The great Milton Friedman repeatedly explained that rising prices are an inevitable consequence of easy-money policies by central banks.

That’s a lesson everyone should have learned about 50 years ago when the Federal Reserve unleashed the inflation in the 1960s and 1970s (also blame Lyndon Johnson and Richard Nixon for appointing the wrong people).

And we should have learned another lesson when the Fed (with strong support from Ronald Reagan) then put the inflation genie back in the bottle in the 1980s.

But today’s central bankers must have been very bad students.

Writing for National Review, E.J. Antoni explains that we are once again bearing the inevitable cost of bad monetary policy.

…central banks are allowing interest rates to rise in an effort to belatedly respond to a crisis they helped cause. …the global economic downturn has been baked into the cake for months. …central banks around the world laid the groundwork for economic pain when they decided to finance trillions of dollars in unfunded government spending in 2020. As those central banks continued — and in some cases accelerated — their excessive money creation throughout 2021 and into 2022, a global downturn became inevitable. …History shows that high levels of inflation almost always lead to recession …once inflation became apparent central bankers persisted with their earlier course, feeding inflation, rather than starving it. If they had acted earlier, far less drastic treatment would now be required. …there is no way around the harsh reality that the bill is coming due for the last two years of monetary malfeasance.

Well said. Easy-money policy is like having six drinks at the bar. The consequences – rising prices, financial bubbles, and recessions – are akin to the hangover.

However, while I agree with the above article, I don’t agree with the title. It should be changed to: “Economies Can’t Avoid the Consequences of Central Bank Actions.”

Why the new title?

For the simple reason that central bankers are actually very capable of dodging responsibility for their mistakes.

For instance, has anyone heard the head of the Federal Reserve, Jerome Powell, apologize for dumping $4 trillion of liquidity into the economy in 2020 and 2021, thus creating today’s big price increases in the United States?

A more glaring example comes from the United Kingdom, where the former Governor of the Bank of England wants to blame Brexit. I’m not joking. Here are some excerpts from a Bloomberg story.

Former Bank of England Governor Mark Carney pointed to Brexit as a key reason why the UK central bank is now having to hike interest rates in its struggle to contain inflation. Alongside rising energy prices and a tight labor market, Britain’s exit from the European Union added to the economic headwinds for the UK, according to Carney. “In the UK, unfortunately, we’ve also had in the near term the impact of Brexit, which has slowed the pace at which the economy can grow,” Carney said in an interview with BBC Radio 4’s “Today” program on Friday. …“The economy’s capacity would go down for a period of time because of Brexit, that would add to inflationary pressure, and we would have a situation, which is the situation we have today, where the Bank of England has to raise interest rates despite the fact the economy is going into recession.”

This is galling.

Brexit did not cause inflation. The finger of blame should be pointed at the Bank of England.

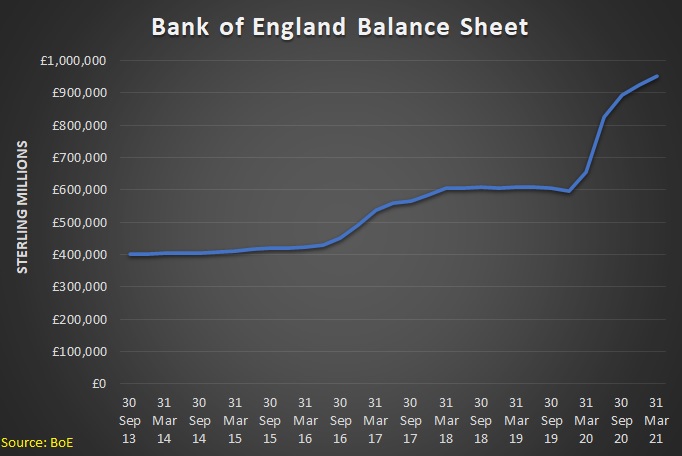

Like the Fed, the BoE dramatically expanded its balance sheet starting in the spring of 2020.

And, like the Fed (and the European Central Bank), it maintained an easy-money policy for the remainder of the year and throughout 2021 – even after it became very clear that the pandemic was not going to cause an economic crisis.

To be fair, Carney left the Bank of England in early 2020, so it’s possible he might not have made the same mistake as Andrew Bailey, who took his place.

But Carney blaming Brexit shows that, if nothing else, he is willing to prevaricate to protect the BoE’s reputation.

What makes his analysis so absurd is that he almost surely would have made the same claims regardless of what happened after Brexit.

- Boris Johnson delivered Brexit, but then proceeded to enact bad policies such as higher taxes and more spending. The economy weakened and Carney says this is why the BoE is being forced to raise interest rates.

- But if Johnson had enacted good policy (the Singapore-on-Thames scenario), the economy would be performing much better. In that case, Carney doubtlessly would have claimed interest rates needed to rise because of overheating.

In reality, of course, interest rates are going up because the BoE is trying to undo its easy-money mistake.

Too bad Carney isn’t man enough to admit what’s really happening. Maybe a woman would be more honest.

P.S. The current Governor of the BoE, Bailey, also likes shifting blame since he wants people to think that Liz Truss’ proposed tax cuts were responsible for financial market instability – even though his easy-money policies are the real culprit.

———

Image credit: Rdsmith4 | CC BY-SA 2.5.