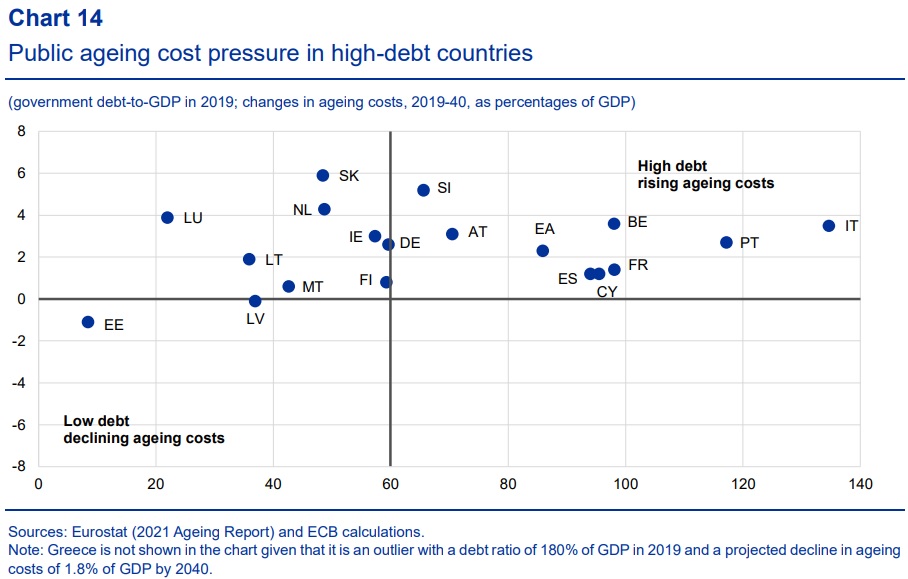

Last month, I shared a chart from a study published by the European Central Bank.

It showed which European nations were in the unfortunate position of facing big future spending increases (the vertical axis) combined with already-high levels of government debt (the horizontal axis).

The bottom line is that Italy, Portugal, France and Belgium face a very difficult fiscal future.

And Estonia (at least relatively speaking) is in the best shape.

Today we are going to augment those ECB numbers by looking at some data from the OECD’s recent report on Estonia.

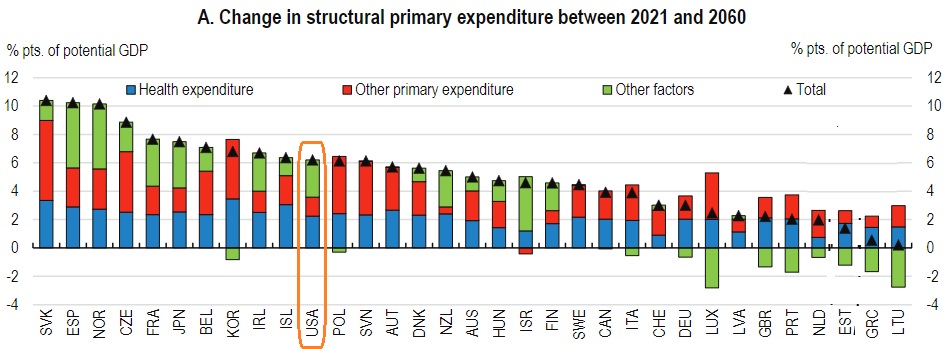

Here’s a chart showing how the burden of government spending is going to increase in various nations between now and 2060.

Slovakia, Spain, Norway, and the Czech Republic have the biggest problem.

Lithuania is in the best shape, surprisingly followed by Greece (I assume because that nation already hit rock bottom, not because of good policy).

I also highlight the United States, which will have to face the challenge of above-average spending increases.

But if you want to know which nation will be the next to suffer fiscal collapse, you also need to know whether (or the degree to which) it has the capacity – or “fiscal space” – to endure a bigger burden of government spending.

James Capretta addressed that topic in an article for the Bulwark.

