Yesterday’s column analyzed some depressing data in the new long-run fiscal forecast from the Congressional Budget Office.

Simply stated, if we leave fiscal policy on auto-pilot, government spending is going to consume an ever-larger share of America’s economy. Which means some combination of more taxes, more debt, and more reckless monetary policy.

Today, let’s show how that problem can be solved.

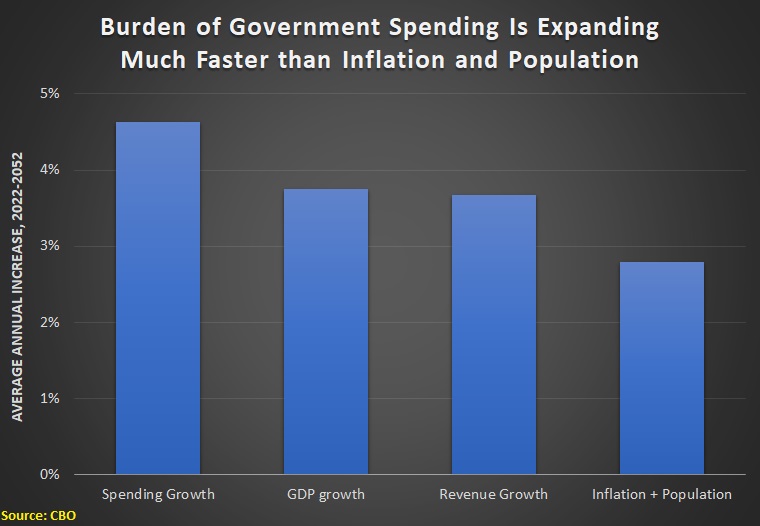

My final chart yesterday showed that the fundamental problem is that government spending is projected to grow faster than the private economy, thus violating the “golden rule” of fiscal policy.

Here’s a revised version of that chart. I have added a bar showing how fast tax revenues are expected to grow over the next 30 years, as well as a bar showing the projection for population plus inflation.

As already stated, it’s a big problem that government spending is growing faster (an average of 4.63 percent per year) than the growth of the private economy (an average of 3.75 percent per years.

But the goal of fiscal policy should not be to maintain the bloated budget that currently exists. That would lock in all the reckless spending we got under Bush, Obama, and Trump. Not to mention the additional waste approved under Biden.

Ideally, fiscal policy should seek to reduce the burden of federal spending.

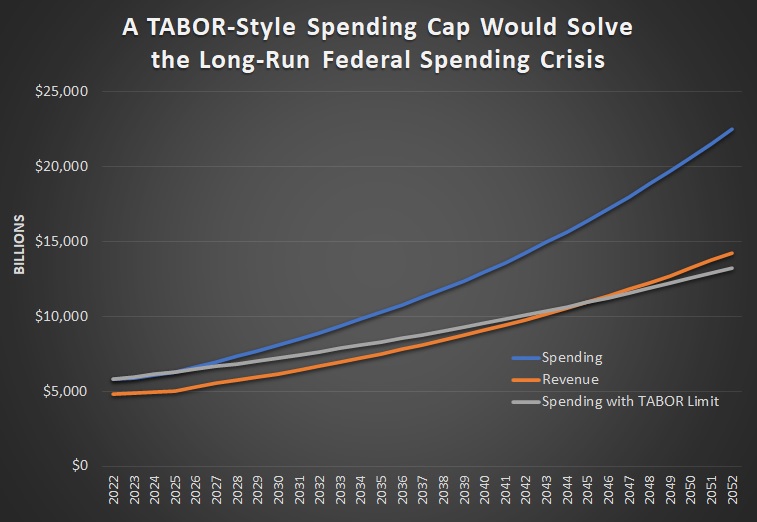

Which is why this next chart is key. It shows what would happen if the federal government adopted a TABOR-style spending cap, modeled after the very successful fiscal rule in Colorado.

If government spending can only grow as fast as inflation plus population, we avoid giant future deficits. Indeed, we eventually get budget surpluses.

But I’m not overly concerned with fiscal balance. The proper goal should be to reduce the burden of spending, regardless of how it is financed.

And a spending cap linked to population plus inflation over the next 30 years would yield impressive results. Instead of the federal government consuming more than 30 percent of the economy’s output, only 17.8 percent of GDP would be diverted by federal spending in 2052.

P.S. A spending cap also could be modeled on Switzerland’s very successful “debt brake.”

P.P.S. Some of my left-leaning friends doubtlessly will think a federal budget that consumes “only” 17.8 percent of GDP is grossly inadequate. Yet that was the size of the federal government, relative to economic output, at the end of Bill Clinton’s presidency.

———

Image credit: Shaw Girl | CC BY-NC-ND 2.0.