There is not a lot of suspense when the Tax Foundation releases its annual International Tax Competitiveness Index.

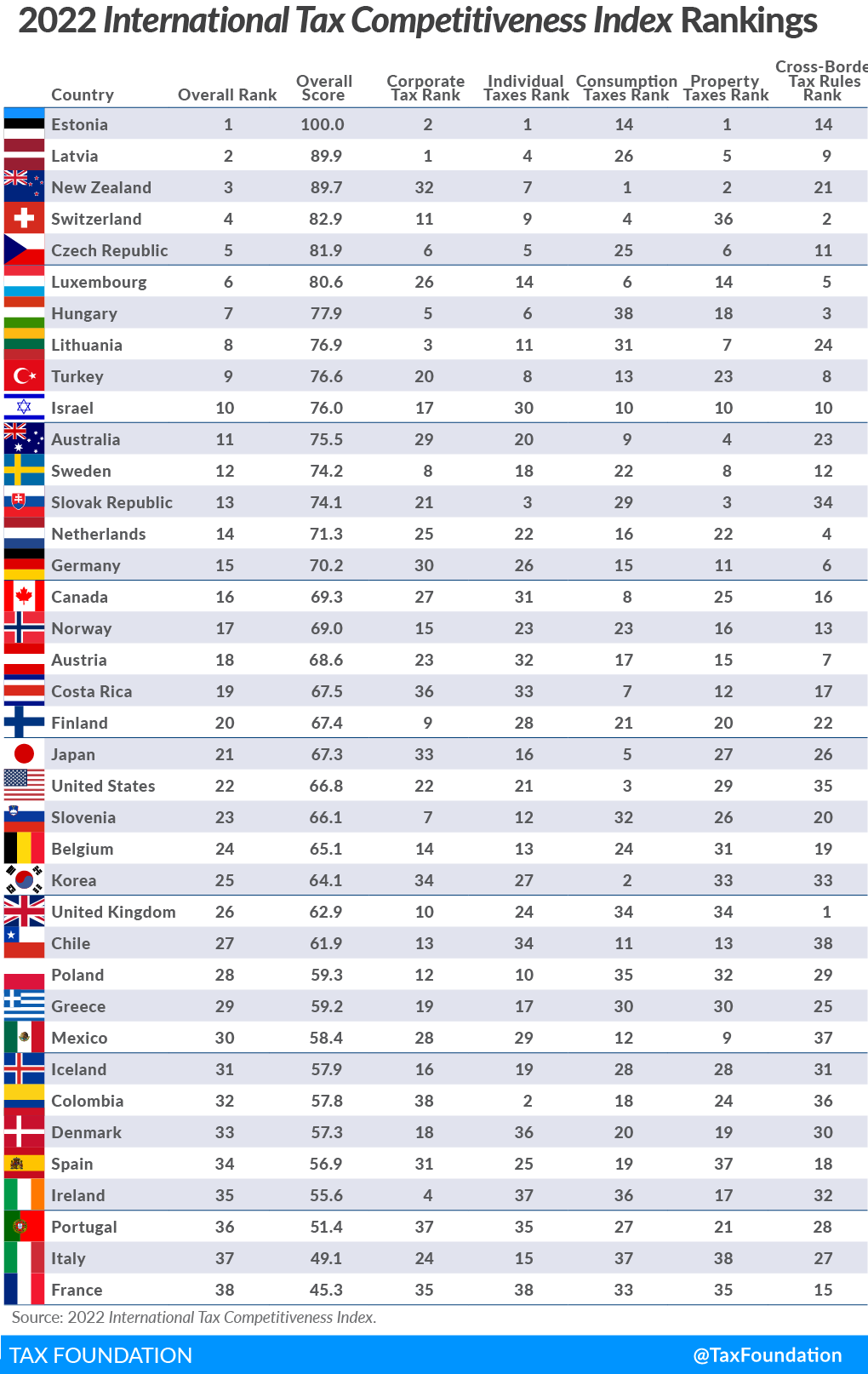

The “improbable success” of Estonia once again ranks #1. Just like in 2021, 2020, 2019, etc, etc.

Its Baltic neighbor Latvia is #2, followed by New Zealand and Switzerland.

It’s also worth noting that France is continuing its proud tradition of being in last place.

The United States, for what it is worth, has a mediocre #22 rank, dragged down by a horrible score – last among developed nations – for “cross-border tax rules” (but helped by a good score for consumption taxes since the U.S. has not made the mistake of imposing a value-added tax).

If you want to understand the Tax Foundation’s methodology, here’s a description from the report.

The structure of a country’s tax code is a determining factor of its economic performance. …The International Tax Competitiveness Index (ITCI) seeks to measure the extent to which a country’s tax system adheres to two important aspects of tax policy: competitiveness and neutrality. A competitive tax code is one that keeps marginal tax rates low. …businesses will look for countries with lower tax rates on investment to maximize their after-tax rate of return. If a country’s tax rate is too high, it will drive investment elsewhere, leading to slower economic growth. In addition, high marginal tax rates can impede domestic investment and lead to tax avoidance. …Separately, a neutral tax code…means that it doesn’t favor consumption over saving, as happens with investment taxes and wealth taxes. It also means few or no targeted tax breaks for specific activities carried out by businesses or individuals.

If you’re interested in which nations got better and worse over the past year, Greece and Turkey tied for the biggest improvement, both climbing four spots (easier for Greece since it started near the bottom of the rankings).

Ireland suffered the biggest decline, dropping seven spots, in part because of depreciation laws that penalize investment.

I’ll close with a wish that the report eventually gets expanded to include jurisdictions such Bermuda, Hong Kong, Monaco, Liechtenstein, Singapore, and the Cayman Islands. It would be very interesting to see if all of those places are ahead of Estonia.

It also would be interesting if the Tax Foundation augmented the report by speculating about potential big developments. For instance, how much would the U.S. score have declined if Biden’s tax plan had been adopted? And how much would the U.K. score have increased if Prime Minister Truss’ original tax plan was approved?

P.S. The Tax Foundation has very interesting comparative data showing international tax burdens on saving and investment.

———

Image credit: NakNakNak | Pixabay License.