The worst piece of legislation in 2021 was Biden’s so-called stimulus, which added $1.9 trillion to America’s fiscal burden.

The worst provision of that legislation almost certainly was a temporary per-child entitlement of $3,000-$3,600.

Biden then wanted to make this entitlement permanent as part of his $5 trillion plan to “build back better.”

Fortunately, that boondoggle sank under its own weight and the slimmed-down (but still bad) version that ultimately was enacted earlier this year did not include any per-child handouts.

That’s the good news, at least relatively speaking.

The bad news is that Congress and the White House have renewed their push for a permanent per-child entitlement.

And, because Republicans will control the House of Representatives starting in January, they are trying to push the policy through next month.

The Wall Street Journal editorialized today about per-child handouts.

A core Democratic priority in Congress is resurrecting a $3,000 child tax credit for dependents ages six and up, with a $600 bonus for younger children. …The Internal Revenue Service is now another turnstile of the welfare state. That’s because over time Congress made more of the credit “refundable,” which means available to those who don’t owe federal income taxes. …a universal basic income for people with children. …The full Democratic allowance would cost $1.6 trillion over 10 years… Low-income voters are always assumed to support cash benefits, but 46% of those earning less than $50,000 opposed the payments. That may be because Americans understand that poverty in the U.S. is now less about material deprivation and more about idleness, addiction, mental illness and other destructive realities that can’t be cured with a bigger check.

There were many arguments against these per-child handouts (reversing Bill Clinton’s welfare reform, setting the stage for universal basic income, etc).

But those topics are not playing a big role in this debate.

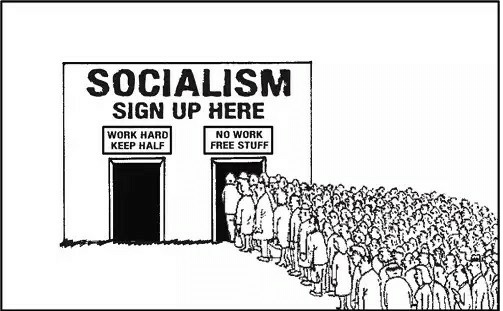

Instead, the White House and Congress are engaged in a naked vote-buying scheme.

They want to create more dependency, regardless of the economic and societal consequences.

What are some of those consequences? Those are discussed in a column by Scott Hodge, which also is in today’s Wall Street Journal.

He starts with a mea culpa about his role in creating child credits and also warns about the risks of creating a system where the IRS is a dispenser of goodies rather than a tax-collection agency for almost half the population.

I was one of the inventors of the child tax credit, nearly 25 years ago—and I think it’s a bad idea. …Key elements of this plan made their way into the 1994 House Republicans’ Contract with America. Congress enacted the $500 child tax credit as part of the Taxpayer Relief Act of 1997, and it grew from there. …The Bush tax cuts in 2001 temporarily doubled the credit to $1,000… The 2017 Tax Cuts and Jobs Act doubled the credit again, to $2,000… Each expansion meant fewer households on the tax rolls. …The expanded credit…contributed significantly to increasing the number of households with little or no income-tax liability. …some 74 million tax filers—or nearly half (48.3%) of all filers in 2021—had no income tax liability. …Can we have a sustainable tax system if the number of nonpayers continues to grow?

Since I’m mostly worried about the economic consequences, here’s the part of Scott’s column that grabbed my attention.

…recent studies estimating the economic effects of the proposed expansion suggest that it would cause people to leave the workforce, reduce work effort, and lower capital investment, ultimately shrinking economic output. A recent study by economists at the University of Chicago determined that without any changes in behavior, expanding the credit would reduce child poverty by 34% and “deep” child poverty—families whose income is less than half the poverty level—by 39%. But those gains would come at a cost: the diminution of the workforce by 1.5 million people. …A new study by Congress’s Joint Committee on Taxation…determined…the policy would reduce the labor supply by 0.2% and reduce the amount of capital by 0.4%. As a result of the reduced supply of labor and capital investment, gross domestic product would shrink by 0.2%.

I’m guessing that some readers will be shrugging their shoulders because numbers such as 0.2 percent and 0.4 percent don’t sound very big.

But keep in mind that we have dozens of bad policies in Washington that have this type of effect, and their cumulative impact is very big.

And for those who like comparisons, it’s worth observing that living standards in Europe are significantly below American levels precisely because politicians in places such as Greece, France, and Italy have made even more of these mistakes.

The bottom line is that free enterprise is the best way of helping poor people, not government dependency.