As part of my recent appearance on The Square Circle (we discussed Uvalde police, gun control, and Ukraine), I said that the new Social Security numbers were the under-reported story of the week.

For more details, I was referring to the latest Trustees Report, published yesterday by the Social Security Administration.

Most people, when that annual report is released, focus on when the Social Security Trust Fund runs out of money. But since the Trust Fund only contains IOUs, I view that as a largely irrelevant number.

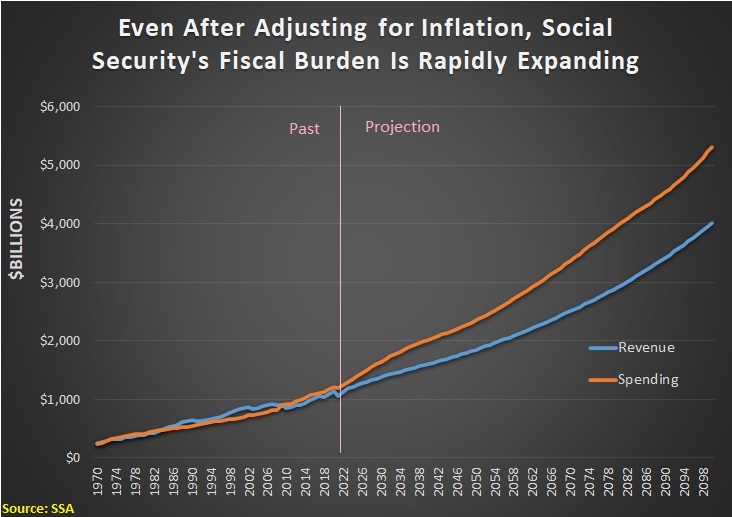

Instead, I immediately look at Table VI.G9, which shows how much revenue is being collected and how much money is being spent every year.

Here is that data displayed in a chart. The left side shows actual fiscal numbers from 1970 to 2021 while the right side shows the projections between 2022 and 2100.

As you can see in the chart, revenues going into the system (the blue line) are growing rapidly.

But you also can see that Social Security spending (the orange line) is expanding even faster.

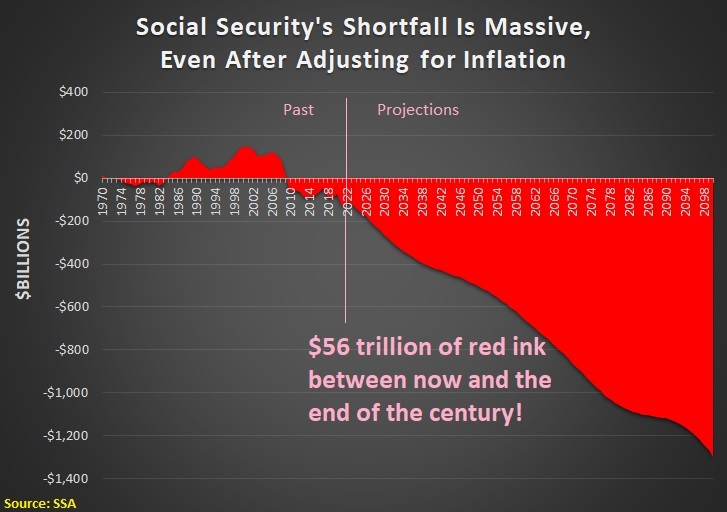

And when spending grows faster than revenue, one consequences is more red ink.

This next chart shows that annual deficits between now and 2100 will total $56 trillion.

At the risk of understatement, these two charts should be very sobering. Especially since they only show the taxes, spending, and red ink for Social Security.

If we also add the fiscal aggregates for other entitlement programs, it would be abundantly clear why we face a “crisis” and a “train wreck.”

So how do we solve this mess. I’ve written about the needed reforms for Medicare and Medicaid, so let’s focus today on Social Security.

The ideal approach is to take the current pay-as-you-go entitlement and turn it into a system of personal retirement accounts.

Many nations around the world have adopted this approach, most notably Chile and Australia.

But as I noted two years ago, there will be a big “transition” challenge if the United States decides to modernize.

P.S. I mentioned “public choice” at the end of that clip. You can click here to learn more about the economic analysis of political choices.

P.P.S. I mentioned that Chile and Australia have created personal retirement accounts. You can also learn about reforms in Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, and Sweden.

———

Image credit: 401kcalculator.org | CC BY-SA 2.0.