As part of a recent discussion with Gene Tunny in Australia, I explained why I support “Starve the Beast,” which means keeping taxes as low as possible to help achieve the goal of spending restraint.

The premise of Starve the Beast is very simple.

Politicians like to spend money and they don’t particularly care whether that spending is financed by taxes or financed by borrowing (both bad options).

As Milton Friedman sagely observed, that means they will spend every penny they collect in taxes plus as much additional spending financed by borrowing that the political system will allow.

The IMF published a study on this issue about 10 years ago. The authors (Michael Kumhof, Douglas Laxton, and Daniel Leigh) assert that there’s no way of knowing whether Starve the Beast will lead to good or bad results.

…there is no consensus regarding the macroeconomic and welfare consequences of implementing a starve-the-beast approach, henceforth referred to as STB. …it could be beneficial in the ideal case in which it results in cuts in entirely wasteful government spending. In particular, lower spending frees up resources for private consumption, and the associated lower tax rates reduce distortions in the economy. On the other hand, …lower government spending may itself entail welfare losses…if it augments the productivity of private factors of production. …the paper examines whether the principal macroeconomic variables such as GDP and consumption, both in the United States and in the rest of the world, respond positively to this policy. …In addition, the paper assesses how the welfare effects depend on the degree to which government spending directly contributes to household welfare or to productivity.

The authors don’t really push any particular conclusion. Instead, they show various economic outcomes depending on with assumptions one adopts.

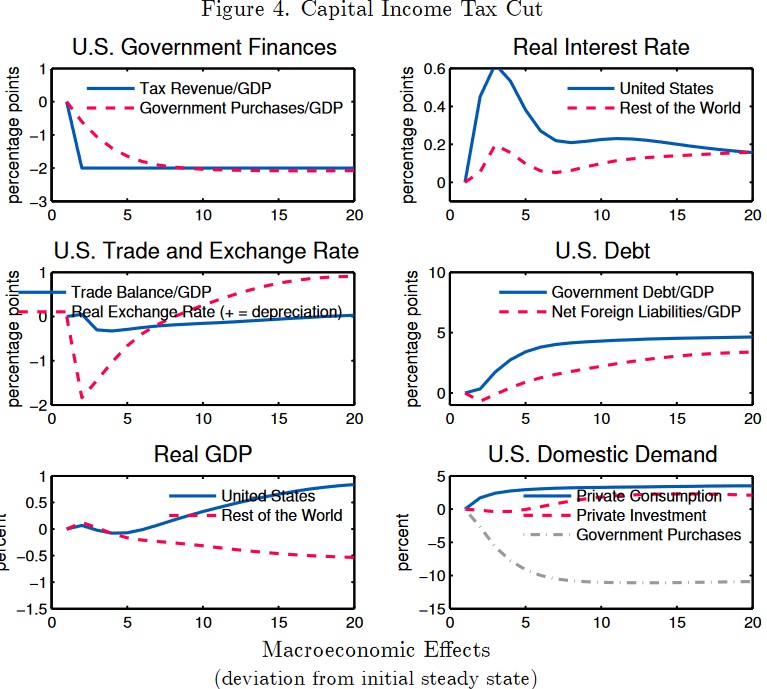

Since plenty of research shows that government spending is not a net plus for the economy (even IMF economists agree on that point), and because I think a less-punitive tax system is possible (and desirable) if there’s a smaller burden of government spending, I think the findings shown in Figure 4 make the most sense.

Now let’s shift from academic analysis to policy analysis.

In a piece for National Review back in July 2020, Jim Geraghty notes that Starve the Beast has an impact on government finances at the state level.

…we’re probably not going to see a massive expansion of government at the state level in the coming year or two. …Thanks to the pandemic lockdown bringing vast swaths of the economy to a halt, state tax revenues are plummeting. …So states will have much less tax revenue, constitutional balanced-budget requirements that are not easily repealed, and a limited amount of budgetary tricks to work around it. State governments could attempt to raise taxes, but that’s going to be unpopular and hurt state economies when they’re already struggling. Add it all up and it’s a tough set of circumstances for a dramatic expansion of government, no matter how ardently progressive the governor and state legislatures are.

For what it’s worth, Geraghty warned in the article that fiscal restraint by state governments wouldn’t happen if the federal government turned on the spending spigot.

And that, of course, is exactly what happened.

Now let’s look at the most unintentional endorsement of Stave the Beast.

A couple of years ago, Paul Krugman sort of admitted that cutting taxes was a potentially effective strategy for spending restraint.

…the same Republicans now wringing their hands over budget deficits…blew up that same deficit by enacting a huge tax cut for corporations and the wealthy. …this has been the G.O.P.’s budget strategy for decades. First, cut taxes. Then, bemoan the deficit created by those tax cuts and demand cuts in social spending. Lather, rinse, repeat. This strategy, known as “starve the beast,” has been around since the 1970s, when Republican economists like Alan Greenspan and Milton Friedman began declaring that the role of tax cuts in worsening budget deficits was a feature, not a bug. As Greenspan openly put it in 1978, the goal was to rein in spending with tax cuts that reduce revenue, then “trust that there is a political limit to deficit spending.” …voters should realize that the threat to programs… Social Security and Medicare as we know them will be very much in danger.

In other words, Krugman doesn’t like Starve the Beast because he fears it is effective (just like he also acknowledges the Laffer Curve, even though he’s opposed to tax cuts).

Let’s close by looking at some very powerful real-world evidence. Over the past 50 years, there’s been a massive increase in the tax burden in Western Europe.

Did all that additional tax revenue lead to lower deficits and less debt?

Nope, the opposite happened. European politicians spent every penny of the new tax revenue (much of it from value-added taxes). And then they added even more spending financed by additional borrowing.

To be fair, one could argue that this was an argument for the view of “Don’t Feed the Beast” rather than “Starve the Beast,” but it nonetheless shows that more money in the hands of politicians simply means more spending. And more red ink.

P.S. I had a discussion last year with Gene Tunny about the issue of “state capacity libertarianism.”

———

Image credit: Andy Withers | CC BY-NC-ND 2.0.