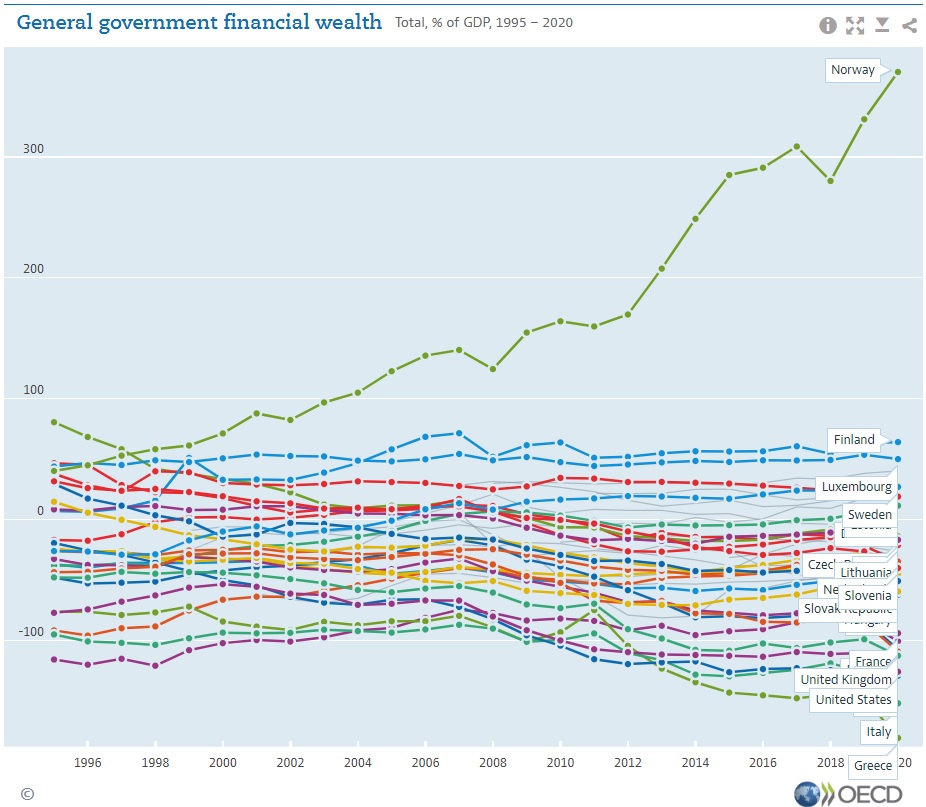

Which governments have exercised budgetary restraint in recent years, even while confronting sequential global crises? Which have been more profligate? And what do the differences portend for their differing abilities to handle an era when servicing debt may be more expensive than it has been in many years? …Accuracy…requires assessing both assets and liabilities. …The Organization for Economic Cooperation and Development…’s most comprehensive measure of fiscal resilience is the “financial net worth” of the reporting countries, which includes the main sources of accumulated liabilities (especially public debt) along with financial assets owned by governments.

And here’s a chart showing how developed nations (with the exception of oil-rich Norway) have been spending themselves into a fiscal ditch.

Here are some of Capretta’s observations.

Among the twenty-seven OECD countries that reported data every year from 1995 to 2020, the average deterioration in their net financial position, weighted by population size, was equal to 48 percent of GDP. …Several countries stand out for the steepness of their declines. Japan’s net financial position was -20 percent of GDP in 1995, and in 2020 it was -129 percent of GDP—in other words, in just 25 years it worsened by over 100 percent of the country’s annual GDP. Similarly, the United Kingdom experienced a serious deterioration, with a net financial position in 2020 equal to -109 percent of GDP. In 1995, it was -26 percent. …France, Greece, Italy, and Spain are regularly criticized for their uneven approaches to fiscal discipline. The OECD data showing a substantial deterioration of their net financial positions over the last quarter century provides more evidence that each of these countries needs to take further steps to lower the risk of a fiscal crisis in future years.

The United States obviously is not in good shape, though I think the OECD’s methodology is imperfect.

Yes, America will have to deal with a fiscal crisis if we don’t figure out a way of controlling spending, but I suspect many other countries will reach that point before the U.S. (with Italy quite likely being the next to go belly up).

P.S. At the risk of repeating advice from previous columns, genuine entitlement reform is the only solution to America’s long-run spending problem, ideally enforced by a Swiss-style, TABOR-style spending cap.

———

Image credit: pxhere | CC0 Public Domain.