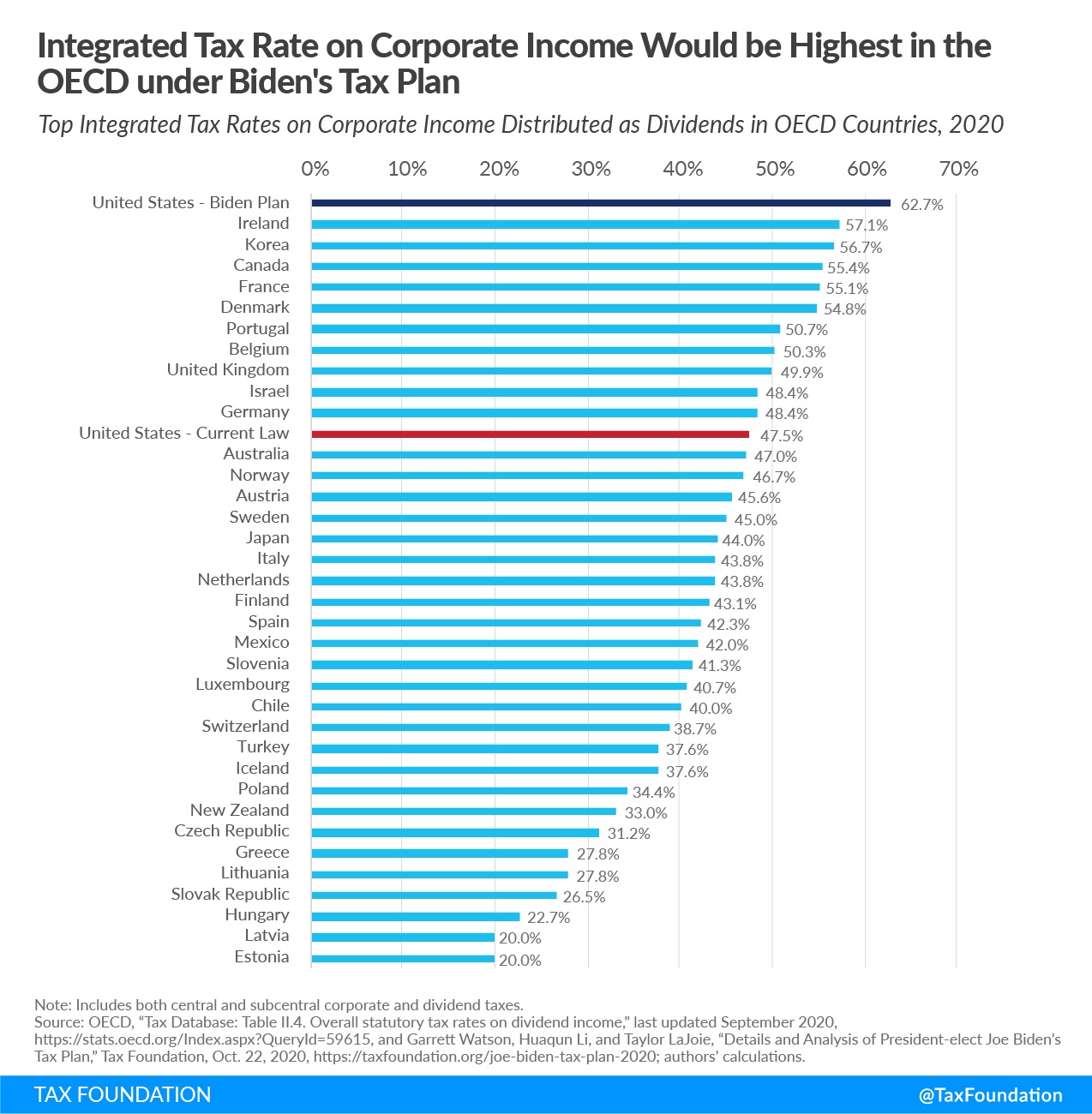

To make matters worse, Joe Biden wants America to be #1 on the list. I’m not joking.

I’ve already written about his plan for a higher corporate tax rate.

But he wants an even-bigger increases in the second layer of tax on dividends.

How much bigger?

Pinar Cebi Wilber of the American Council for Capital Formation shared the unpleasant details in a column last year for the Wall Street Journal.

The Biden administration has released a flurry of tax proposals, including a headline-grabbing tax hike on capital gains that would apply retroactively from April. Dividends would be subject to the same treatment, according to a recently released Treasury Department document. …the proposal would tax qualified dividends—dividends from shares in domestic corporations and certain foreign corporations that are held for at least a specified minimum period of time—at income-tax rates (currently up to 40.8%) rather than the lower capital-gains rates (23.8%).

I also like that the column includes references to some academic research.

A 2005 paper by economists Raj Chetty and Emmanuel Saez looked at the effect of the 2003 dividend tax cuts on dividend payments in the U.S. The authors “find a sharp and widespread surge in dividend distributions following the tax cut,” after a continuous two-decade decrease in distributions. …Princeton’s Adrien Matray and co-author Charles Boissel looked at the issue the other way around. In a 2019 study, they found that an increase in French dividend taxes led to decreased dividend payments. …Another study from 2011, looking at America’s major competitor, reached the same directional conclusion: A 2005 reduction in China’s dividend tax rate led to an increase in dividend payments.

Not that anyone should be surprised by these results. The academic literature clearly shows that it’s not smart to impose high tax rates on productive behavior such as work, saving, investment, and entrepreneurship.

Unless, of course, you want more people dependent on government.

P.S. Biden also wants American to be #1 for capital gains taxation. So at least he is consistent, albeit in a very perverse way.

———

Image credit: Sébastien Bertrand | CC BY 2.0.