I’ve identified seven reasons to oppose tax increases, but explain in this interview that the biggest reason is that it would be a mistake to give politicians more money to finance an ever-larger burden of government spending.

I had two goals when responding this question (part of a longer interview).

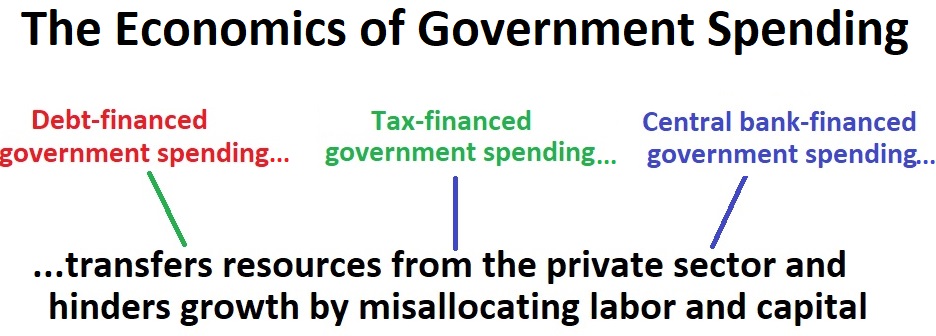

First, I wanted to help viewers understand that America’s fiscal problem is too much government spending and that red ink is simply a symptom of that problem.

Over the years, I’ve concocted all sorts of visuals to make this point. Like this one.

And this one.

And this one.

Second, I wanted viewers to understand that higher taxes will simply make a bad situation even worse.

From my perspective, the biggest problem with tax increases is that they will enable a bigger burden of government spending.

But even the folks who fixate on red ink should adopt a no-tax increase position.

Why? Because politicians who want big tax increases want even bigger spending increases.

Joe Biden is pushing for a massive tax increase, for instance, but his proposed spending increase is far larger.

We also have decades of evidence from Europe. There’s been a huge increase in the tax burden in Western Europe since the 1960s (largely enabled by the enactment of value-added taxes).

Did that massive increase in revenue lead to less red ink?

Nope, just the opposite, as I showed in both 2012 and 2016.

If you don’t agree with me on this issue, maybe you should heed the words of these four former presidents.

P.S. Some people warn that endlessly increasing debt is a recipe for an eventual crisis. They’re probably right. Which is why it is important to oppose tax-increase deals that wind up saddling us with more red ink. Besides, the long-run damage of tax-financed spending is very similar to the long-run damage of debt-financed spending.

P.P.S. As I mention in the interview, the only real solution is spending restraint. And a spending cap is the best way of enforcing that approach.

———

Image credit: Shaw Girl | CC BY-NC-ND 2.0.