More than 11 years ago, the Center for Freedom and Prosperity released this video about the OECD, a Paris-based bureaucracy subsidized by American taxpayers.

As outlined in the video, there are many reasons to dislike the Organization for Economic Cooperation and Development.

As a fan of tax competition, I don’t like the OECD because the bureaucrats persecute jurisdictions with low tax burdens.

But the bureaucracy’s pro-tax harmonization campaign is a symptom of a broader problem, which is that the OECD relentlessly advocates for higher taxes.

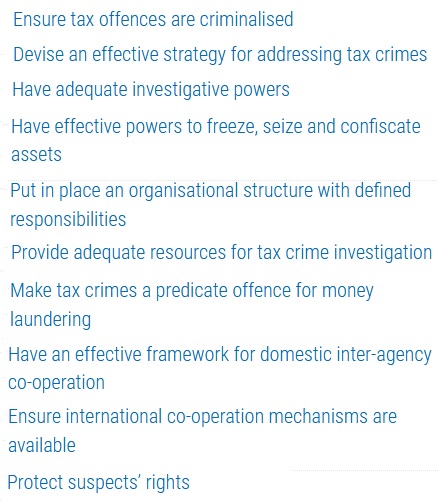

Consider the recent publication entitled “Fighting Tax Crime – The Ten Global Principles.” As you can see, nine of those ten principles involve more power and authority for government.

Since I’m not an anarcho-capitalist, I realize some taxation is necessary (ideally only the amount needed to finance genuine public goods).

As such, I don’t necessarily condemn enforcement policies.

But I am irked by a big sin of omission. If the bureaucrats at the OECD should have added an 11th principle about modest tax rates.

Why?

Because the academic literature very clearly shows that low tax rates are correlated with better tax compliance.

And those low tax rates also are better for prosperity, which is something that should be of interest to a bureaucracy with the words “economic” and “development” as part of its name.

Heck, some OECD economists have written about these benefits of low tax rates.

But none of that now matters. The bureaucrats today are totally fixated on carrying water for the world’s uncompetitive, high-tax governments.

Which is why I’m a big fan of defunding the OECD.

P.S. I suppose we should be happy that the bureaucrats acknowledge that taxpayers should have rights.

P.P.S. In the interest of fairness, I’ll acknowledge that the OECD occasionally produces good work. I’ve even favorably cited research from the bureaucracy on issues such as government spending and expenditure limits.

———

Image credit: DG EMPL | CC BY-ND 2.0.