As part of my continuing efforts to derail Biden’s global minimum tax on businesses (here’s Part I and Part II), I explain the downsides of the president’s plan in this clip from a recent interview.

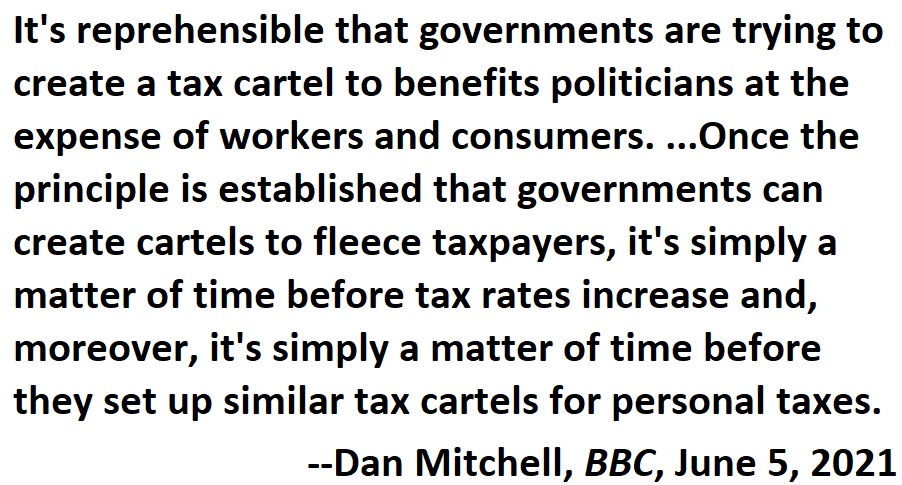

If you don’t want to spend three minutes to watch the above video, my views are summarized by this excerpt from an interview with the BBC.

Simply stated, politicians want to grab more money from businesses.

But let’s not forget that taxes on companies are actually paid by workers, consumers, and shareholders.

We do have some good news. Hungary is stopping, at least temporarily, the European Union from embracing its version of a minimum tax.

In a column for the Wall Street Journal, a member of that nation’s parliament explains his government’s position.

Adopting the European Commission’s minimum-tax directive now would be a profound mistake. …The EU directive, proposed by the European Commission in December 2021, aims to introduce a 15% minimum tax rate, effective Jan. 1, 2023…the current proposal would increase the tax burden on European manufacturers, which drive economic growth. The directive would need to be unanimously agreed by 27 EU member states to take effect. Hungary can’t support a proposal that would hurt the weakened European economy… Adopting the directive would hit Central European economies the hardest by damaging their favorable tax systems, a key competitive advantage over their Western European counterparts. …Hungary’s ability to set its own fiscal policies in this crisis is indispensable. To protect our competitiveness and sovereignty, the Hungarian National Assembly passed a resolution prohibiting the government from agreeing to implement a global minimum tax.

Let’s be thankful that Hungary said no.

But I’m still very worried, for two reasons.

- First, the column focuses on why it would be a very bad idea to impose a global tax cartel during the current period of economic turmoil. That’s true, but it implies that it might be acceptable to impose a global minimum tax at some other point. That’s definitely not the case.

- Second, it’s bad news that other nations – such as Ireland, Estonia, and Luxembourg – didn’t side with Hungary (Ireland’s capitulation is particularly disappointing).

Since we’re discussing the merits (or lack thereof) of a global minimum tax, let’s look at what others have written about the idea.

Aharon Friedman and Joshua Rauh opined against the concept of a global minimum corporate tax in an article for Fox News.

…the administration is conspiring at the OECD to stifle tax competition across the globe by effectively requiring all countries to impose similarly high tax rates. …teaming up with the OECD to be the world’s tax policeman would be disastrous for many reasons. …a global minimum tax would have to feature very detailed rules over every aspect of taxation, from cost recovery, losses, and interest deductibility, to tax incentives such as R&D and what kinds of businesses must be subject to the tax in the first place. The scheme would shift enormous power to the OECD Secretariat, which would start to look like the world’s IRS Commissioner. This would also be a backdoor through which to further strip tax lawmaking from Congress and place it in the hands of Treasury and its foreign counterparts. …The Biden administration is trying force countries across the world to adopt its own preference for high taxes on corporate income regardless of the effect on employment and wages.

The Wall Street Journal editorialized against this scheme last year.

Ignore the back-slapping about revenues and “fairness.” This deal is bad news for economies recovering from the pandemic, and especially the U.S. …Officials and progressive activists say they’re halting a global “race to the bottom” on corporate taxes. We’re glad they finally concede that tax rates matter to decisions about investment and job creation, since the left has denied this for decades. But the real action has been on tax policy competition, which has been instrumental to economic growth, innovation and job creation since the 1980s. The OECD plan will throttle that competition. That’s because, while the G-7 agreement focuses on the headline rate for the new minimum tax, the OECD plan comes with reams of harmonized fine print… Suppressing tax competition is the main reason the Biden Administration broke with Washington’s long, bipartisan tradition of opposing a global minimum tax. …American workers, consumers and shareholders will pay the price.

Writing for CapX, Kai Weiss warns that a global minimum tax is a cartel to benefit governments with uncompetitive tax systems.

…there’s a real danger that these proposals will damage the prosperity of competitiveness of the world’s major economies, while trampling on nation states’ freedom and sovereignty. …The likes of France and Germany have long taken umbrage that smaller member states like Ireland and Luxembourg have used low corporate tax rates… Rather than reconsider their own counterproductive policies, the EU’s two biggest economies have simply decided to try forcing everyone else to play by their rules. …It’s hard to avoid the conclusion that this is another bout of protectionism from countries such as Germany, France, and Italy which have long pursued counter-productive, draconian tax policies. The big difference now is that they have a willing ally in the shape of Joe Biden. …there’s a word for this kind of behaviour. If businesses were following such a strategy instead of governments “we would call this a cartel”.

Last year, Thomas Duesterberg wrote critically about the implications for national sovereignty in a column for the Wall Street Journal.

Treasury Secretary Janet Yellen has a grand idea: a global tax regime. …Together with the Biden administration’s plan to raise the U.S. corporate tax rate to 28% and eliminate preferences, it would return the U.S. to its pre-2017 status as a high-tax jurisdiction, discouraging domestic capital investment and production. More insidious, it would cede authority over taxation, one of the pillars of democratic governance… This approach would transfer significant national sovereignty over corporate taxation, key to overall economic policy, to some yet-to-be-defined international regime under the guidance of the OECD… The Biden team should understand the road it is heading down. …Ceding corporate-taxation authority to an undefined international authority that will inevitably be controlled by an unelected technocratic elite would erode Madisonian principles even further. It would move America closer to the EU model of governance.

Needless to say, the EU model of governance (centralization, harmonization, and bureaucratization) is not a good idea.

I’m not optimistic, but my fingers are crossed that this awful idea of a global minimum tax will fall apart.

If the politicians prevail, the rest of us will lose. We’ll have a system that produces ever-higher tax burdens.

P.S. If you want to understand the case for tax competition, click here, here, and here.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.